Bitcoin mining has become a relatively efficient and intensely competitive industry…

For several reasons, the cost to mine bitcoin — the world’s foremost cryptocurrency — is increasing. In some instances, bitcoin miners looking for a competitive edge have moved to faraway countries where energy is cheap.

Also, as the line between profit and loss narrows, bitcoin miners are turning to power providers as they look to save money.

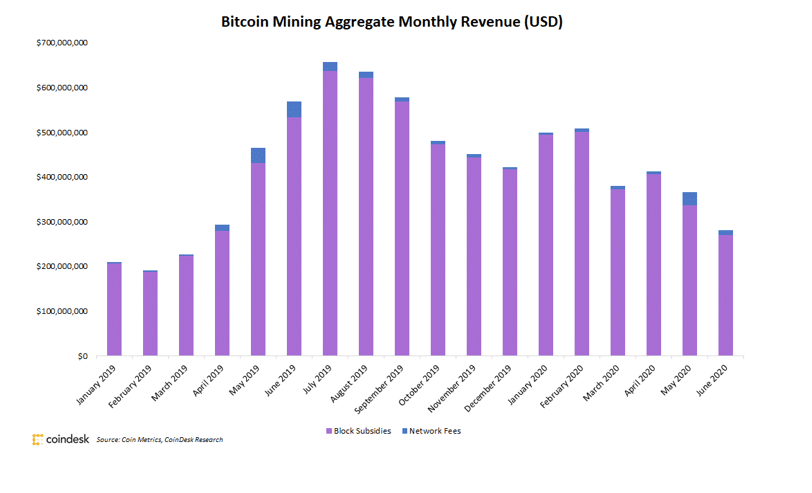

Bitcoin Mining is Big Business

Bitcoin mining is no longer an arena for mom-and-pop operators. It hasn’t been for quite some time. With monthly revenue from mining ranging from roughly $200 to $600 million worldwide, according to Coindesk, bitcoin mining has become a multi-billion-dollar industry.

The market cap of all bitcoins in circulation in early July 2020 with the BTC price trading at US$9,120.12 was about US$170 billion.

For bitcoin miners hoping to compete in this large and increasingly competitive marketplace, success and profitability will rely mainly on three metrics: cheap energy, low transaction fees, and of course, a rising bitcoin price.

While transaction fees and the price of bitcoin are out of miners’ control, how and where they source their energy/electricity is not.

Cheap Electricity | A Key to Bitcoin Mining Profitability

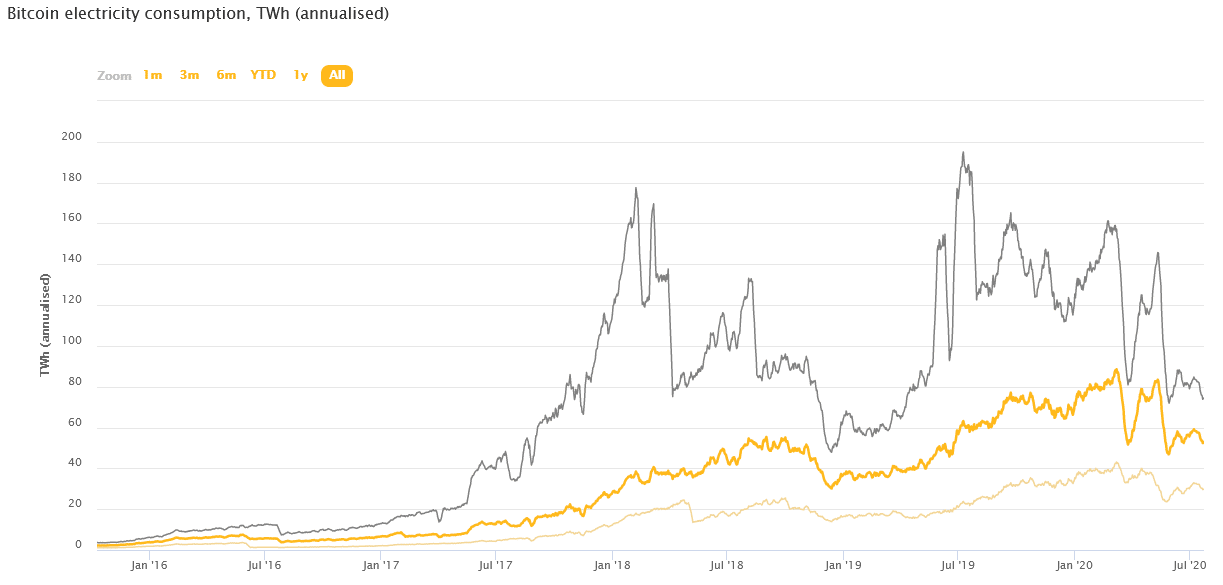

In mid-2019, a new estimate from researchers at the University of Cambridge showed that the bitcoin network consumed more energy than many countries, on an annual basis.

