- The Gold Bull Market of 2024 Has Begun

- From Central Banks to Ordinary Americans, Gold Buyers Come in Different Shapes And Sizes

- Gold Price Outperforms Bitcoin and Forecasts

Many fundamental forces continue to drive gold prices higher today, from the looming threat of war to a technical breakout. In the latest podcast, What’s Really Driving Gold Prices Higher, Aaron and Alex outline why this gold bull market is different, and why it’s not going away.

The major supply and demand forces for gold are explained, from gold mining and exploration to monetary policy and the ever-present threat of inflation.

Gold has broken through technical resistance. Prior to the latest price surge, it had been bumping up to about $2,075 since August 2020, cresting above $2,000 in early 2022, early 2023, and late 2023 before retreating each time. But in early 2024, it finally broke through and shortly after, gold traded above $2,400 for the first time ever.

After years of consolidation, many technical forecasters believe gold’s price could extend beyond $2,500 soon.

Central Banks Lead Buying Frenzy

Central banks bought over 1,000 tonnes of gold in both 2022 and 2023 – a record for any two years in modern history. What’s fascinating is that while central banks buy record amounts, investors have been net sellers of gold for three straight years.

According to Mining.com and Reuters,

“…gold ETFs saw three consecutive years of outflows with 244.4 tonnes of decline in 2023 amid high-interest rates. Some analysts expect that the ETFs could start seeing inflows of non-yielding gold once the U.S. Federal Reserve cuts rates.”

China’s End Game as It Buys Huge Amounts of Gold

China remains the world’s largest producer of gold, producing more than 300 tons in 2023. But, in addition to that production, China is always near the top of gold buyers. The People’s Bank of China bought 225 tonnes of gold in 2023, worth about $15 billion. According to Felix Salmon of Axios Markets, who wrote in ‘Central banks have been buying gold at a record pace’,

“Its current holdings now stand at 2,235 tonnes and represent about 4% of its international reserves.”

China, as one of the leaders of the BRIC nations, may be planning to underpin its currency or a new currency with gold. If successful, it may finally offer an alternative to the U.S. dollar.

