With inflation surging across the West, due in large part to unprecedented money-printing and borrowing in the wake of the pandemic, gold is staying top of mind. The precious metal is hovering between US$1,700 – US$1,800 per ounce and continues to find support.

In July, Matthew Fox of Markets Insider reported on Goldman Sachs’ thesis regarding gold’s upside potential:

“’In a scenario where the global economic recovery does not play out as expected or inflation begins to move materially above expectations, we see material upside to gold given its undervaluation and low allocation from the investment community,’ Goldman said.”

Fox went on to report that,

“The bank sees gold hitting as high as $2,500, representing 38% upside potential from current levels in the event that US investors’ allocation to gold ETFs rises to its 2011 peak of 0.7% of their portfolio.”

Now, after a summer of drilling, juniors worldwide are preparing to release results from their respective work programs at various gold properties; and we are ready to introduce our client and first featured gold company of 2021…

Production Potential, Exploration Upside and Stout Management

So, after seeking out a junior gold play with an intriguing project in a prolific mineral region, exploration upside, near-term production potential, and a seasoned management team, we came across O2Gold Inc. (the “Company” or “O2Gold”)…

O2Gold (TSXV: OTGO) – Welcome To Colombia

O2Gold’s flagship project is in a prolific region of Colombia. The region has 17 million ounces of historical production and roughly 100 million ounces discovered…

So how did O2Gold get here?

O2Gold acquired its flagship project from Robert Allen’s Bullet Holding Corp., now the Company’s largest shareholder. Allen has a long history in Colombia’s gold sector, and he knows a thing or two about making large discoveries.

A Career of Prospecting: Resulting in Millions of Ounces of Gold Discovered

Allen’s Grupo de Bullet S.A.S (“Bullet Group”) — a subsidiary of Bullet Holding Corp. — is directly or indirectly responsible for discovering over 30 million ounces of gold in Colombia. According to O2Gold, Bullet Group,

“…has also discovered or contributed to the discovery of nearly every major Colombian deposit of the last two decades.”

As the Founder and Chairman of Bullet Group, a mineral exploration company active in Colombia since 1984, Mr. Allen is nothing short of a legend when it comes to finding gold in the South American nation.

What’s more, Robert Allen was the founding Chairman of Continental Gold, which inevitably sold in a deal valued at CAD$1.4B in 2020.

