With the FBI notifying Congress it has reopened its investigation into the Democratic presidential nominee, all bets are off as election day looms. Traders have been dumping stocks en mass as Trump’s odds of winning continue to rise, while action in the gold market continues to heat up.

Gold, right now, is one of the only perceived safe haven assets…

Truth be told, no matter who wins the election in two days, gold will likely be one of the best assets to own for the next 4 years. With debt skyrocketing in most western nations (led by the US) and negative interest rates threatening North America, gold has quietly, and very easily, risen back above $1,300 an ounce. The precious metal is receiving heightened demand as investors search for safety and something non-dilutable. As our economic system becomes increasingly susceptible to shocks, we are encouraging diversification and a substantial weighting in hard assets.

Negative Rates and Stock Bubble Bullish for Gold Market

Multibillionaire, and one of the greatest investors of our lifetime, Mr. Stan Druckenmiller – a man who from 1986 – 2010 achieved an unprecedented annualized rate of return of 30% – is calling for an economic collapse in the near-term. Druckenmiller believes that the U.S. is headed for financial ruin. He isn’t a gold bug… this is one of the greatest wealth managers in history. On a macro level, simply put, Druckenmiller believes the demographic picture in the U.S. will make the nation insolvent…

With each passing year, Baby Boomers become more of a drain on the economy. The demographic that once provided mass wealth creation in the U.S. is now sucking the treasury dry.

Druckenmiller stated earlier this year:

“When I look at the current picture of expected tax revenues combined with benefits promised to future generations, I see the most unsustainable situation I have ever seen in my career.”

7 Factors Supporting Stronger Gold Market and Higher Gold Prices in the Near-Term

#1 – The Election

HSBC’s Chief Precious Metals Analyst James Steel stated the price of gold will enjoy at least an 8% jump whoever wins the race. While this may be one of the more bullish predictions, we can’t help but agree the short-term prospects for gold look strong. The many promises made during this campaign, by both candidates, will add trillions in debt. Trump, the self-proclaimed ‘King of Debt’, wants to spend at least half a trillion on infrastructure. Clinton promised to provide interest-free loans to college kids; and insinuated that, if elected, she would kick the hornets nest in the Middle East… this Bush-like behavior would lead to another debt-financed war.

* In debate with Trump, Clinton recommended there be a no fly zone in Syria. General Joseph Dunford, Chairman of the Joint Chiefs of Staff, said this would lead to war with Syria and Russia. Click here to watch.

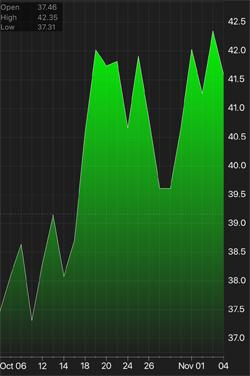

Whether Clinton or Trump, each candidate is preparing to unleash massive fiscal spending in the GDXJ One Month Chartquarters ahead that will explode the balance sheet  and money supply. Remember how gold reacted to Obama’s first two years in office when he enacted his brand of ‘stimulus spending’? The precious metal had three of its best years on record. Point is, new, spendthrift American Presidents are great for gold. And unlike in years past, both candidates are promising to spend their way out of America’s economic malaise.

and money supply. Remember how gold reacted to Obama’s first two years in office when he enacted his brand of ‘stimulus spending’? The precious metal had three of its best years on record. Point is, new, spendthrift American Presidents are great for gold. And unlike in years past, both candidates are promising to spend their way out of America’s economic malaise.

HSBC predicted, “If the real-estate magnate triumphs, gold could rise to $1,500 an ounce.” Imagine what $1,500 gold would do to the TSX Venture… many gold stocks were already breaking out to end last week and would hit multi-year highs if the yellow metal topped $1,500.

