Well, the day arrived… This past Wednesday, recreational marijuana became legal in Canada. Just the second country to legalize, behind Uruguay, it made headlines the world over as the first G7 nation to embrace marijuana. Canada continues to establish itself as a leader in legalization after being among the first to legalize medical marijuana in 2001.

Unsurprisingly, the big day had little effect on Canadian cannabis stocks. It was baked in long ago. But new opportunities within the sector are already starting to emerge; and the trajectory of expansion and innovation has been crystallized in recent months.

Cannabis Stocks Lose Buzz After Legalization

While a watershed moment for Canada and the domestic industry, the buzz quickly wore off. After climbing from mid-August into September, numerous cannabis stocks are trading flat or declining. The proverbial buy on mystery sell on history took over after October 17th, and that’s to be expected.

Canadian Marijuana Index – 5-Day Chart

After such a monumental build up, investors are now wondering – what next?

Where do cannabis stocks and the entire marijuana-related sector go from here?

Investors to Focus on Four Key Fundamentals:

- Medical marijuana and potential involvement of ‘Big Pharma.’

- Sub-sectors, including CBD-oil, infused-beverages, edibles, various extraction plays, and ‘craft’ weed brands.

- The continued legalization and liberalization of laws towards medical and recreational cannabis globally. The most important market, by far, being the United States.

- Retail outlets and the potential emergence of chains. If a retail brand emerges quickly and establishes a regional or potentially national footprint, they could be ripe for acquisition from any of the major LPs – all of which will be hungry for more and more distribution.

Medical Marijuana | A Sleeping Giant

Let’s start with medical marijuana, which could have the longest lasting impact on the cannabis market.

In a Bloomberg article titled, Forget Stoners. The Real Money Is in Medical Marijuana, Jen Skerritt highlights the looming opportunity:

“Medical marijuana sales are expected to dip in Canada when recreational use becomes legal, but significant growth is expected in markets where medical marijuana programs are emerging, according to a report from Arcview Market Research and BDS Analytics.”

Now, consider this,

“The global medical pot market could be worth more than $50 billion by 2025, from $8 billion in 2017, 10 times the projected size of Canada’s total marijuana sector, according to PI Financial Corp. Medical “is potentially bigger, for sure as a percentage growth,” says Bruce Linton, chief executive officer of Canopy Growth Corp.”

Furthermore,

“In June the U.S. Food and Drug Administration approved GW Pharmaceuticals Plc’s Epidiolex to treat two rare forms of childhood epilepsy. It was the first medical treatment derived from the marijuana plant to get the greenlight for sale in the U.S. British Columbia-based producer Tilray Inc. already has an agreement to develop products and delivery systems with Sandoz, the Canadian division of Novartis International AG of Switzerland.”

These are two examples, but there is a suite of companies, universities, and countries exploring and testing the benefits of medical marijuana…

FSD Pharma | Exploring Cannabinoid-Based Treatments

For example, Canadian marijuana company, FSD Pharma (HUGE: CSE), whose market cap has recently fallen below $1 billion, is sponsoring a research program at Tel Aviv University utilizing a cannabinoid-based treatment focused on cardiovascular disease. Interestingly, the research program is designed “at the development of novel and proprietary cannabinoid-based treatments for the prevention and treatment of atherosclerosis, the underlying factor for most cases of stroke and cardiac stenosis events in the western world,” according to the company. Israel is one of the world’s foremost biotech hubs.

There have been encouraging studies out of the EU regarding cannabinoid-based therapies and the potential for reduced inflammation of the heart, which we have been monitoring for years.

Global Market Insights is predicting the global medical marijuana market is projected to surpass USD$55 billion by 2024. The report features key industry trends across the application, route of administration, distribution channel, and regional landscape. Most notably,

“The extensive demand for marijuana in the treatment of chronic pain due to cancer, arthritis, HIV/AIDS, and cancer will foster the global medical marijuana market growth. The rising inclination toward marijuana, as opposed to opioid narcotics, will also influence the industry trends.”