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), the global bitcoin network is consuming approximately 60 TWh or terawatt-hours of energy consumption per year. For some context, the entire country of Switzerland uses 58 TWh, according to estimates from the CBECI.

The CBECI “…estimates how much energy is needed to maintain the Bitcoin network in real time, before using this to calculate its annual energy usage,” according to The Verge.

Bitcoin Electricity Consumption, in terawatt hours

The above chart highlights the upper and lower bound estimates of electricity consumption, with the dark yellow line in the middle representing the consensus estimate.

Apparently, one of the cheapest places to mine for Bitcoin is in China. Forbes contributor, Joseph Young, wrote in June of 2020 that,

“According to several Chinese miners based in Sichuan, China, electricity in the region costs around $0.04 per kilowatt-hour.”

And that,

“With $0.04/kwh, miners based in China said that the breakeven cost to mine Bitcoin hovers in the $5,000 to $6,000 range.”

With the price of bitcoin above US$9,000, this tells us two things: first, that some miners (particularly those in China) can still be very profitable at current BTC prices; and secondly, a correction in price would not surprise us given the cost to produce Bitcoins is dropping for some miners.

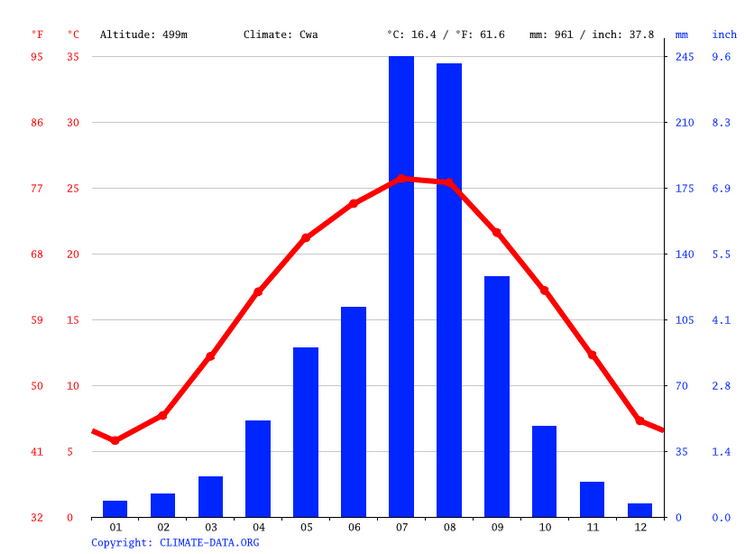

Now, here is the catch: the cheap electricity in Sichuan, China may not last. Located in China’s southwest, the region experiences incredible precipitation at certain times of the year, which affects its power costs.

Home of the giant pandas and a stretch of Asia’s longest river, the Yangtze, the Sichuan region has hydropower plants scattered throughout which benefit from heavy rains. June to September is the rainy season, as can be seen by the below chart.

The Sichuan region receives about half of its annual rainfall in just two months: July and August. Given we are currently in July, it is no surprise the cost to mine bitcoin in this region is low. With the bitcoin price holding above US$9,000, one has to wonder what will happen in September and October when the rainy season concludes?

Link Global Technologies & Low-Cost Power

Link Global Technologies (LNK:CSE) is engaged in the business of providing infrastructure and operating expertise for digital mining operations. For a small and relatively unknown company, it has a lofty set of goals…

Link Global Technologies’ (“Link” or the “Company”) objectives include locating and securing, for lease and option to purchase, properties with access to low-cost reliable power and deploying this low-cost power to conduct digital mining, among other activities.

In mid-June, Link announced it had received a security deposit of US$1 million on the signing of a Power Supply Agreement for its Smart Mining Program with an arm’s length third party private investment fund.