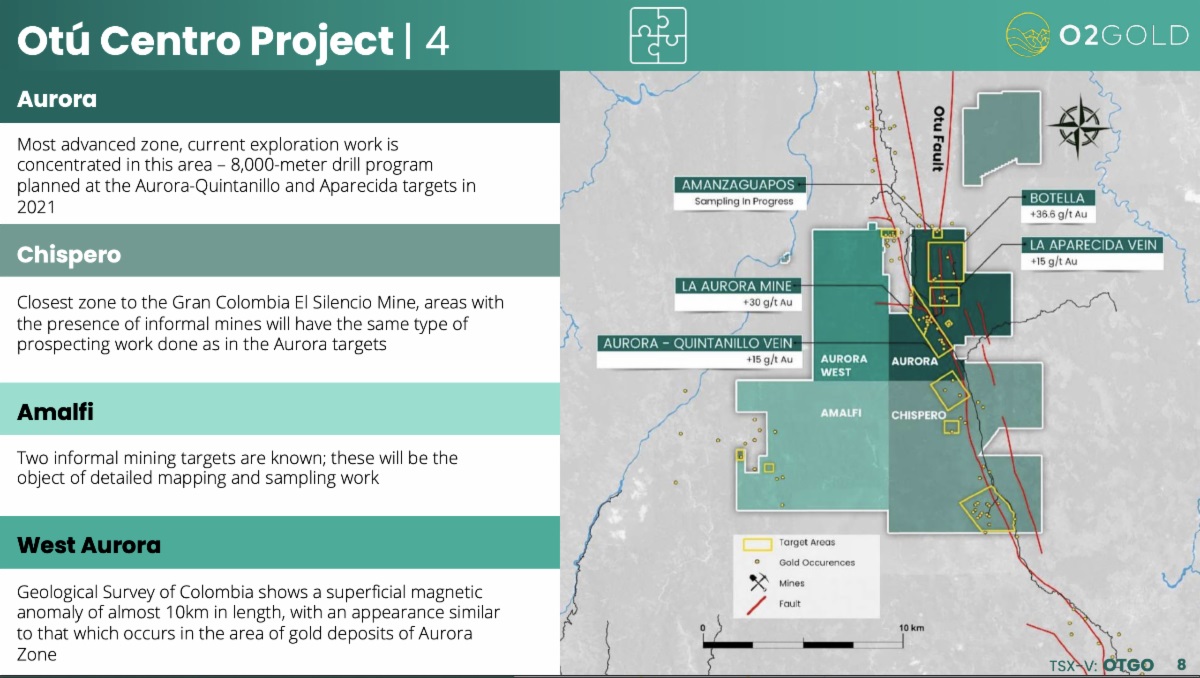

O2Gold’s land package is known as the “Otú Central Project.” It lies within the prolific Otú fault of Colombia — a region that, according to Colombia’s national mining agency, has produced an estimated 17M oz of gold counting only artisanal methods.

The Company commenced exploration on the project for the very first time this spring and drilling began this summer, the results of which are expected in the near-term.

Immediately upon announcing the acquisition of the Otú Central Project, O2Gold also announced that Robert Allen had joined its board of directors.

We had the opportunity to meet with Bob, as his friends call him, at his offices and ranch in Perryville, Arkansas. A southern gentleman through and through, Bob shared his experiences in Colombia during the Escobar days, some of his major gold discoveries, and exactly what he likes about O2Gold’s positioning in the country. He is a prospector at heart and lives for the journey and rush of discovery.

The Company’s Otú Central Project consists of interests in 26 mining claim titles and applications in the Segovia/Zaragoza regions of Antioquia in Colombia. The project is massive, covering approximately 30,000 hectares.

While many in North America may not have heard of the Antioquia region of Colombia, it is home to 100 million + ounces of discoveries.

The region hosts some of the world’s largest gold companies, including Anglo Gold and B2 Gold, with Anglo recently appointing Colombian Alberto Calderon as CEO.

Note: Past historical and/or current production in the region of O2Gold’s Otú Central Project is not indicative of future production potential for the Company. Any comparisons to other companies or projects may not be valid or come into effect. Mineralization on nearby projects is not necessarily indicative of mineralization on O2Gold’s Otú Central Project.

Why Now?

The reason for our introduction today is that O2Gold began a planned 8,000-metre drill program this summer, with results expected in the coming weeks.

This is the first drill program the Company has ever conducted on the project. There are no prior or current mineral resource estimates for the Otú Central Project, and historic work of a technical nature on the project is relatively minimal.