Italy Following Canada’s Lead in Medical Marijuana

Italy is a clear front-runner in Europe, legalizing medical cannabis in 2013. Many European nations are closely watching various studies ongoing in Italy and Canada. Aphria, who we visited earlier this year, gained access to the Italian market in early 2018. Access is through its subsidiary, Aphria International, whose CEO Lorne Abony went on record stating the Italian market has the potential to be “$9 billion larger than the combination of the recreational and medical markets in Canada.”

By any measure, large medical markets are set to open up in Europe, including in England. Medical marijuana and cannabidiol (CBD) are positioned to offer alternatives to conventional treatment options.

While Canada legalized medical marijuana way back in 2001, dozens of countries are just now evaluating the decision. Many of these nations will likely legalize medical marijuana in the coming years, adding significant fuel and capital to the cannabis movement.

Sub-Sectors to Dominate Cannabis Headlines

Next up is the ever-increasing list of sub-sectors, which include everything from CBD-oil, cannabis infused-beverages, edibles, various extraction plays, and luxury weed brands.

All of these sub-sectors will play a key role, but today we’ll focus primarily on CBD-oil because of its diverse use profile. From young athletes looking to recover quicker, to middle age folks with hip and joint issues, to the elderly dealing with chronic arthritis or pain, and even the veterinarian industry, CBD oil is fast becoming an acceptable alternative to painkillers.

Hemp-Based CBD Oil Continues to Garner Attention

A Rolling Stone article from September, Exclusive: New Report Predicts CBD Market Will Hit $22 Billion by 2022 reveals the upside potential in hemp-based CBD oil. According to the author,

“…it turns out that one market is spinning off into a mega-industry of its own: according to a new estimate from cannabis industry analysts the Brightfield Group, the hemp-CBD market alone could hit $22 billion by 2022.”

The marijuana-derived CBD market is also projected to grow rapidly, but as we’ve written about before, hemp is already legal and being grown all over the U.S. (Federal legislation still pending). Also, it can rather easily be grown outside in less than ideal, even somewhat harsh, conditions, making it scalable and very attractive to the farming community given its current value.

The Rolling Stone article continued,

“Previously, CBD products have been available mostly in head shops, with a few doctors recommending it for various maladies. But in 2017 and 2018, the products spread to natural food stores, beauty aisles, cafés and doctors offices. So far the industry is on track to hit $591 million in 2018, and thanks to a number of factors – including, surprisingly, Senate Majority Leader Mitch McConnell – that could increase 40 times in the next four years.”

All of us should be keeping a close eye on the CBD market as it could prove a catalyst for capital chasing the next cannabis sub-sector.