Under the terms of the Agreement, Link “…has agreed to supply the Client with SmartMiner computing power generated by Asics processors, configured for the purpose of supplying process computing power that meets the needs of digital currency software, in exchange for cash consideration at an agreed upon rate of kilowatts per hour…”

While not disclosing the agreed upon rate of kilowatts per hour, Stephen Jenkins, Link President & CEO, stated,

“Link is extremely pleased with the signing of the Power Supply Agreement and securing the US$1 million required to execute the plan. This is the first commercial power supply agreement for our Alberta assets, and a key milestone that puts the Company on track to achieve profitability.”

And that,

“Our team continues to execute on our core strategy of securing low cost, reliable power and supplying our partners with smart infrastructure and cost-efficient power solutions for their data hosting and digital mining operations.”

Click here to read the full press release.

Not to take anything away from the Power Supply Agreement, but it only accounts for 3 megawatts, according to the press release. Link highlighted this fact, stating,

“As previously announced on March 24, 2020, Link has secured up to 50 megawatts (M.W.) of electricity for its cryptocurrency mining community under a letter of intent with its partners in Alberta, allowing for 15,000 new generation machines. This program plans on using approximately 3 M.W. of electricity.”

Click here to read the entire press release, Link Global Technologies (CSE: LNK) Receives US$1 Million Security Deposit on Signing of Power Supply Agreement for Its Smart Mining Program.

And here to read Link’s March 24, 2020 release.

In respect to power capacity, Link provided projections of what will be available, and when…

The Company stated in its March 31, 2020 press release:

“By end of April 2020

– Three MW of power to be made operational

– Planned generation of 54,000 terahash of computing power, or approximately 1 Bitcoin per day equivalent **· By end of May 2020:

– 6 MW of power to be made operational

– Planned generation of 108,000 terahash of computing power, or approximately 2 Bitcoin per day equivalent **· By end of July 2020:

– An additional 15 MW of power to be made operational, for a total combined effort of 21 MW

– Planned generation of 378,000 terahash of computing power, or approximately 7 Bitcoin per day equivalent **

** calculated using today’s earning potential”

Another Agreement Signed

Link didn’t have to wait long to ink another agreement. Six days following the aforementioned deal with the third-party private investment fund, the Company announced a new deal with Block One Technologies…

Link Global Technologies Signs 6 MW Power Purchase Agreements With Block One Technologies For Their Digital Currency Mining Operations

Based in Calgary, Alberta, Block One describes itself as “North America’s Leading Crypto Mining Company.”

According to the terms of these Agreements with Block One, Link will provide Block One with 6 megawatts (M.W.) of electrical power for an initial term of one year, at an agreed-upon rate calculated in Canadian dollars per kilowatt hour.

Stephen Jenkins, President & CEO of Link commented that,

“While this is the first formal agreement between Block One and Link, the companies intend to pursue future agreements that will play an important role in Link’s growth strategy.”

Bijan Alizadeh, Founder & Chairman of Block One, noted,

“By working with Link, Block One can take advantage of the competitive energy prices Link offers…”

And that,

“We have deep expertise in the digital mining space and partnering with Link on power supply makes a lot of sense for us and our clients.”

Click here to read the full press release.

For companies like Block One, access to competitively-priced, reliable power is critical. While Link aims to deliver precisely that, its margins remain unknowns…

Link’s upside potential may begin to crystallize once new financials are released. They may also shed light on if/when Link could reach profitability.

Link Global Technologies — More to the Story

To further understand Link, it is worth learning about its President and CEO, Mr. Stephen Jenkins…

Mr. Jenkins holds a Master’s Degree in Environmental Management from the Royal Roads University and served as a partner at Energies du Futur S.A. (2014-2017).

Furthermore, Mr. Jenkins has twice been recognized at the United Nations in New York for innovation in the environmental field.

Towards the end of 2014, Mr. Jenkins went to Senegal to look at biomass opportunities. According to a bctechnology.com article,

“He returned home and discussed his ideas with close friend and Chairman of Goldcorp Inc., Ian Telfer. Stephen pitched his plan for a clean energy facility and both men contributed funding to launch the project.”

* Goldcorp merged with Newmont in 2019 to become the largest gold producer in the world.

Moreover,

“Energies Du Futur was formed in January 2016, with Stephen, Balanced Power, Ian Telfer, and the Town of Nguekokh holding equity shares.”

As a founding partner, Mr. Jenkins and his team at Energies du Futur brought private companies together to partner on projects that create economic activity around renewable energy in West Africa.

Mr. Jenkins is a big picture thinker who looks for solutions to difficult problems — the quintessential entrepreneur you might say.

