Imagine a high-stakes financial game where the U.S. and Canada, post-pandemic, are still splurging as if their economies were in deep freeze. Imagine if they were borrowing to splurge at near 20-year high interest rates?

Now… wake up… that’s our reality.

Unlike over the past 15 years of cheap money and skyrocketing asset values, today’s high interest rates and large deficit spending amidst weak economic growth (or recession in Canada’s case) is truly unsustainable.

According to a November 13th MarketWatch article by Greg Robb,

“Interest paid on the [US] national debt almost doubled compared with the prior year. The Treasury paid $88.9 billion in interest [for October], up from $47.6 billion in the same month last year.”

At today’s prices, the U.S. will shell out roughly $1 trillion annually on interest for its nearly $34 trillion-dollar federal debt…

And that interest expense could rise further (as old debt rolls over at much higher rates) unless the Fed can slash interest rates once again…

The conundrum facing the U.S. and all debtors is that they need inflation to erode the real value of their debt; and now, because of the sheer size of America’s national debt, they need low-interest rates to make the payments more sustainable. It’s a mess.

$34 trillion doesn’t age well at 5% rates!

And that’s why rates may be headed lower sooner than most think…

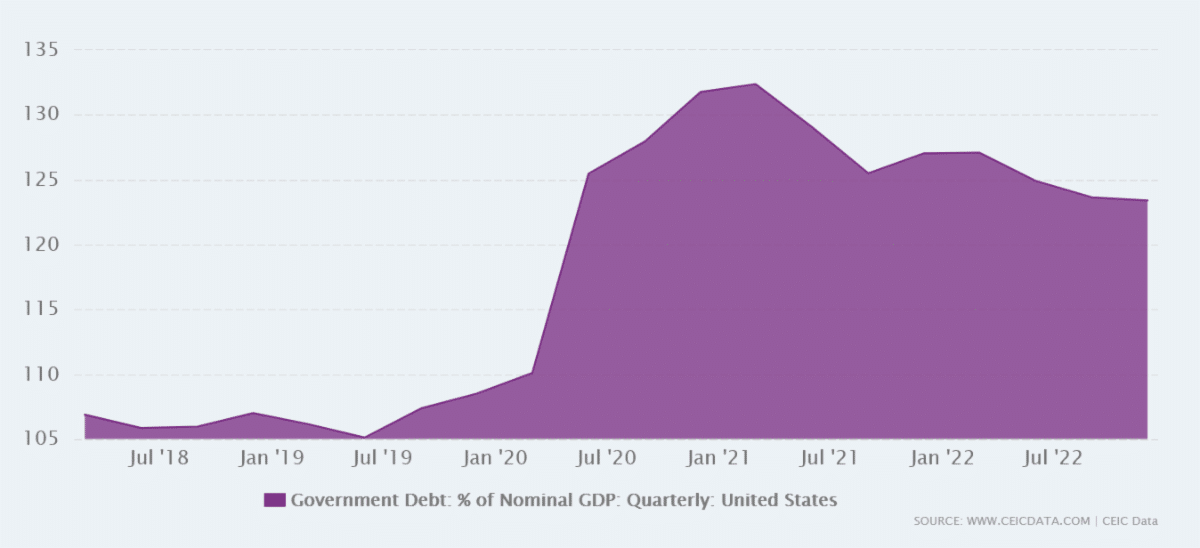

Debt-to-GDP Ratio Falls As Inflation ‘Grows’ Economy

On one hand, inflation has been incredible for the United States’ government. The American economy expanded at an annualized rate of 4.9% last quarter due to inflation, not ‘real’ economic vibrancy, lowering the ever-important debt-to-GDP ratio… however, it’s still way too high, and so are interest rates… and we saw a consequence of that earlier this month.

You see, foreign buyers of U.S. Treasuries are drying up, recently buying less while demanding even higher interest rates.

Moody’s came out in early November, lowering its outlook to “negative” from “stable” regarding U.S. credit. The rating agency cited large fiscal deficits and a decline in debt affordability. No kidding…

So, how does the U.S. entice more bidders for its debt? Continue to lower the all-important debt-to-GDP ratio.

U.S. Debt-to-GDP Falls from Above 130% to 123%

A 100% debt-to-GDP for America is possible. If the Fed and U.S. government can pull this off, demand for Treasuries will come back in force, and they may be able to kick the can down the road for another 10 to 15 years.

But time is running out. Trillions in US government debt will roll over in the next 24 months, which could send interest payments and deficits surging even higher.

The High Stakes Game America Is Playing

Utilizing inflation to grow the U.S. economy, at least nominally, combined with lower interest rates beginning in 2024, will boost tax revenues, reduce budget deficits by reducing interest costs, thereby reducing the debt-to-GDP ratio further.