Cannabis Infused-Beverages | Multi-Billion Market in the Making

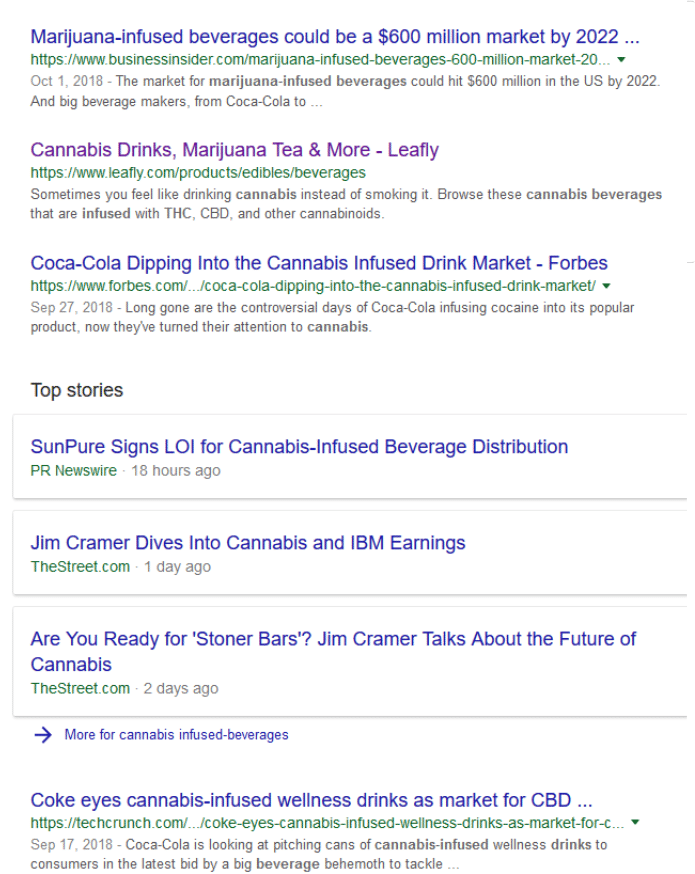

Google ‘cannabis infused-beverages’ on any day of the week, and dozens of new stories will pop up. The sub-sector is rapidly evolving into a multi-billion dollar industry and will likely dominate headlines over the coming months. Check out the search results from Google on Friday:

Branding and ‘craft’ products will provide opportunity for investors. Although retailers in the cannabis space will not have the huge valuations of producers, they could be attractive acquisition targets if they can roll out a national or regional footprint. Consumers prove year after year their willingness to pay more for trusted name brands with built-in perceived value.

The most successful and profitable water brands in the world are the luxury brands. Think of Evian, Fiji, Perrier, and Voss. Consumers choose to pay higher prices for what they deem to be superior taste and quality (brand affinity). Cannabis brands/dispensaries are racing to secure market share and position themselves as the trusted, high value brand.

Edibles | A Work in Progress

We have heard various estimates, from a year to two years, before marijuana-related edibles become legal in Canada. Consider this from CBC,

“According to Deloitte’s 2018 cannabis report pot smoking is expected to generate more than $5 billion in 2019 but that’s nothing compared to edibles.

The edibles sector could hit $12-$22 billion by the time the market is open for business.”

Again, going back to the beverages and the optionality of cannabis-related products,

“The Deloitte survey suggests that cannabis may serve a larger role as a substitute for beer, spirits, and wine.”

Expect to see marijuana and cannabis-related products popping up everywhere.

The US Contemplates Federal Legalization

It is unlikely a movement such as the one we are witnessing will simply grind to a halt or fade away over time. In all likelihood, marijuana legalization will continue to be pushed through as the majority of people in the developed world support it.

Make no mistake… If the U.S. legalizes recreational marijuana it will be a total game changer, unlike anything we’ve seen to date. U.S. Representative Earl Blumenauer, a Democrat from Oregon, sent a letter to House Democratic leadership this past Wednesday outlining a plan to advance federal legalization measures. The goal is to legalize cannabis by the end of 2019 (federally). The Democrats would need to at least take the House in the coming midterms for this to be a possibility. An article from Rolling Stone reads,

“Congress is out of step with the American people and the states on cannabis,” he wrote. “There is no question: cannabis prohibition will end…”

Voter support aside, strictly from an economic perspective, every day the U.S. keeps pot illegal is another day Canada has to advance its status as the global powerhouse in the sector. For all his rhetoric, Trump knows he is losing out on a major industry to Trudeau at the moment.

Americans and their view of marijuana are changing rapidly. A Quartz article cites Pew Research Center, which according to a recent survey noted,

“62% of Americans support marijuana legalization, which is almost double the number of those who supported legalization in 2000.”

Trump’s Attorney General, Jeff Sessions, has been adamantly against recreational legalization, but his view is in contrast to the majority of Americans, and likely even the President. It’s also no secret that Trump and Sessions have somewhat of a contentious relationship. A firing may be in the cards after the midterms, which could be bullish for legalization in America.