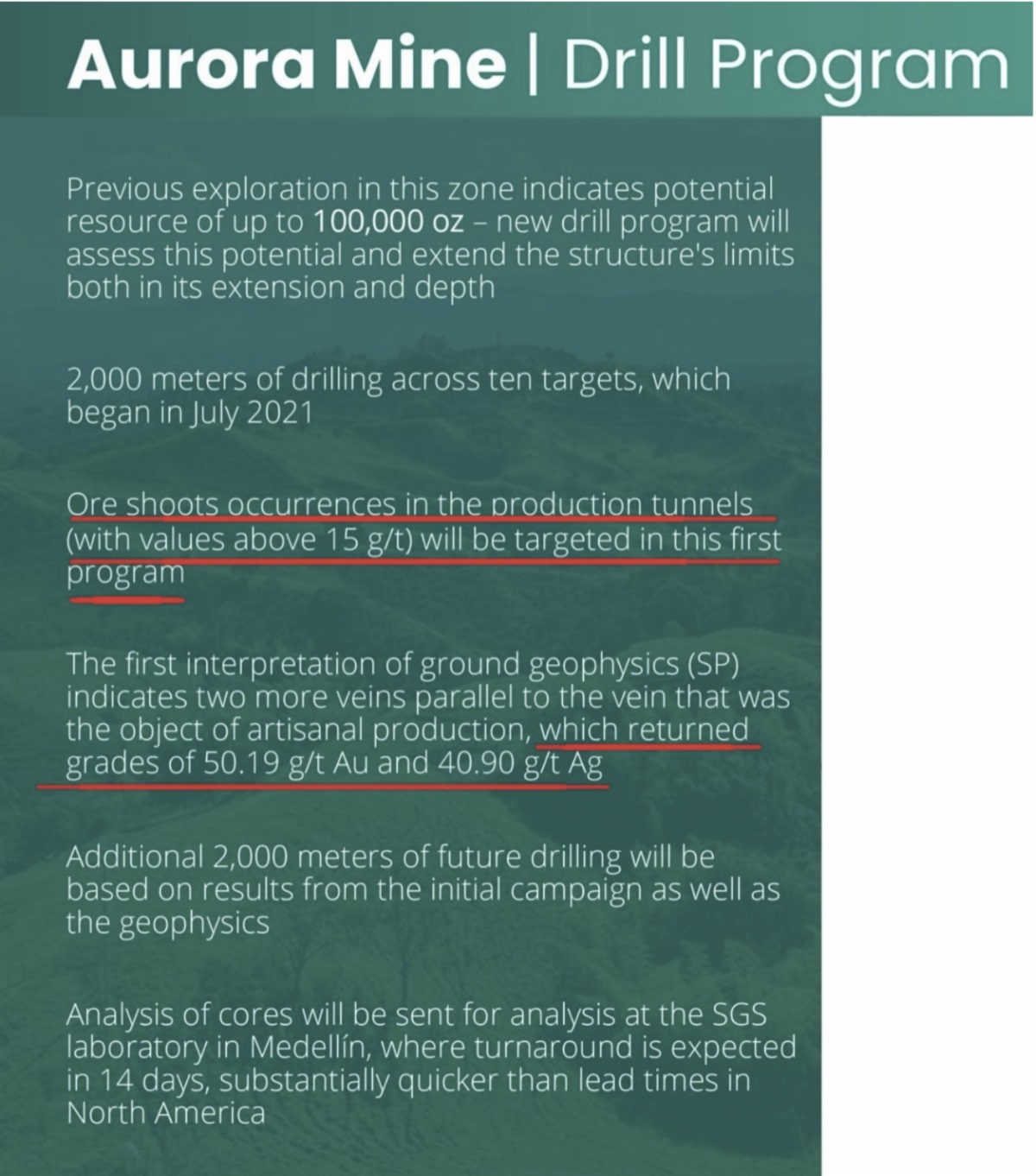

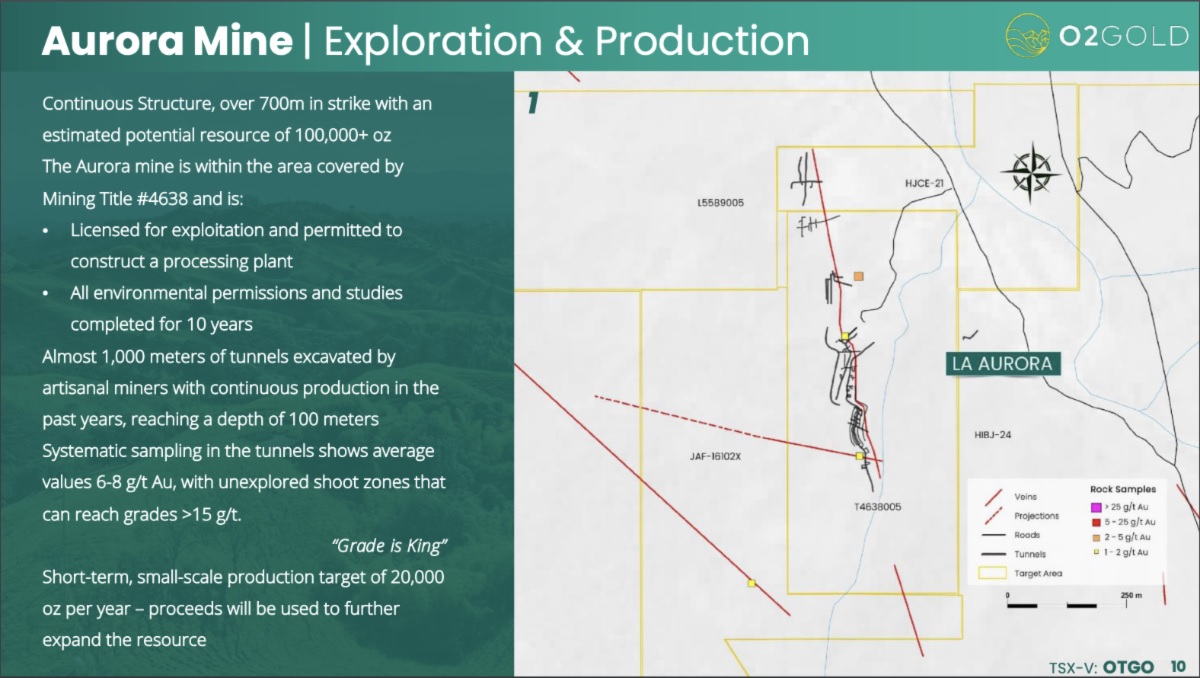

A once-productive asset that has been untouched for more than a decade, the Aurora Mine is a top target within the Otú Central Project. Check out the highlights below:

On August 17th, the Company confirmed that the first 2,000 meters of drilling had begun, while updating the market on a freshly completed geophysical study. Here is what they found:

“The integration of the Aurora-Quintanillo target shows a projected vein system of almost 4 km in length along strike.”

Furthermore,

“The geological mapping and sampling on the Quintanillo target identified occurrences beyond those known from the artisanal production works in the Quintanillo mine.”

And that,

“Due to the coverage by colluvial material and weathered rocks, these occurrences could not be followed in the field, hence the choice of geophysical methods to verify their continuity.”

Click here to read the full press release.

While the data is relatively new, and there are still many unknowns, the Company is hoping to connect the mineralization between these two historic mines.

Production Target

While the Company is drilling to determine the scope and breadth of the Aurora tunnel, it is also aiming to commence small-scale production there within 12 months. Check out the highlights below:

On July 15, 2021, the Company reported that,

“The mining exploration title which contains the Aurora tunnel has received approval from the National Mining Agency of Colombia for transformation into a concession, which means the Company anticipates being permitted to commence production at the site to satisfy the mining authority’s requirements…”

The release continued,

“…the Company will need to meet production obligations, among others, to keep the title in good standing; these obligations include recovery of a minimum of 2,229 oz Au within one year. The minimum recovery sum increases year over year for the first six years of the title’s 30-year extension.