We hope this report provides a high-level overview of Link Global Technologies and its near to medium-term plans, but it is not intended to be exhaustive. Recognize that we are biased when it comes to Link Global Technologies. Link Global Technologies is a sponsor and client of Pinnacle Digest, and we own shares of the Company, making us cheerleaders and shareholders. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in an early-stage, speculative company of this nature. A good place to start your due diligence is reviewing the Company’s Sedar filings at www.sedar.com under Link Global Technologies’ issuer profile.

No doubt, it is still very early days for Link Global Technologies (LNK: CSE). With two agreements announced in June, we look forward to watching the Company pursue its business development goals over the summer months.

All the best with your investments,

PINNACLEDIGEST.COM

LINK Global Technologies’ Investor Presentation

Stock Information

Symbol: LNK

Exchange: CSE

Last Price: CAD$0.50

Market Capitalization: CAD$16.02 million (according to Bloomberg data)

ONLINE RESOURCES

Visit LINK Global Technology Online

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE, NOR A RECOMMENDATION TO PURCHASE ANY SECURITY, NOR IS IT INTENDED TO BE A COMPLETE OVERVIEW OF LINK GLOBAL TECHNOLOGIES INC. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in Link Global Technologies Inc.

Link Global Technologies Inc. is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by Link Global Technologies Inc., and therefore we are not independent reporters, our coverage of Link Global Technologies Inc. features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on Link Global Technologies Inc. applies to the date this report was posted on our website (July 24, 2020). This disclaimer will never be updated, even if we buy or sell shares of Link Global Technologies Inc.

Do Your Own Due Diligence: An investment in securities of Link Global Technologies Inc. (“Link” or the “Company”) should only be made by persons who can afford a significant or total loss of their investment. Link’s stock price is volatile, and its shares are thinly traded. The value of the Company’s securities may experience significant fluctuations due to many factors, some of which could include operating performance, performance relative to estimates, disposition or acquisition by a large shareholder, a lawsuit against Link, the loss or acquisition of a significant customer, industry-wide factors, and general market trends. There can be no assurance that an active trading market for Link’s common shares will be established and sustained.

Unless otherwise indicated, the market and industry data contained in this report is based upon information from industry and other publications and the knowledge of Pinnacle Digest and Link. While Pinnacle Digest believes this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. Pinnacle Digest has not independently verified any of the data from third-party sources referred to in this report or ascertained the underlying assumptions relied upon by such sources.

In all cases, interested parties should conduct their own investigation and analysis of Link, its assets and the information provided in this report. Readers should refer to Link’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand Link’s objectives and the risks associated with the Company.

The securities of Link are highly speculative due in part to the nature of the Company’s plans/objectives, the highly competitive industry it operates in, and the early stage of Link’s development. Link is therefore subject to many of the risks common to early-stage enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial, and other resources and lack of revenues.

The Company has limited financial resources, and no assurances that sufficient funding, including adequate financing, will be available to advance its objectives. If the Company’s generative commercialization and development programs are successful, additional funds will be required for development of one or more initiatives. Failure to obtain additional financing could result in the delay or indefinite postponement of further business development. There can be no certainty that Link will be able to implement successfully the objectives and strategies described in this report. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by Link with Canadian securities regulatory authorities available at www.sedar.com.

Important: Please be aware and note the date this report was published (July 24, 2020). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

The statements and opinions expressed by Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of Link. The statements and opinions expressed by representatives of Link are solely those of Link and not the opinions of Pinnacle Digest.

Cautionary Note Regarding Forward-Looking Information:

