Ray Dalio: A New Type of Money, New Type of

In this latest Cooper Academy video, why Ray Dalio thinks the 2020 crisis will be worse than the 2008 recession comes under review. What’s more,

Insights

In this latest Cooper Academy video, why Ray Dalio thinks the 2020 crisis will be worse than the 2008 recession comes under review. What’s more,

African Gold Group, Inc. (TSX-V: AGG) (“AGG” or the “Company”) is pleased to report the final drill results from its extensive diamond drilling program at

In today’s world of record monetary stimulus and inconceivable deficits, investors are rushing to the safety of gold. Gold producers, including Barrick Gold and Kinross

VANCOUVER, British Columbia, April 16, 2020 (GLOBE NEWSWIRE) — Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (“Calibre” or the “Company”) today announced operating results for the three

Frank Holmes, CEO of U.S. Global Investors, is predicting gold’s rally has just begun. He warns investors that between the Fed and U.S. government, $10

VANCOUVER, BC / ACCESSWIRE / April 14, 2020 / Klondike Gold Corp. (TSXV:KG)(FRA:LBDP)(OTC:KDKGF) (“Klondike Gold” or the “Company”) announces that it plans to raise up to $1,050,000

We hate to be the bearer of bad news, but there is no ‘V-shaped’ economic recovery coming. Not in the U.S., and especially not in

Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (the “Company” or “Calibre”) is pleased to report drilling results from the Panteon deposit, part of the El Limon mine complex.

One of the best ways to determine market sentiment is by way of IPO financings. Whether they are rising or falling in frequency along with

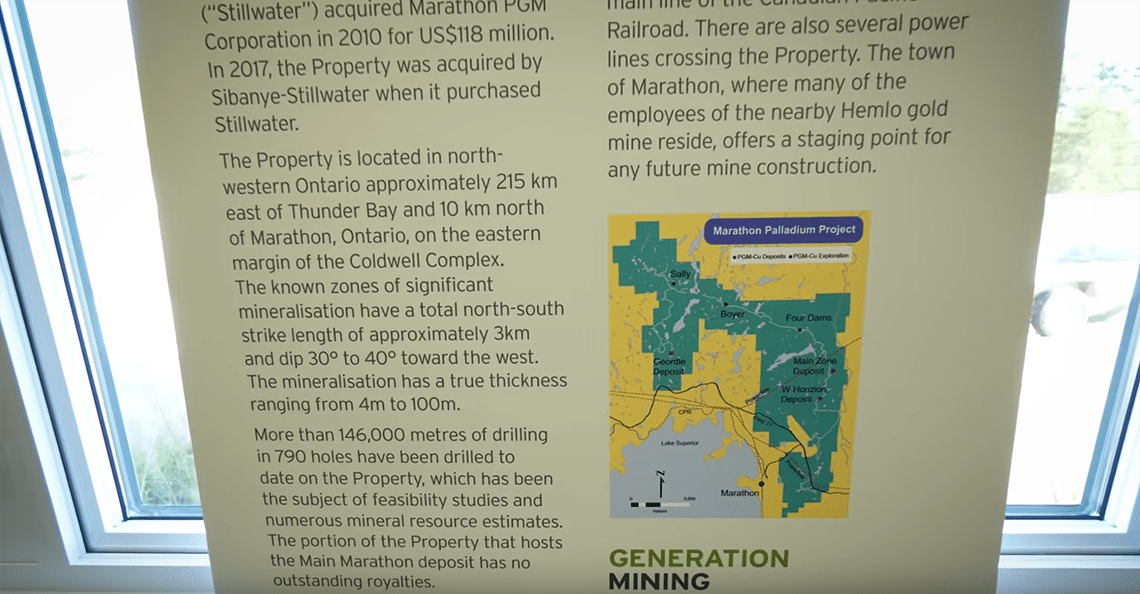

Generation Mining Limited (CSE:GENM) (“Gen Mining”, “Generation”, or the “Company”) is pleased to announce that it has begun the process of interviewing consultants to undertake

Gotcha Mobility, LLC (“Gotcha“), a subsidiary of Last Mile Holdings Ltd. (“MILE“) (TSXV: MILE; OTC: AZNVF), announced today its first quarter results. The company officially