Title 4638, which is the scheduled site of the Company’s first 2,000 meters of drilling, has all environmental studies completed and a permit for the construction of a plant.”

Click here to read full press release.

Note: The Aurora Mine is licensed for exploitation and permitted for the construction of a processing plant. It has all environmental permissions and studies completed for 10 years. And, systematic sampling in the tunnels shows average values of 6-8g/t Au, with several samples over bonanza grade (Click here and here to learn more about the results from the aforementioned sampling). Management is not basing O2Gold’s production decision on a feasibility study of mineral reserves demonstrating economic and technical viability; as a result, there may be increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved.

Watch our in-depth interview with O2Gold CEO Jaime Lalinde to learn about the Company’s production goals for 2022:

The area around the Aurora Mine is just one target within the Company’s massive land package.

Here is a closer look at O2Gold’s project and its four main zones:

Excluding Aurora, which has a history of informal mining, the Company states that the Chispero zone also has,

“…areas with the presence of informal mines.”

Generally, we view artisanal mining as a potential benefit to a junior. Artisanal miners may provide cost-effective exploration work while digging out gold-bearing veins and possibly aiding in the discovery process. We’ve seen this with some successful gold miners and explorers in South America, Central America, and Africa.

Furthermore, O2Gold has a policy in place that we admire and feel will significantly aid with its social, political and exploration endeavours moving forward. The Company explains its philosophy,

“Our belief is that artisanal mining and large-scale exploration are complementary activities. Success in this jurisdiction has belonged to those companies that have allowed small-scale miners to participate in the gold value chain. For that reason, we are committed to offering the administrative services necessary for artisanal miners in our title areas to formalize their mines.”