#2 – Markets are Due for a Significant Decline

As of Wednesday, the S&P had declined for its 7th consecutive trading day. As reported by Zero Hedge,

“This ‘event’ has only occurred three other times in the last 20 years… and each coincided with a major financial crisis…”

U.S. stocks declined on Thursday and Friday, marking their longest slide since 1980…

Furthermore, the more than seven-year-old economic expansion in the U.S., which began in mid-2009, is the fourth longest since 1850…

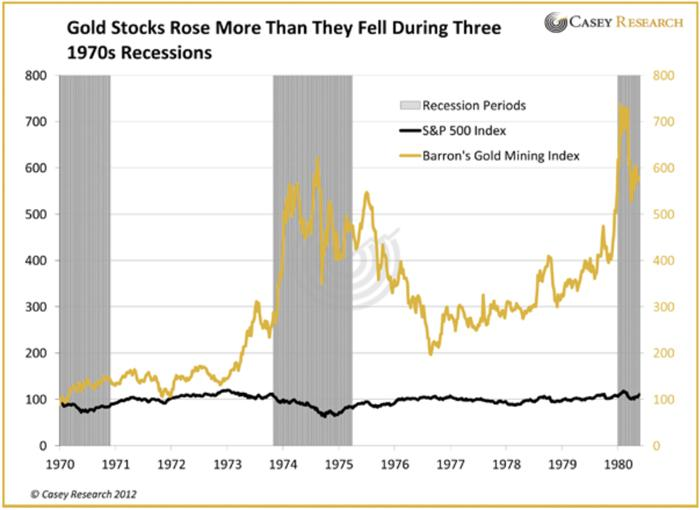

This could be good news for gold and gold stocks. Although gold fell in the heart of the last financial crisis (2008), it was still up 5% on the year. During the 1970’s recessions, gold stocks performed very well.

Lastly, the U.S. economy averaged about 1% growth in the past 3 quarters (Q4 2015, Q1-Q2 2016). This changed last week when Q3 2016 GDP was reported at a shocking, and questionable, 2.9%. A 300% increase from the average of the previous 3 quarters, just days prior to the election? Anyway, CNBC quickly debunked the number, which clarified, “Some nine-tenths of a percentage point of the gain came from a surge in soybean exports…”

Don’t count on soybeans to save the U.S. economy next quarter.

A final point in respect to the U.S. stock market:

The stock market is a giant bubble, kept afloat by low interest rates and share buyback programs fueled by debt. By and large, the U.S. stock market has been flat for over a year as growth remains muted and low rates lose their economic muster.

Warren Buffett has been an outspoken critic of Trump, and he is eerily under invested, holding $72 billion in cash in Q2 2016. According to an article from The Motley Fool, “This is the most cash Buffett has had on hand in his entire 40 years as the CEO of his firm Berkshire Hathaway.”

$72 billion represented more than half of Buffett’s total U.S. investment portfolio in Q2 of this year, which was worth $130 billion. While Buffett is somewhat of a permabull, one has to wonder if he has increased his liquidity in preparation for a sell-off.

#3 – The Fed

It came as no surprise the Fed left rates unchanged at its November meeting, which concluded this past Wednesday. The Fed has failed to raise rates at every policy meeting since December of last year. Chances are, it will fail to raise rates this December (for some reason November’s decision, like all before it, has reinforced ‘expectations’ for a December hike, with some pundits calling for an 80% likelihood). And, even if the Fed chooses to raise rates a quarter point in December, it will be seen as another symbolic rate hike. Monetary policy will remain dovish, and that favors gold throughout 2017.

Peter Schiff warned listeners in a recent podcast that, if the Fed fails to raise rates in December, free from its political agenda of electing Clinton (who would continue Obama’s policies), it will prove how weak the U.S. economy truly is.

The Fed will hold its final Federal Open Market Committee on December 13th-14th.

#4 – Quitaly

This is a sleeper issue that has been largely ignored thus far by the press due to the U.S. election. Matteo Renzi is the leader of the ruling centre left government in Italy; his party thought it could pass the most significant set of constitutional reforms since the birth of the Italian Republic in 1946, without needing approval by a referendum, according to European Politics and Policy… they were wrong.