This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that Link or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: the future financial position, business strategy and objectives, potential mergers and acquisitions, budgets, projected costs and plans of or involving Link; future growth predictions for the Company and its respective industry; expectations for future revenues, earnings, capital expenditures, operating and other costs; Link being in a growth phase; market forecasts and predictions; the nature of potential business partnerships or agreements; the timing and the completion of various development projects; the timing of any rollout or commercialization plans; the Company significantly increasing its development in the future; the Company’s intention to grow its business and operations; the future performance of Link; expectations for revenues, expenses, product/service launches, and anticipated cash needs; the expected timing and completion of Link’s near-term and long-term objectives; new technologies and regulatory frameworks being drivers of growth in the Company’s industry; the global cryptocurrency market continuing to grow in the future; the Company being positioned for growth in its industry; the Company being able to leverage its expertise to grow its business; Link’s competitive advantages, future business plans and future product/service offerings; the Company’s ability to scale; the partnership with Block One allowing Block One to access Link’s existing power assets in order to conduct its digital mining operations more cost effectively, while also allowing Link to expand its current business operations; Block One being able to take advantage of the competitive energy prices Link offers, while continuing to expand its digital currency mining operations; the increasing cost to mine bitcoin; decreasing margins for bitcoin miners; the success of bitcoin miners relying on cheap energy, low transaction fees and a rising bitcoin price; bitcoin miners being able to control how and where they source their electricity from; future energy consumption by bitcoin miners; the future price of bitcoin and price volatility; Link being able to secure future low-cost, reliable power and then deploying that power to conduct digital mining, and other activities; Link being able to secure, via contractual agreements, the use of power infrastructure; agreements with 3rd parties being key milestones that put the Company on track to achieve profitability; the Company continuing to execute on its core strategy of securing low cost, reliable power and supplying its partners with smart infrastructure and cost-efficient power solutions for their data hosting and digital mining operations; securing new partnerships to facilitate the Company’s global expansion; approximate electricity usage by 3rd parties; the planned output capabilities of the Company and what it will provide for bitcoin miners; the future power capacity and future computing power Link will be able to provide; future agreements playing an important role in Link’s growth strategy; access to power not being an issue for the Company; the regulatory environment in which Link operates; the Company being able to attract and retain key personnel; currency exchange and interest rates; the impact of competition; changes and trends in Link’s industry or the global economy; the Company being able to achieve and sustain profitability; Link’s ability to raise additional capital to fund its operations; and other statements, estimates or expectations.

Information provided relating to projected costs, capital expenditure, production profiles and timelines are expressions of judgment only and no assurances can be given that actual costs, production profiles or timelines will not differ materially from the estimates contained in this report.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond Link’s control. These statements should not be read as guarantees of future performance or results because a number of assumptions and estimates have been made, and they may prove to be incorrect. Forward-looking statements are based on the opinions and estimates of Link’s management or Pinnacle Digest at the date the statements are made. In this report, assumptions and estimates may have been made regarding, among other things, demand for the Company’s products/services being strong; Link being able to fund its development plans; Link being able to secure future financing to meet its growth targets; the Company’s ability to transition to new product/service offerings that meet market demands; Link successfully completing its development and growth plans, and doing so on schedule; an increase in the number of potential customer relationships; the length of sales cycles; the competitive environment; the ability to maintain or accurately forecast revenue from the Company’s products or services; the ability of the Company to identify, hire, train, motivate, and retain qualified personnel; the ability of the Company to develop, introduce, and implement enhancements or improvements for existing products or services that respond in a timely fashion to customer requirements and rapid technological change; risks associated with operations; Link’s ability to carry on current and future operations; the ability of the Company to meet current and future obligations; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; the current and future social, economic and political conditions; currency exchange rates; capital costs; the future size of the markets that Link intends to service; the business and development impacts of the novel coronavirus (COVID-19) global health pandemic on Link’s operations, and other assumptions and factors generally associated with Link’s industry. We caution all readers that the foregoing list of assumptions and estimates is not exhaustive.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of Link to differ materially from those discussed/written in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, Link. Factors that could cause Link’s results to differ materially from those expressed in forward-looking statements in this report include, but are not limited to, the following risks and uncertainties: any development activities Link may conduct which may not produce favourable results; changes in customer preferences; reliance on third parties for products, supplies and/or services critical to the Company’s operations; general business and economic conditions may limit the Company’s ability to obtain necessary capital to carry out all of its business plans; the overall performance of stock markets; volatility in the Company’s stock price; foreign exchange fluctuations; the consequences of competitive factors in the highly competitive industry in which Link operates may restrict the success of the Company; increased competition by larger and better financed competitors; negative impacts of COVID-19 on the Company’s operations; actions of competitors and partners; the inherent uncertainties associated with operating as an early stage company; changes in energy prices; the effectiveness of the Company’s products and services; acceptance of products and services by target markets; the regulatory environment; regulatory failings; the potential for changes to the regulatory environment with previously open markets becoming closed, or adopting prohibitive regulations; privacy breaches; the corporate governance required for Link; the Company’s ability to generate sufficient cash flow from operations to meet its current and future obligations; the Company’s ability to scale its operations as expected; the potential for issues which could expose the Company to legal liability; the Company may not be able to raise the additional funding required to complete its development plans and to continue to pursue its other business objectives; the Company may not be able to attract or retain key personnel; conflicts of interest; officers and directors allocating their time to other ventures; the willingness of third parties to sign agreements with Link on terms that are acceptable to management of Link; management’s ability to manage growth; major changes in the political and economic environment of Link’s fields of activity; the risks inherent to monitoring the lifecycles of products and services with a high technological feature in a global environment; the risks inherent in the lifecycles of technology products and services in the cryptocurrency industry; risks related to the response-time that might be needed in case of totally unexpected events in areas relevant to Link’s field of activity; the market in which Link operates may not continue to expand, and potentially even contract; failure to develop and successfully market new technology products and services at favourable margins, or at all; the intellectual property of others and any asserted claims of infringement; dilution and future issuances of equity; loss of key customers; unanticipated problems related to Link’s business objectives; the Company’s ability to obtain and/or maintain any necessary permits, consents or authorizations required to pursue its business objectives; general business, economic, geopolitical and social uncertainties; the risk of claims and legal actions for various commercial and contractual matters in respect of which insurance is not available; bitcoin becoming less profitable to mine; volatility or a collapse in the value of bitcoin and other cryptocurrencies; regulatory risks pertaining to energy production and consumption; the future potential halving of bitcoin; changes in the network difficulty rate and price of digital currencies/bitcoin; negative changes in the level of digital currency/bitcoin rewards per block; the securing of economic rates for the purchase of power; difficulties acquiring digital currency mining hardware; changes in laws, regulations or other industry standards affecting the business of the Company; governments prohibiting or severely restricting the right to acquire, own, hold, sell, use or trade cryptocurrencies or to exchange cryptocurrencies for fiat currency; security breaches in blockchain or distributed ledger technologies and cryptocurrency exchanges; changes in environmental legislation; governments taking regulatory action that increases operational costs, and other risks pertaining to Link’s industry as well as those factors discussed in the section entitled “Risk Factors” in Link’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars, and other disclosure documents filed with Canadian securities regulators. The Company’s filings can be found on the SEDAR website (www.sedar.com) under Link’s issuer profile.

Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (July 24, 2020) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information because we can give no assurance that such expectations will prove to be correct. Should one or more of the aforementioned risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, or expected.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy Link’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: Link is a client of ours (details in this disclaimer on our compensation). We also own shares of the Company. For those reasons, we want to remind you that we are biased when it comes to Link.

Because Link has paid us CAD$45,000 plus GST for our online advertising and marketing services, and Maximus and Alexander Smith (Head of Market Research for PinnacleDigest.com) own shares of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on Link; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including Link) represented by PinnacleDigest.com are typically early-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as Link it is possible to lose your entire investment over time or even quickly. Link is not an appropriate investment for most investors.

Important: Set forth below is our disclosure of compensation received from Link and details of our stock ownership in the Company as of July 24, 2020:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$45,000 plus GST to provide online advertisement coverage for Link for a six-month online marketing agreement. Link paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of this report authored by PinnacleDigest.com about Link, as well as display advertisements and news distribution about the Company on our website and in our newsletter. We (Maximus Strategic Consulting Inc.) own shares of Link. Alexander Smith, Head of Market Research for PinnacleDigest.com, also owns shares of Link. Maximus Strategic Consulting Inc. and Alexander Smith intend to sell every share they own of Link for their own profit. All shares Maximus Strategic Consulting Inc. and Alexander Smith currently own or may purchase in the future of Link will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. and Alexander Smith benefit from price and trading volume increases in Link, and are therefore extremely biased when it comes to the Company.

Link is a Very Risky Investment: Link is an early stage company that poses a much higher risk to investors than established companies. Risks and uncertainties for early-stage companies such as Link are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.sedar.com to review important disclosure documents for Link.

Link will need to raise additional capital in the future to fund its operations and objectives, likely resulting in dilution to its shareholders.

History of Operating Losses: Link has a relatively limited operating history from which an investor can evaluate its business and prospects. Link has generated net losses from operations since the commencement of operations and the Company will likely incur net losses from operations for a significant period of time. There is no assurance that the Company will achieve or maintain profitability and it may continue to incur significant losses in the future. Furthermore, the Company’s revenues may fluctuate substantially from quarter to quarter.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past successes of members of Link’s management team, board of directors, and advisory team are not indicative of future results for the Company.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including Link.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically Link) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of Link is highly speculative.

To get an up to date account on any changes to our disclosure for Link (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.