Dow 30,000 Prediction from January 2018 Comes True

In January of 2018, almost three years ago, I predicted the Dow was heading to 30,000. The article Why the Dow is Heading to 30,000

Insights

In January of 2018, almost three years ago, I predicted the Dow was heading to 30,000. The article Why the Dow is Heading to 30,000

As America continues to churn in an amalgam of post-election jubilation, disappointment, and confusion, we want to take a step back… Despite the S&P 500

The covid-19 pandemic is increasing public debt to levels last seen after WWII. The Economist attempts to answer the question: is rising public debt a

Perhaps more than anything else, Trump is known for cutting taxes. The Tax Cuts and Jobs Act of 2017 cut the maximum corporate federal income

It appears COVID-19 has given central bankers the extra nudge they needed to explore digital currencies. According to the Federal Reserve Chair Jerome Powell, 80%

Across North America, risk aversion is on the rise again. According to BNN Bloomberg, Tiff Macklem, Governor of the Bank of Canada, recently stated in

The U.S. Dollar remains under pressure amidst many factors, including soaring deficits and an increasing money supply. Epic Economist believes recent data highlights the demand

Canada, like many countries, is at an economic and societal crossroads — the choice between conventional and welfare capitalism (i.e. the Nordic model). Via Financial

COVID-19 is bringing about a reckoning for companies around the world. According to Yelp, 60% of U.S. businesses that closed due to COVID-19 will not

The global economy’s ability to recover from COVID-19 hinges on one very important factor: unemployment. More specifically, how high the unemployment rate gets. Although the

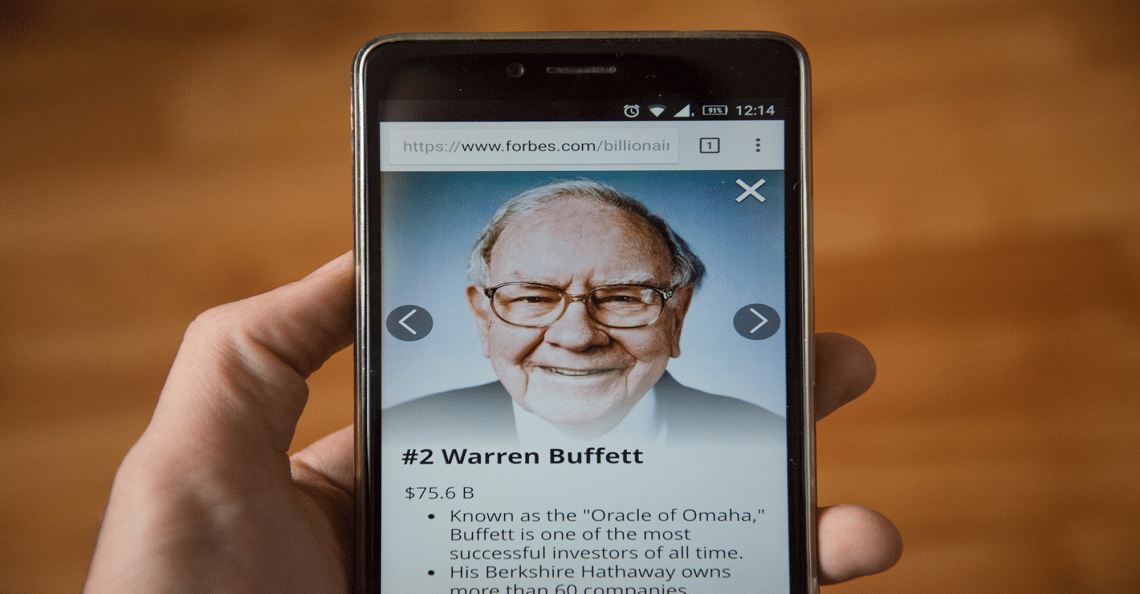

Many who follow Warren Buffett are sounding the alarms that he is prepping for a market decline. The Cooper Academy notes, “If we look at

After pushing into uncharted territory above US$2,000 an ounce, gold faced significant selling pressure last week, closing as low as US$1,921.16. While many were expecting

Exclusive Content

Garrett Goggin breaks down the investment potential in undervalued gold miners…

Peter Schiff believes gold will continue to thrive in today’s economic climate…

Discover Kevin O’Leary’s latest predictions for Bitcoin and institutional crypto investments…

For well over a century, gold stocks have been one of the most popular investment assets

among speculators. An essential fact sometimes ignored is that gold equities often drastically…

Authors for PinnacleDigest.com are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read on PinnacleDigest.com. As with all investments, an investor should carefully consider his investment objectives and risk tolerance before investing. Use of this Site constitutes acceptance of our Terms of Use, Privacy Policy and Disclosure & Compensation. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Pinnacle Digest.

Securities covered in articles on this website are highly speculative. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly. These are not suitable investments for most investors.

All statements in articles on this website are to be checked and verified by the reader. Articles on this website may contain technical or other inaccuracies, omissions, or typographical errors for which PinnacleDigest.com assumes no responsibility.

Please be aware and note the date in which articles are published on this website. As a result of the passing of time, the relevancy of the opinions and facts in articles are likely to diminish over time and may change without an update to the articles. As such, you cannot rely on the accuracy and timeliness of the information provided and should consider many of the articles irrelevant after an extended period of time from the date which it was published. Since there is no specific guideline as to how long an article may remain relevant, you should consider that all articles may be irrelevant shortly after they are published. This is especially true for articles that include information on publicly traded companies.

2025 © Pinnacle Digest. All rights reserved | Privacy Policy | Disclosure & Compensation | Terms of Use

Subscribe to our free newsletter for a weekly dose of the stories that move markets, and much more.

* By submitting your email you will receive our best content in your inbox weekly, which sometimes includes information about our sponsors. And you also agree to our Terms of Use and Privacy Policy.