With less than 12 months until the 2020 U.S. Presidential Election, President Trump is harnessing the power of the Fed to ensure his victory. Despite Trump’s past Twitter attacks on Fed Chairman Powell, the two finally appear to be dancing to the same song—the Fed is back buying Treasury bills to the tune of $60 billion per month.

The Federal Reserve is by far the world’s most powerful financial institution. And it is now acting as an extension of the White House.

Despite a weakening economy from a GDP standpoint (1.9% in Q3) and a declining manufacturing sector, the Fed is reigniting the risk-on trade. For the first time in years, its balance sheet is rising at an alarming rate as it floods the system with liquidity.

Fed Unites with Trump as Balance Sheet Balloons to Shore Up U.S. Economy

Total Assets of the Federal Reserve I Balance Sheet (Trillions)

$60 billion in quantitative easing per month is massive. Today, the Fed’s balance sheet is expanding as fast as it did back in 2013-2014. At this pace, it may surpass its all-time high of $4.5 trillion by June 2020. Below is a ten-year chart for some context.

Source: U.S. Federal Reserve

In a recent MarketWatch article, Ivan Martchev clarifies what repurchase agreements mean and why the Fed’s newest round of QE can have such a powerful effect on the markets and economy:

“Balance-sheet expansion is like printing money — but for financial institutions only. It does affect the monetary base (excess reserves plus currency in circulation), which is the narrowest definition of money supply (M0). It basically causes asset-price inflation without causing uncontrolled broad money supply growth, which is why [sic] it has not (yet) resulted in hyperinflation.”

Fed’s Winning Streak Continues With U.S. Expansion

The age-old adage “don’t bet against the Fed” is holding true. As we embark upon the eleventh year of this bull market, the longest in U.S. history, the resilience of short-sellers has been tested like never before.

ZeroHedge highlights the pain short-sellers have endured recently in an article titled Going Down Swinging: “World’s Most Bearish Hedge Fund” Loses 75% Of Its Assets After Worst Year On Record. The Horseman Global Fund is under severe pressure as the Fed continues to inject liquidity; the funds’ assets under management have declined from $581 million at the start of the year to just $150 million today—a loss of 75%, according to data compiled by ZeroHedge and Citco Fund Services.

Those who have bet against the Fed or Trump have been burned.

Trump’s All-in Bet on the Economy is Winning

On Monday, November 18th, 2019, ZeroHedge.com reported,

“Moments ago, the Fed announced that in a previously unannounced meeting that was not on the official White House calendar, Fed Chair Powell met with Trump and Mnuchin at the White House “to discuss the economy, growth, employment and inflation”, marking the second face-to-face meeting between the world’s two most powerful people amid Trump’s relentless criticism of the central bank.”

Furthermore, in a sign that Powell is cozying up to Trump,

“During his Congressional testimony last week, Powell called the U.S. economy a “star” performer and voiced solid confidence that its record expansion will stay on track even as, paradoxically, the Fed recently cut rates three times in the past four months and in October launched NOT QE (spoiler alert: it is QE) to purchase T-Bills in a move which Bank of America described is QE in all but name.”

Rarely does a Fed Chair tout the economy while slashing rates.

Jim Rickards Explains How Trump Took Over the Fed

American lawyer, financial commentator, and best-selling author Jim Rickards dubbed Donald Trump a genius in late October 2019. According to an interview with Rickards, Trump’s genius is in large part due to the fact that he “owns” the Fed:

“Trump came in. There were two vacancies on the board of governors at the Federal Reserve. Why were there two vacancies?

Well, Obama was so sure that Hillary was going to win that he didn’t bother with the appointments. He said, well, I’ll give them to Hillary. She’ll appoint some strong hands. So, Trump got two seats right off the bat, then there were a couple of resignations, so there kind of went up to four seats, and then one more since then. Plus promoting J. Powell from a governor, where he already was a governor before Trump, to Chairman.

So, Lael Brainard is going to end up as the only non-Trump appointee on the Board of Governors of the Federal Reserve. She must feel like a hostage when she goes into the room.

Trump owns the Federal Reserve.”

You can watch the full interview here: James Rickards: “Donald Trump is a Genius”

We will reserve judgement on the “genius” title for now…

Many people read Trump’s bombastic and sometimes ridiculous tweets and think Powell and the Fed must hate his guts. They don’t realize he hand-selected almost the entire Board of Governors. Despite claims otherwise, the Fed has always been political; we are witnessing this truth today, just as we did during the Obama years.