Approximately 8000 meters of drilling are planned to be conducted in the Aurora project area (upper right quadrant on the map above). The other three zones will be systematically explored using a suite of modern techniques, including geophysics, and drone LIDAR mapping…

We hope this report provides a high-level overview of O2Gold’s recent developments and its near-term plans, but it is not intended to be exhaustive. Recognize that we are biased when it comes to O2Gold. The Company is a sponsor and client of Pinnacle Digest, and we own shares and warrants of O2Gold, making us cheerleaders and shareholders. O2Gold is in the early stages of exploration, and there are no formal reserves or resources known on the Company’s Otú Central Project. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a speculative company of this nature. A good place to start your due diligence is reviewing the Company’s Sedar filings at www.sedar.com.

Fast Turnaround Anticipated

O2Gold states on its website that,

“Analysis of cores will be sent for analysis at the SGS laboratory in Medellin, where turnaround is expected in 14 days, substantially quicker than lead times in North America.”

Now well into September, we anticipate the first of those drill results shortly.

Gold and mining have become important elements of Colombia’s economy, as the government appreciates the tax revenues from the industry and the history of its people’s contribution to the gold sector. O2Gold’s CEO is Colombian, lives in Colombia, and has a team of Colombians managing the Company’s project. When one combines this local expertise with Bob Allen’s track record in Colombia, the result, in our view, is a well-positioned junior gold company in its early stages.

All the best with your investments,

PINNACLEDIGEST.COM

O2Gold’s Corporate Presentation

Stock Information

Symbol: OTGO

Exchange: TSXV (TSX Venture Exchange)

Share Price: CAD$0.185

Market Capitalization: ~CAD$22.1 million (according to Bloomberg)

Watch Our Exclusive Video on O2Gold

Online Resources

Visit O2Gold Online

Company News

SEDAR Filings

Management and Directors

Disclosure, Compensation, Risks Involved and Forward-Looking Statements:

You must read the following carefully before proceeding.

THIS REPORT IS NOT INVESTMENT ADVICE OR A RECOMMENDATION TO PURCHASE ANY SECURITY. IT IS NOT INTENDED TO BE A COMPLETE OVERVIEW OF O2GOLD INC. THE INFORMATION IN THIS REPORT IS NOT A SUBSTITUTE FOR INDEPENDENT PROFESSIONAL ADVICE. SEEK THE ADVICE OF YOUR FINANCIAL ADVISOR AND A REGISTERED BROKER-DEALER BEFORE MAKING ANY INVESTMENT DECISIONS.

All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “Maximus” or “we” or “us”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. This report does not purport to contain all the information that may be necessary or desirable to fully and accurately evaluate an investment in O2Gold Inc. (“O2Gold” or the “Company”). O2Gold is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by O2Gold, and therefore we are not independent reporters, our coverage of O2Gold features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on O2Gold Inc. applies to the date this report was posted on our website (September 19, 2021). This disclaimer will never be updated, even if we buy or sell shares of O2Gold Inc.

Do Your Own Due Diligence: An investment in securities of O2Gold should only be made by persons who can afford a significant or total loss of their investment.

In all cases, interested parties should conduct their own investigation and analysis of O2Gold, its assets and the information provided in this report. Readers should refer to O2Gold’s public disclosure documents found on the SEDAR website (www.sedar.com) before considering investing in the Company. The public disclosure documents will help investors understand O2Gold’s objectives and the risks associated with the Company.

The securities of O2Gold are highly speculative due in part to the nature of the Company’s plans/objectives and the present stage of O2Gold’s development. The Company is in the early stages of exploration and development, and it has not commenced commercial production at any project or property. Furthermore, there are no formal reserves or resources known on the Company’s Otú Central Project. O2Gold has limited financial resources, no operating revenue and no assurances that sufficient funding, including adequate financing, will be available to conduct further exploration and development of its projects. If the Company’s generative exploration and development programs are successful, additional funds will be required for development of one or more projects. Failure to obtain additional financing could result in the delay or indefinite postponement of further exploration and development or the possible loss of the Company’s project/properties. A prospective investor should consider carefully the risk factors set out in this disclosure statement and outlined in the Company’s annual and quarterly Management’s Discussion and Analysis, and in other filings made by O2Gold with Canadian securities regulatory authorities available at www.sedar.com.