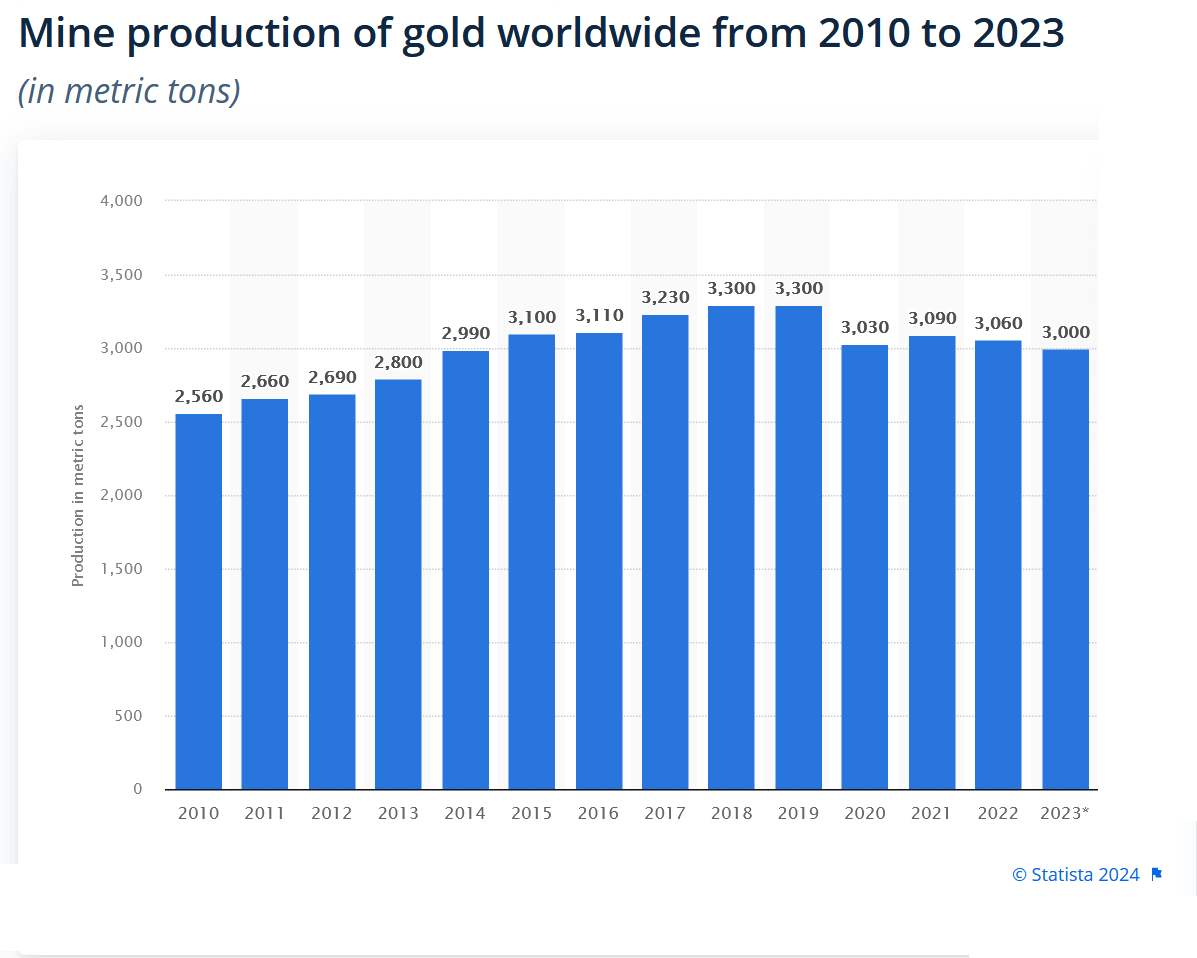

Limited Exploration and Flat Gold Production for the Past 10 Years

Gold mining companies need help finding new world-class deposits, which confirms supply will grow slowly. Mine production of gold worldwide has been relatively flat for the past 10 years. 2,990 tons were produced in 2014, compared to just 3,000 tons in 2023.

Cost Per Ounce to Produce Soars

According to Adam Webb, the Director of Mine Supply at Metals Focus, in an article from April of 2023 featured on the World Gold Council, 2022 saw average all-in-sustaining costs soar to a record high of US$1,276 per ounce. This number will likely only rise in 2023 and 2024, which means margins are shrinking (unless gold’s price rises further) for miners.

Only the most economically sound projects will receive financing and move into production. As the gold bull market takes flight, investors will realize rather quickly that there aren’t too many quality names to invest in.

Third Factor Driving Gold Higher: Soaring Interest Cost on U.S. Debt

As the U.S. continues to pile on debt in the face of far higher interest rates, the amount of interest paid on that debt is soaring. As the interest rises above $1 trillion annually and heads towards $2 trillion, the market is pricing in necessary interest rate cuts. Gold historically does well in an interest rate-cutting environment.

Main Street Begins Buying Gold, Realizes Inflation is Destroying Purchasing Power

While ETF outflows continue in much of the West, especially Europe, a different type of gold buyer is emerging… Paranoid or prudent middle—to upper-class Americans are now protecting themselves against currency debasement through gold. Jeff Cox from CNBC broke the story titled Costco selling as much as $200 million in gold bars monthly, Wells Fargo estimates on April 9th.

Last year, it was estimated that Americans were buying up to $100 million in gold bars per quarter, and that buying has increased to between $100 million and $200 million monthly! We have not seen this kind of participation, which may be the most significant signal that today’s gold bull market has legs.

Gold to Begin Outperforming Bitcoin

The trend of gold outperforming Bitcoin is a new one. Bitcoin has destroyed gold by almost every metric over the past 10 or 12 years, but recently, that has changed. Gold is showing strength as Bitcoin stagnates and drops in the face of global turmoil…

Take Iran’s recent aggression towards Israel. Bitcoin almost immediately sold off while gold climbed. Gold is diverging from Bitcoin and the broader U.S. markets. Bitcoin is trading with the U.S. markets, which have been down lately.

Focus on the Miners for Largest Gains

As is always the case in every bull market, gold mining stocks outperform the metal. In past bull markets, gold stocks outperform the precious metal by roughly 3 to 1.

Inflation is Here to Stay

The narrative that central banks had inflation controlled and that it was heading down for good is all but gone. Remember the projected six rate cut theory in 2024? Investors know inflation is sticky and won’t easily go away.

Gold Could Have a Long Way to Go

Both Aaron and Alex believe gold’s run has much further to go. While both agree that $2,500 will be hit before $2,200, Alex is even more bullish, citing past bull markets. Gold ran from $35 per ounce in 1971 to about $800 in 1980. Precious metals performed well in the early 2000s, as gold’s price went from around $300 to a high of about $1,900 in 2011.

So, given this gold bull market is starting at about $2,000 per ounce, Alex believes $10,000 and even $20,000 an ounce is not out of the realm of possibilities.