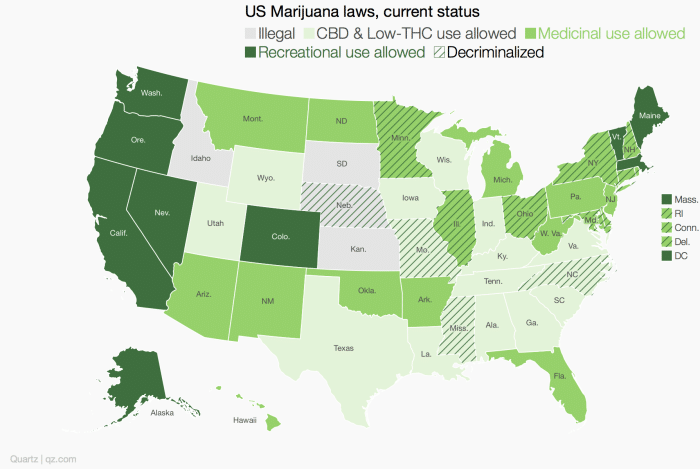

US Marijuana Laws State by State

It is our strong opinion the legalization and liberalization of laws towards medical and recreational cannabis globally will continue. With that in mind, all eyes will be on the United States; and don’t rule out support from President Trump, who is a businessman, dependent on a thriving U.S. economy to stay in power. The cannabis industry could be a major employer and economic driver. Trump knows this, which is why he has been sheepishly supportive of the potential for legalization, despite negative comments from some high-ranking Republicans. He likely also knows legalizing marijuana could broaden his base of supporters.

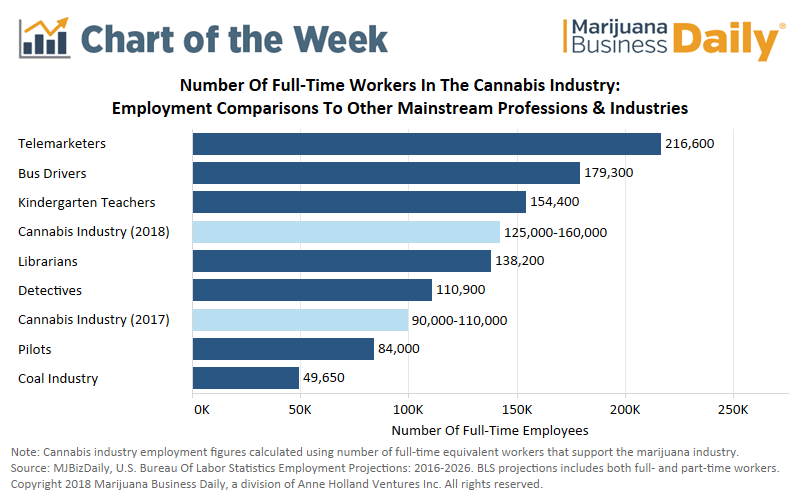

Cannabis Industry Produces Growing Number of Full-Time Jobs

Cannabis stocks are here to stay. The sector is in its infancy. It is several years, if not a decade away from becoming a mature market. There are just too many countries, including the top five largest economies in the world, that have yet to legalize (we believe most — with the exception of China — will within 3-5 years).

Canadian Cannabis Market in 10 Years

In ten years, the Canadian cannabis market will be an afterthought, almost irrelevant from a global perspective. However, the players in Canada have a once in a lifetime opportunity to lead this global expansion as first movers. They could even be amongst the dominant players in America if rec-pot is legalized there. Yes, many publicly traded producers appear overvalued at the moment, but their ability to be at the doorstep of nations on the verge of legalization creates a truly historic opportunity both for our country, and investors. Volatility in the space is inevitable, but the future looks bright for Canadian medical marijuana players, and our cannabis sub-sectors.

In February of this year we wrote,

“Why do wine connoisseurs spend thousands more on top wines from France, Italy and Spain? While the history plays a significant role, the leading answer is quality and taste. The wines are believed to be derived from superior grapes, produced by sophisticated growers. In fact, the French have a word for these people. They call them vignerons. These people understand the entire process like a science and live on the vineyard to oversee every aspect of the operation with the purpose of creating a fine wine. The finest.

If Canada can emerge as the ‘vignerons of the weed industry,’ which we believe it can, while keeping costs low, valuations could grow exponentially over the next five to ten years. That is the blue sky potential for so many producers in this country…”

Finally, as more countries experiment with and approve medical marijuana based treatment, a secure, trusted supply will be in increasingly tight demand. With year end approaching (tax loss selling season), late-November to mid-December could prove an opportune moment to take positions in the cannabis space. If January 2019 is anything like January 2018 for marijuana stocks, that timing will be ideal.

All the best with your investments,

PINNACLEDIGEST.COM

P.S. If you’re not already a member of our newsletter and you invest in CSE or TSX Venture stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.