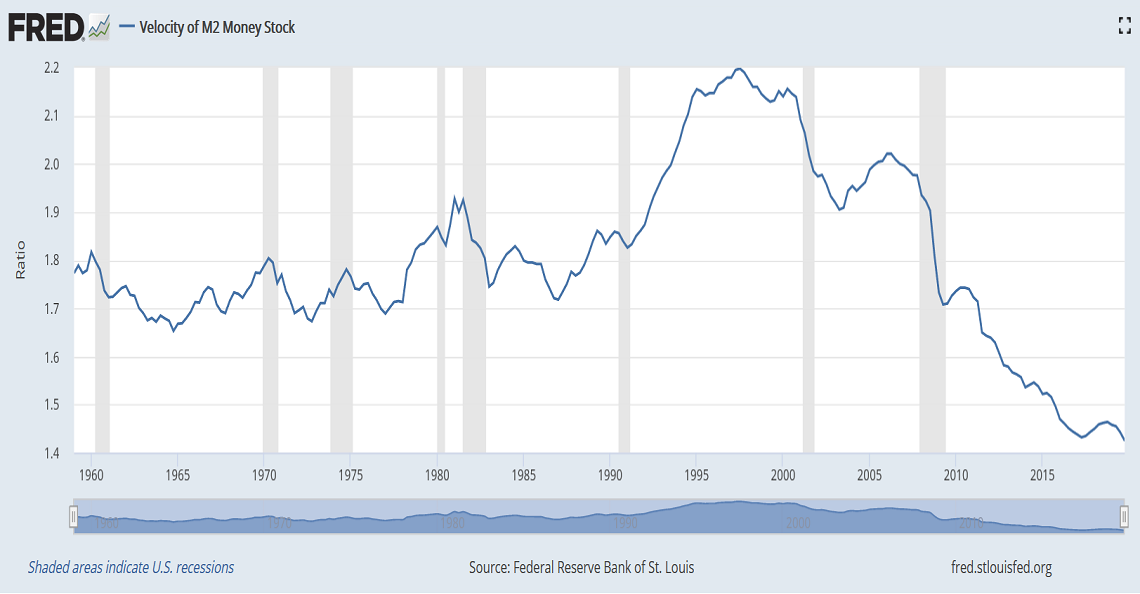

The Federal Reserve, anemic growth, and an aging population are causing the velocity of money in the United States to crater. While many believe trillions

Exclusive Content

Why Adrian Day remains bullish on gold following the Trump bump in equities…

Canada’s economy is largely underutilized, relying too heavily on natural resources…

Find out why falling birthrates, rising inflation, and soaring gold prices are connected…

For well over a century, gold stocks have been one of the most popular investment assets

among speculators. An essential fact sometimes ignored is that gold equities often drastically…

Authors for PinnacleDigest.com are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read on PinnacleDigest.com. As with all investments, an investor should carefully consider his investment objectives and risk tolerance before investing. Use of this Site constitutes acceptance of our Terms of Use, Privacy Policy and Disclosure & Compensation. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Pinnacle Digest.

Securities covered in articles on this website are highly speculative. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly. These are not suitable investments for most investors.

All statements in articles on this website are to be checked and verified by the reader. Articles on this website may contain technical or other inaccuracies, omissions, or typographical errors for which PinnacleDigest.com assumes no responsibility.

Please be aware and note the date in which articles are published on this website. As a result of the passing of time, the relevancy of the opinions and facts in articles are likely to diminish over time and may change without an update to the articles. As such, you cannot rely on the accuracy and timeliness of the information provided and should consider many of the articles irrelevant after an extended period of time from the date which it was published. Since there is no specific guideline as to how long an article may remain relevant, you should consider that all articles may be irrelevant shortly after they are published. This is especially true for articles that include information on publicly traded companies.

2024 © Pinnacle Digest. All rights reserved | Privacy Policy | Disclosure & Compensation | Terms of Use

Subscribe to our free newsletter for a weekly dose of the stories that move markets, and much more.

* By submitting your email you will receive our best content in your inbox weekly, which sometimes includes information about our sponsors. And you also agree to our Terms of Use and Privacy Policy.