Important: Please be aware and note the date this report was published (September 19, 2021). As a result of the passing of time, the relevancy of the opinions and facts in this report are likely to diminish and may change. As such, you cannot rely on the accuracy and timeliness of the information provided in this report. Since there is no specific guideline as to how long this report may remain relevant, you should consider that it may be irrelevant shortly after its publication date.

Cautionary Note Regarding Forward-Looking Information: This report contains “forward-looking information” within the meaning of Canadian securities legislation (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that O2Gold or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward-looking statements. Such forward-looking statements also include, but are not limited to, statements regarding: the planned exploration of O2Gold’s Otú Central Project; prospective targets for drilling and other exploration work; the growth potential of any deposits or trends; the size, quality and timing of O2Gold’s exploration and development plans; potential mineral resources at O2Gold’s property interests in Colombia; the estimation of mineral resources; future trends; any comparisons of O2Gold’s projects to other mineral projects not owned by the Company; the potential or likelihood of making a new gold discovery; the types of gold deposits O2Gold is exploring for; information with respect to O2Gold’s potential future production from, and further potential of, the Company’s Otú Central Project; O2Gold’s future financial position and budgets; potential future revenue from the Company’s anticipated gold production; potential use of proceeds from future gold production; the acquisition of the Otú Central Project, including in connection with the Company’s future payment obligations; the Company’s intention to pursue acquisitions of production and processing capacity in Colombia; O2Gold’s project within the Otú fault having the potential to be one of Bob Allen’s greatest discoveries; community support and social licence for O2Gold’s activities and initiatives; the potential size and number of undiscovered gold deposits along the Otú fault, and their potential production capacity; estimates of O2Gold’s project economics; forecasts; the future price of minerals, particularly gold; the size and duration of the current gold cycle; funding availability; investor sentiment; conclusions of economic evaluation; capital expenditures; inflation and its potential benefits to gold-related companies such as O2Gold; mineralization projections; mining or processing issues; currency exchange rates; government regulation of mining operations; taxes; the likelihood of the Company making it to a production stage; the amount of gold the Company intends to produce and the timing of when its gold production will occur; the Company receiving assay results and the timing of any assay results being released to the public; O2Gold being able to find material mineral deposits in the future; O2Gold receiving any necessary permits for its operations in the future; the Company’s ability to utilize third-party processing infrastructure; O2Gold completing and releasing resource estimates in the future; the timing and likelihood of O2Gold achieving objectives and development plans, and costs of development.

Relating to exploration, the identification of exploration targets and any implied future investigation of such targets on the basis of specific geological, geochemical and geophysical evidence or trends are future-looking and subject to a variety of possible outcomes which may or may not include the discovery, or extension, or termination of mineralization. Further, areas around known mineralized intersections or surface showings may be marked or described by wording such as “open”, “untested”, “possible extension” or “exploration potential” or by symbols such as “?”. Such wording or symbols should not be construed as a certainty that mineralization continues or that the character of mineralization (e.g. grade or thickness) will remain consistent from a known and measured data point. The key risks related to exploration in general are that chances of identifying economical reserves are extremely small.

Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects”, “could”, “would”, and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond O2Gold’s control. These statements should not be read as guarantees of future performance or results because a number of assumptions and estimates have been made, and they may prove to be incorrect. Forward-looking statements are based on the opinions and estimates of O2Gold’s management or Pinnacle Digest at the date the statements are made. In this report, assumptions and estimates may have been made regarding, among other things, the presence of, and continuity of, mineralization at O2Gold’s Otú Central Project not being fully determined; the availability of personnel, machinery and equipment at estimated prices and within estimated delivery times; currency exchange rates; metals sales prices and exchange rates; tax rates and royalty rates applicable to the Company’s property interests in Colombia; present and future business strategies and the environment in which the Company will operate in the future; the accuracy and reliability of estimates, projections, forecasts, studies and assessments; anticipated costs; general business and economic conditions not changing in a material adverse manner; governmental and other approvals required to conduct the Company’s planned exploration and production activities being available on reasonable terms and in a timely manner; the potential of the Company’s Otú Central Project to contain economic mineral deposits; the ease with which the Company will be able to find gold in the Otú Central Project; the Otú fault providing the most productive gold mining in Colombia; community support for O2Gold’s activities and initiatives; the current and future social, economic and political conditions in Colombia; the anticipated timing and amount of gold production; the Company’s ability to meet its working capital needs for the short term; the availability of acceptable financing; success in realizing proposed operations, and other assumptions and factors generally associated with the mining and exploration industry.

