For years monetary policy and inflation have eroded purchasing power. Speaking at the World Economic Forum in Davos, Switzerland, Ray Dalio warns of the dangers of holding cash. While he doesn’t believe a downturn to be imminent, he does believe central bankers are reaching the limit of what they can do to prevent a serious contraction. Dalio speaks of a paradigm shift and explains why cash is trash in this interview from earlier in the week.

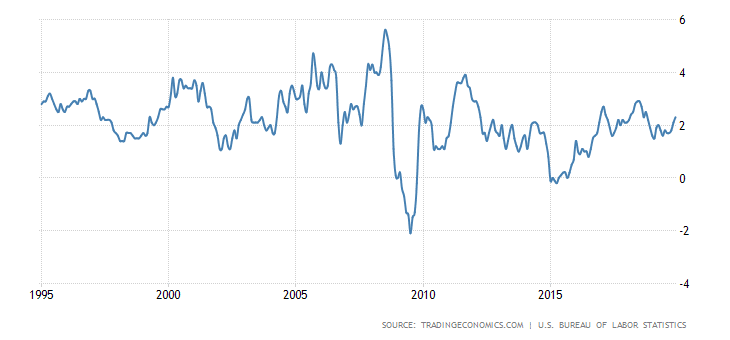

For the past 25 years, the US consumer price inflation has hovered between 1 and 4 percent. Only during the Great Recession and a period of weakness in early 2015 did we witness deflation. In a debt-based monetary system, deflation is a force that can wield unspeakable damage.

The US national debt expanded by about $1.2 trillion in 2019 as the US ran a trillion-dollar deficit for the first time since the Obama years.

Dalio Sounds Off on Easy Monetary Policy

“We’re going to have larger deficits which we’re going to print money for.”

And that,

“At a point in the future, we still are going to think about what’s a store holder of wealth. Because when you get negative-yielding bonds or something, we are approaching a limit that will be a paradigm shift.”

In the meantime, US stocks continue to hit new all-time highs and confidence remains unwavering in the Federal Reserve.

Despite the Fed turning on the liquidity taps again and expanding its balance sheet, the US Dollar Index remains relatively solid as we head into 2020.

U.S. Dollar Index Staying Strong