We’ve long forecast that the political will for austerity does not exist and that politicians would choose to inflate the debt away. And that is precisely what is happening. When inflation ran hot in 2022, nominal GDP exploded.

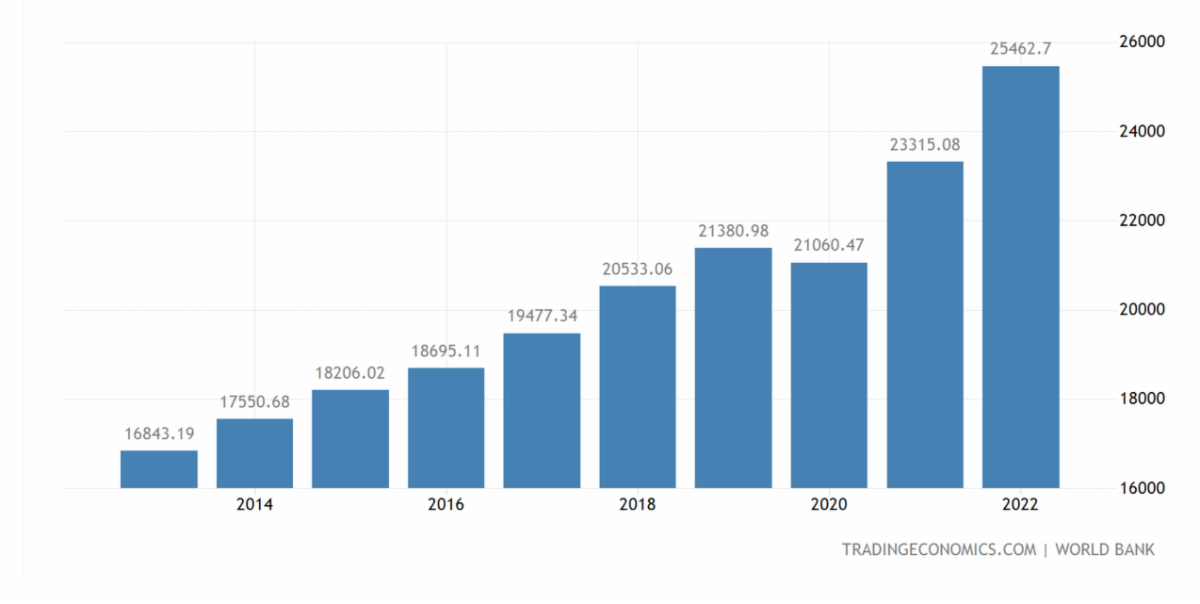

Take a look at the run the U.S. economy has been on…

According to Trading Economics, from 2021 to 2022, the U.S. added over $2 trillion to its GDP.

U.S. GDP Soaring Past $27 Trillion

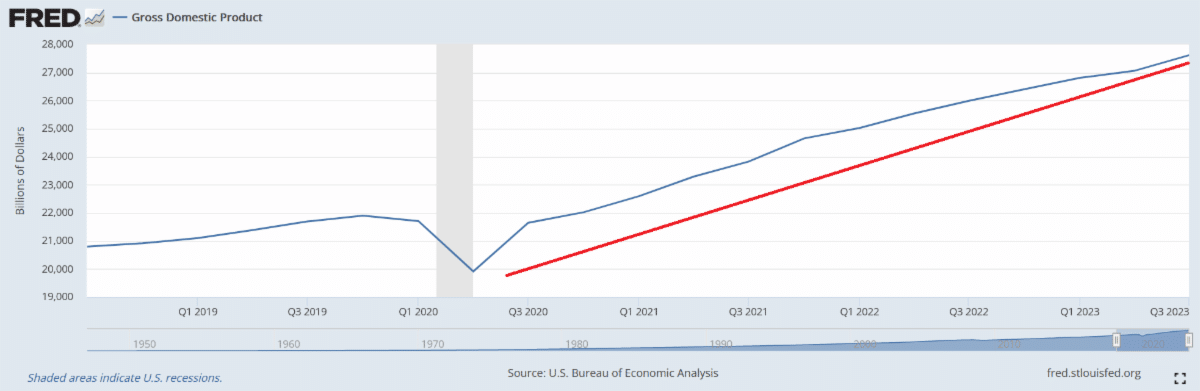

The St. Louis Fed reported a few weeks ago that by Q3 of 2023, US GDP had soared to $27.6 trillion (annualized). Yet, most ordinary Americans are suffering as the cost of living exceeds wage growth year after year.

Inflation Grinds U.S. GDP Higher (Rising 4.9% in Q3 of 2023)

In the last few years, the U.S. has been adding GDP faster than it is adding to its national debt – which stands at $33.7 trillion.

Again, the U.S. economy, in inflation adjusted terms, is probably flat or in recession. But, the amount of money changing hands is soaring – up 5% last quarter alone. This is the power of inflation.