A referendum has been scheduled for December 4th and Renzi has lost all momentum in the polls. Quitaly will drive gold higherThe party most likely to replace him is the  Five Star Movement, a group running on a promise to hold another referendum, upon gaining power, to leave the EU… can you say Quitaly?

Five Star Movement, a group running on a promise to hold another referendum, upon gaining power, to leave the EU… can you say Quitaly?

Note: In June, two Five Star Movement candidates were selected as the Mayor of Rome and Turin (a left-wing stronghold). The two men who founded the Five Star Movement in 2009 are anti-establishment and were not politicians at the time. Sound familiar?

Italy’s economy has been stuck in a malaise for the past two decades. According to The Guardian, “The economy is 10% smaller than it was before the financial crisis and as a result unemployment is high…”

If Italy’s constitutional referendum vote on December 4th fails, the next Brexit, this time the Italian version, which has already been dubbed ‘Quitaly’, may soon follow. This would essentially end the failing experiment of the EU as other nations push for their own referendums. As in Britain leading up to the Brexit vote, expect gold sales to rise throughout Italy and much of Europe for the foreseeable future…

#5 – Negative Interest Rates

In June of this year, ‘Bond King’ Bill Gross referred to the sovereign bond market as an “Economic Supernova” and tweeted, through his firm Janus Capital, that,

“…the spread of negative interest rate policy though central banks around the world will cause the record-breaking $10.4 trillion of negative-interest-rate sovereign bonds on the market to explode one day.”

In his October 4th, Monthly Investment Outlook, titled Doubling Down, Gross wrote, in respect to central banks:

“They are quite simply, employing a Martingale System in the conduct of monetary policy with policy rates now in negative territory for both the ECB and the BOJ – which in turn have led to over $15 trillion of negative yielding developed economy sovereign bonds.”

Nearly $5 trillion in negative yielding sovereign bonds have turned negative in just the past four months.

Expect more of the same from policy makers in 2017 as they have gone too far down this road to turn back now.

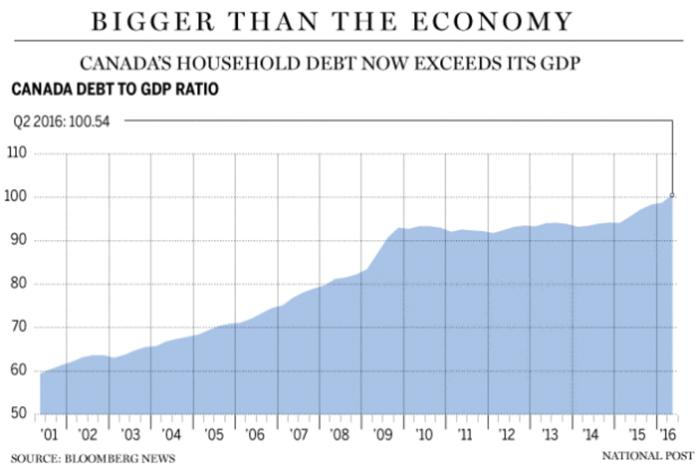

Another reason negative rates, or near zero percent interest rates, are here to stay is that debt has grown too large to feasibly raise rates by more than a quarter point here and there. Many politicians and central bankers, including those in Canada, have come out and admitted this.

#6 – Even Wealthy Countries are Desperate

Take Canada for example…

Calgary-based MNP LLP, said 56% of Canadians polled – up from 48% surveyed six months ago – are close to facing negative cash flow should they take on up to another $200 in monthly debt.

Craig Alexander, chief economist at the Conference Board of Canada, stated:

“Because there’s so much debt, the Bank of Canada can’t raise rates very quickly, or to very high levels.”

Payday lending usage has doubled in Canada over the past 5 years as Canadians rely on high-interest payday lenders to make ends meet.