Trump’s Power Grows Beyond the Fed

While the media stays glued to Trump’s latest tweets and the ongoing impeachment proceedings, Trump is appointing what could become a record number of judges to America’s courts.

According to a New York Times article titled, Trump and Senate Republicans Celebrate Making the Courts More Conservative,

“We are going to be, I think, just about No. 1 by the time we finish — No. 1 of any president, any administration,” President Trump said.

In the same article, Brian Fallon, the head of progressive group Demand Justice, was quoted,

“Democrats have been caught napping on the courts for a while now, and we are going to pay the price for years to come.”

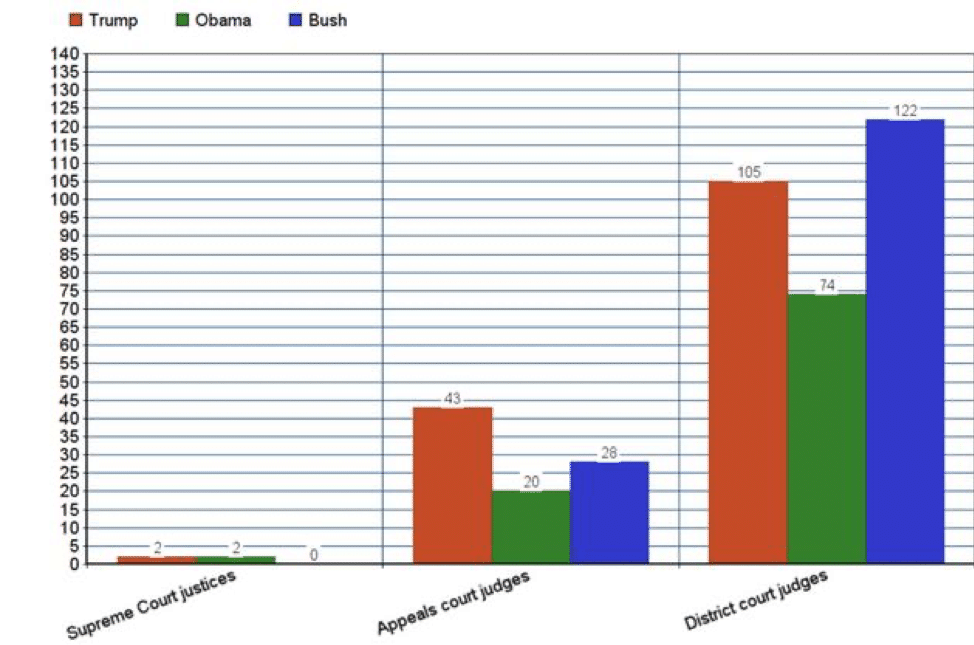

A Huffington Post article titled, Trump Has Confirmed 150 Lifetime Federal Judges. That’s A Lot compares Trump’s judicial appointments versus Obama’s and Bush’s,

“Trump is way ahead of everyone on appeals court judges ― the people who have the final say in nearly all federal appeals cases around the country.”

In fact,

“…nearly 1 in every 4 seats on U.S. appeals courts is now filled by a judge appointed by Trump.”

Source: Huffington Post

While the numbers above have already grown, they are poised to grow even more substantially.

Earlier this month, Bloomberg Law confirmed,

“So far, the Trump has appointed nearly 160 federal judges to lifetime seats to district and appeals court seats.”

And that,

“The administration is currently racing to surpass 180 judicial appointments in the next couple of months, a goal Trump recently announced.”

Trump Targets Supreme Court Domination

In a final comparison, Trump has already tied Obama by appointing two judges to the Supreme Court: Neil M. Gorsuch and Brett Kavanaugh. The importance of the U.S. Supreme Court is immeasurable. In July 2019, the U.S. Supreme Court approved $2.5 billion via military funding for construction of a wall on the southern border after a 5-4 ruling in Trump’s favor. Not coincidentally, there are 5 Republican appointed Supreme Court Justices and 4 Democrat appointees.

If Trump wins in 2020, it could mean two more conservative Supreme Court Justices. Two of the nine Supreme Court Justices with a more liberal-leaning track record are Ruth Bader Ginsburg, 86, and Stephen Breyer, 81. Both have served as associate justices since the mid-90s and will be unlikely to serve until the end of Trump’s potential second term in 2024.

Trump Eyes U.S. Justice System in Final Term

Trump is positioning himself to make significant moves in his second term—if he can get re-elected. After all, Trump-appointed governors are already running the Federal Reserve, and his influence is growing within the U.S. justice system.

All the best with your investments,

PINNACLEDIGEST.COM

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.