While the battle to reduce debt-to-GDP rages and average citizens bear the cost of spend-thrift politicians, the Fed is quietly preparing for what comes next…

The Fed Prepares for the Next Recession

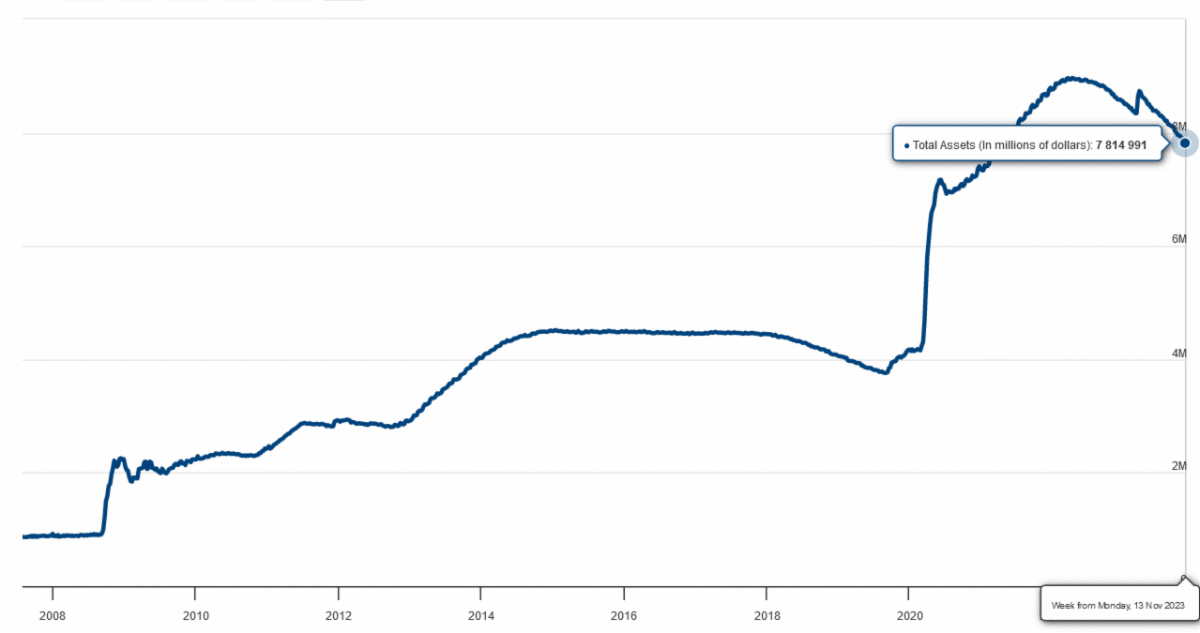

Remarkably, the Federal Reserve has been deleveraging from its quantitative easing purchases, allowing its balance sheet to shrink as hundreds of billions in Treasury and mortgage-backed securities expire. While its critics don’t like to point to this fact, the Fed is currently winning the game…

The economy has yet to crash; inflation is retreating to manageable levels, and the Fed has less assets on its books…

From a high of just below $9 trillion in mid-2022, the Fed’s balance sheet has quickly declined to $7.81 trillion as of November 13, 2023. This will give the Fed much more firepower should the US economy enter recession.

Federal Reserve Balance Sheet Dropped by $45 Billion Last Week Alone

The Fed’s balance sheet has quietly run off nearly $1.2 trillion in little over a year!

With liquidity being removed from the financial system, inflation should continue to decrease. Thus, the Fed regains control. And U.S. Dollar hegemony will remain intact.

Race Against the Clock

Like everything in life, timing is everything. The Federal Reserve and the U.S. economy pulling this off (reducing its debt-to-GDP ratio to 100% or, dare we say, even less) is by no means a guarantee. It’s ambitious. But, the U.S. economy has a way of innovating and growing no matter the circumstances. Still, the math doesn’t work at 5% interest on $34 trillion of government debt…

If rates remain elevated, the U.S. has 24 months before the level of interest being paid becomes too much to bear. It simply cannot afford to pay more than $1.5 trillion in interest annually given that the US government collected roughly $5 trillion in tax revenue last year…

Fiscal year 2023 saw a 23% jump in the federal budget deficit to $1.695 trillion – the largest outside the pandemic year of 2021. The rise was mainly due to soaring interest costs.

Rate Cuts Coming in 2024

Look for inflation to run flat over the coming months, and the Fed to hold rates as capital continues to be sucked out of the system. However, by early Q2, 2024, we expect a rate cut, GDP will continue to run in the 2 – 4% range, almost solely due to inflation, and the Fed will look the other way.

This scenario allows the Fed’s balance sheet to continue to run off. At the same time, deficits shrink amidst smaller interest payments, and a lower debt-to-GDP ratio could be achieved. This would make U.S. bonds and treasuries much more attractive to the international community.

All the best with your investments,

PINNACLEDIGEST.COM