The Financial Consumer Agency (FCA) reported in late October that,

“…the share of Canadians who used a payday lender in the past year rose to 4.3 per cent in 2014, from 1.9 per cent in 2009.”

While it’s easy to ignore 2% of the population, 4.3% is becoming more significant. If this number doubles again, look out.

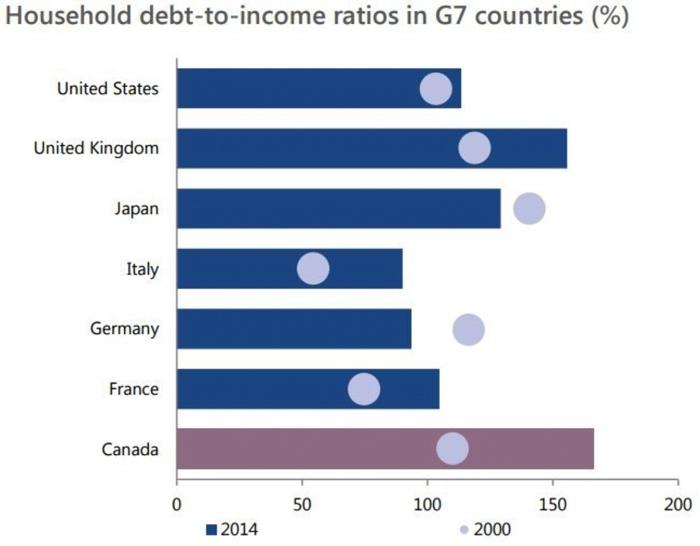

The debt loads can be seen from coast to coast as Canada now has the highest household debt-to-income ratio in the G7…

Canada’s Parliamentary Budget Office has warned this could spark a Canadian consumer debt crisis as early as 2020. Be smart, pay off your debt and reduce your banking fees.

#7 – Buy Gold to Duck the Inflation Tax

With near zero or negative interest rates, a rigged stock market and bond market in the throes of a 30-year plus bull market, there isn’t much shelter from the coming inflation tax.

If you slowly boil a pot of water with a frog in it, the frog will not jump. If you boil it quickly, however, the frog will jump away in pain. Humans have proven to be much the same when it comes to impending currency crises throughout the ages.

In a historic white paper, Paper Money vs. Gold Money, the current instability and leverage the U.S. dollar implores on the world is explained:

“If there are $6 trillion dollars outside the US and the US inflates the money supply by 10% it has stolen $600 billion from these people outside the US. This is about the level of the US military budget. So a case can be made that the US inflation tax on the rest of the world pays for the US military which can then dominate the world.

It would be a mistake to assume that since the Roman dinar, the Spanish reale, and the British pound each took many years to lose reserve currency status that the dollar fall will be slow. Back then they did not have instant worldwide information flow, computers with automatic trading software, etc. While it would be wrong to say that This Time Is Different, the collapse will probably set a new speed record for reserve currency collapses.

The US ability to quietly take wealth from dollar reserves all around the world was like the Golden Goose. But now they have pushed too far and that golden goose is going to die.

People or countries do not pay any inflation tax on their gold and silver holdings. This is where the frog is free.”

China’s yuan joining the basket of currencies backing the IMF’s Special Drawing Rights (SDRs) was a major step in diluting the global influence of the U.S. Dollar (click here to read our report A World Currency is Born). We expect this trend to continue as America piles on trillions in debt with its soon to be new President.

Gold is back above $1,300 and gold stocks are on the move in Canada. This sector will continue to demand our attention as we can see nothing in the immediate term that would derail this focus. U.S. stocks and bonds are hovering near record highs, while growth in much of the West remains near 1% or even negative in some countries. The value and potential for significant gains exist in gold, particularly in certain gold stocks. Over the last two months we have literally traveled to three different continents in search of attractive gold projects. More on this soon…

All the best with your investments,

PINNACLEDIGEST.COM

* If you’re not already a member of PinnacleDigest.com and would like to receive reports like this one, once per week via email, please click here to join for free.