While such estimates and assumptions are considered reasonable by Pinnacle Digest, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks.

Forward-looking statements are subject to a number of risks and uncertainties that may cause the actual results of O2Gold to differ materially from those discussed/written in the forward-looking statements in this report and, even if such actual results are realized or substantially realized, there can be no assurance that they will have the expected consequences to, or effects on, O2Gold. Factors that could cause O2Gold’s results to differ materially from those expressed in forward-looking statements in this report include, but are not limited to, the following risks and uncertainties: unanticipated developments in business and economic conditions in the principal markets for commodities and/or financial instruments; failure to achieve the Company’s gold production targets; changes in the supply, demand, and prices for gold and other commodities; the actual results of exploration and development activities; conclusions of economic evaluations; uncertainty in the estimation of mineral resources and reserves; changes in economic and political stability in Colombia; environmental and reclamation liabilities, risks, hazards and regulatory requirements; adverse weather conditions; legal disputes; not detecting deposits that may be of economic interest; the interest of the Company in its properties may be challenged or impugned; increased infrastructure and/or operating costs; remote operations and the availability of adequate infrastructure; labour and employment matters; government regulation and approvals; challenges to the Company’s title to properties or mineral rights; the need for additional financing and that the Company may not be able to raise additional funds when necessary; the dangers inherent in exploration, development and mining activities; reliance on key personnel; competition; dilution; acquisition risks, such as the Company not being able to meet future payment obligations of its acquisition of the Otú Central Project; changes in project parameters as plans continue to be refined; variations in ore grade and recovery rates; potential revocation or change in permit requirements and project approvals; conflicts of interests; security breach on and around the Otú Central Project; insurance and the risk of an uninsurable or uninsured loss; equipment material and skilled technical workers; risks and uncertainties relating to the interpretation of exploration results; cost estimates and the potential for unexpected costs and expenses; the Company may lose or abandon its property interests; the potential for delays in exploration or development activities, including the completion of geologic reports or studies; the uncertainty of profitability based upon the Company’s history of losses; risks associated with failure to maintain community acceptance, agreements and permissions (generally referred to as “social licence”); conflicts with small-scale miners; failures of information systems or information security threats; the ability to obtain and maintain any necessary permits, consents or authorizations required for mining and exploration activities at the Company’s Otú Central Project; the reliance upon contractors and third parties; use of and reliance on experts outside Canada; risks associated with internal control over financial reporting; compliance with complex regulations associated with mining and exploration activities; risks related to current global financial conditions; risks relating to international operations (including legislative, political, social, or economic developments in the jurisdictions in which O2Gold operates); the impact of viruses and diseases on the Company’s ability to operate; the volatility of O2Gold’s common share price and trading volume, and other risks pertaining to the mining and exploration industry as well as those factors discussed in the section entitled “Risk Factors” in O2Gold’s Annual and Quarterly Reports and associated financial statements, Management Information Circulars and other disclosure documents filed with Canadian securities regulators. Visit www.sedar.com to review these important disclosure documents under O2Gold’s issuer profile.

Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

There is no certainty the discussed targets will be reached nor that the proposed operations will be economically viable. Forward-looking information contained in this report or incorporated by reference are made as of the date of this report (September 19, 2021) or as of the date of the documents incorporated by reference, as the case may be, and Pinnacle Digest does not undertake to update any such forward-looking information, except in accordance with applicable securities laws. Accordingly, readers are cautioned not to place undue reliance on forward-looking information.

We strongly encourage any prospective investor of O2Gold to thoroughly review the Technical Report for the Otú Central Project. The report is titled ‘TECHNICAL REPORT ON THE OTÚ CENTRAL GOLD PROJECT Segovia Gold Belt Department of Antioquia, Colombia’ and is filed under the Company’s issuer profile on www.sedar.com. It has a publication date of October 28, 2020. Its date of filing on www.sedar.com is April 26, 2021.

We Are Not Financial Advisors: This report does not constitute an offer to sell or a solicitation of an offer to buy O2Gold’s securities. Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees/consultants are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

We Are Biased: O2Gold is a client of ours (details in this disclaimer on our compensation). We also own shares and warrants of the Company. For those reasons, we want to remind you that we are biased when it comes to O2Gold.

Because O2Gold has paid us CAD$300,000 plus GST for our online advertising and marketing services, and we own shares and warrants of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on the Company; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in O2Gold. Investigate and fully understand all risks before investing.

PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including O2Gold) represented by PinnacleDigest.com are typically junior companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as O2Gold it is possible to lose your entire investment over time or even quickly.

Important: Set forth below is our disclosure of compensation received from O2Gold and details of our stock ownership in the Company as of September 19, 2021:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$300,000 plus GST to provide online advertisement coverage for O2Gold for twelve months. O2Gold paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about O2Gold (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. We own shares and warrants of O2Gold which were acquired by subscribing to O2Gold’s private placement that closed on April 16, 2021. We intend to sell every share we own of O2Gold for our own profit. All shares Maximus Strategic Consulting Inc. currently owns or may purchase in the future of O2Gold will be sold without notice to PinnacleDigest.com’s subscribers or the general public. Maximus Strategic Consulting Inc. benefits from price and trading volume increases in O2Gold, and is therefore extremely biased when it comes to the Company.

Junior companies such as O2Gold are very risky investments: O2Gold is not an appropriate investment for most investors as it is highly speculative. Risks and uncertainties with respect to mineral exploration and development companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this report. Visit www.sedar.com to review important disclosure documents for O2Gold.

It is highly probable that O2Gold will need to raise additional capital in the future to fund its operations, resulting in significant dilution to its shareholders.

O2Gold has not commenced commercial production at any project or property. O2Gold has a lack of revenue and operates at a loss. O2Gold may never take any project into production. Even if O2Gold is able to achieve commercial production, there is no certainty the Company will generate a profit. Furthermore, past historical and/or current production in the region of O2Gold’s Otú Central Project is not indicative of future production potential for the Company. Any comparisons to other companies or projects may not be valid or come into effect. Mineralization on nearby projects is not necessarily indicative of mineralization on O2Gold’s Otú Central Project.

Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are the particular attributes of a deposit, such as its size and grade, proximity to infrastructure, financing costs and government regulations, including regulations relating to prices, taxes and royalties, infrastructures, land use, importing and exporting and environmental protection. The effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on capital.

While discovery of a mine can lead to substantial rewards, few properties which are explored are ultimately developed into producing mines. It is impossible to ensure that the current or proposed exploration and development programs on the Company’s properties will result in a profitable commercial mining operation.

Cautionary Note Concerning Estimates of Mineral Resources: This report may reference the terms “Measured”, “Indicated” and “Inferred” Resources. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of ‘‘Inferred Resources’’ exist, are economically or legally mineable or will ever be upgraded to a higher category, such as Measured and Indicated categories through further drilling, or into Mineral Reserves, once economic considerations are applied. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. Viewers are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. Mineral Resource Estimates do not account for mineability, selectivity, mining loss and dilution. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past success of members of O2Gold’s management team, board of directors, and advisory team are not indicative of future results for the Company.

The statements and opinions expressed by Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of O2Gold. The statements and opinions expressed by O2Gold are solely those of the Company and not the opinions of Pinnacle Digest.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify the trading price for most junior stock exchange listed companies, including O2Gold.

Unless otherwise indicated, the market and industry data contained in this report is based upon information from industry and other publications and the knowledge of Pinnacle Digest and O2Gold. While Pinnacle Digest believes this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process, and other limitations and uncertainties inherent in any statistical survey. Pinnacle Digest has not independently verified any of the data from third-party sources referred to in this report or ascertained the underlying assumptions relied upon by such sources.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. We do not guarantee that any of the companies mentioned in this report (specifically O2Gold) will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

Trading in the securities of O2Gold is highly speculative.

To get an up-to-date account on any changes to our disclosure for O2Gold Inc. (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/.