Based on a true story, the movie ‘The Big Short’ was nominated for best picture in 2016. One of the leading characters is Michael Burry who, in real life, saw the subprime lending market crisis coming before anyone. He made his investors roughly $700 million on the trade by shorting the housing market well before the crash. In the movie, just before the credits, a quote pops up on the screen that reads,

“…Burry is focusing all his trading on one commodity: Water.”

‘Water wars’ (battles for our most precious resource) have been fought dating back hundreds of years. We wrote about the topic extensively in May of 2016 in Taking Over The World One Drop at a Time. Some of the players in the Libyan war, which led to the killing of dictator Muammar Gaddafi, were believed to be motivated by the discovery of one of largest fresh water aquifers in the world (see more here).

Borders have literally been redrawn and challenged in some regions (namely the Middle East) because clean water is a national security issue for many countries.

But it’s not just governments competing for clean water sources. Not without controversy, corporations are too… perhaps more efficiently.

While multi-nationals turn fresh water into multi billion-dollar businesses (see here and here for an intro to some of the competition), most infrastructure plays surrounding the global water crisis are reserved for big business and government contracts. It is, as one can imagine, highly lucrative. But, these ‘blue chip’ opportunities don’t appeal to us as large water utility companies trade at huge multiples (or remain private), leaving the early growth curve behind them. That said, the intense competition at the top, from the big players, often trickles down into an extensive M&A period amongst the smaller players with market momentum at the retail level. Meaning: those that are selling water-related product to consumers, young companies that have a fast growing and recognized brand, are primed for a potential buyout…

Recent Buyouts Highlight Market in Consolidation Phase

We aim to get involved before the masses may acquire a stock. We seek out the innovators and emerging small companies – those capturing market share with fresh new offerings that are being widely adopted. Companies that are emerging into potential acquisition opportunities for the bigger players.

On August 19th, Pepsi (NYSE: PEP) agreed to buy at-home sparkling water company SodaStream (NASDAQ: SODA) for $3.2 billion, or $144 per share…

SodaStream used to allow its customers to make sugar-filled carbonated drinks at home, but as demand declined beginning in 2014 its valuation crumbled. With its shares trading for just $10 in early 2016, its buyout in August at $144 per share culminated in a monumental turnaround. How did they do it?

Investorplace.com sums up the decisions which led to the multi-billion-dollar buyout and more than ten-bagger return in about two years,

“…in late 2014, SodaStream pivoted towards being an at-home sparkling water company, versus an at-home soda company. This pivot into healthy drinks changed everything. By 2016, demand for SodaStream machines was back, mostly thanks to their ability to make carbonated water…”

On the PepsiCo buyout, Bloomberg echoed a familiar shift, led specifically by millenials,

“In one of her final acts as chief executive officer of PepsiCo, Indra Nooyi is betting on a razors-and-blades kind of business model to reanimate revenue growth that has been waning due to weak demand for traditional sugary soft drinks.”

SodaStream, which many of us have in our homes, is PepsiCo’s largest acquisition in more than 8 years. Expect other major soda companies to follow suit…

Buyout Money is Coming for Premium Water Brands

The PepsiCo’s of the world will continually be forced to acquire what consumers demand. They are retail companies. And consumers the world over are paying up for quality premium bottled water brands.

Travelers to Mexico, Africa, South America or Asia know the value of a brand name water company. These multi-billion-dollar behemoths produce a product with virtually insatiable demand in many regions. And the trend is catching fire in the U.S. – the world’s largest economy.

When it comes to speculating on the TSX Venture, more than half the battle is being in the right sector at the right time. Finding a sector or industry primed for substantial growth over a coming 3-5 year period is an X-factor.

Per capita consumption of bottled water in the United States from 1999 to 2017 (in gallons):

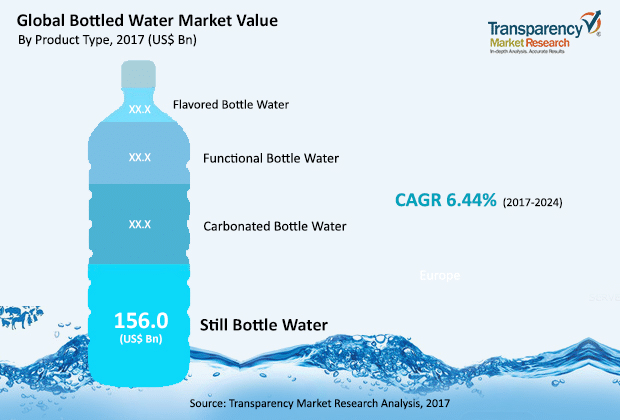

While the above growth is impressive, the global bottled water market is expected to expand by more than $15 billion per year until at least 2024, according to Transparency Market Research. TMR states,

“In terms of revenue, methodology-based market evaluations have confirmed that the global bottled water market will attain a valuation of US$307.2 billion by 2024, swelling up from its evaluated worth of US$198.5 billion as of 2017.”

Expect the U.S. to be home to the majority of this explosive growth.

Culture Precedes Consumer Choices in Bottled Water Market

Millions of consumers are forgoing sugar-filled drinks, instead choosing quality bottled water brands. It is unfashionable to be unhealthy and that starts with what we drink. From carbonated to premium, artesian and alkaline – water is the new cool. It’s the new fit.

This cultural shift in buying patterns is creating an opportunity the beverage industry has not seen in decades…

One of the first movers to capitalize on the idea of drinking healthy was Vitaminwater. The Coca-Cola Company acquired Glaceau, the maker of Vitaminwater, for $4.1 billion in cash way back in 2007. Investopedia calls it “Coca-Cola’s Best Purchase” as Vitaminwater contributed about $950 million to Coca-Cola’s revenue in 2014. Famously, Rapper 50 Cent was rumoured to have walked away from that acquisition with between a US$60 million to $100 million win as he was an early investor and partner in Vitaminwater.

Still, Vitaminwater and products like it contain sugar. Consumers today are more educated and scrutinizing. They are reaching for premium waters with low or no calories to enhance their health. Consider this:

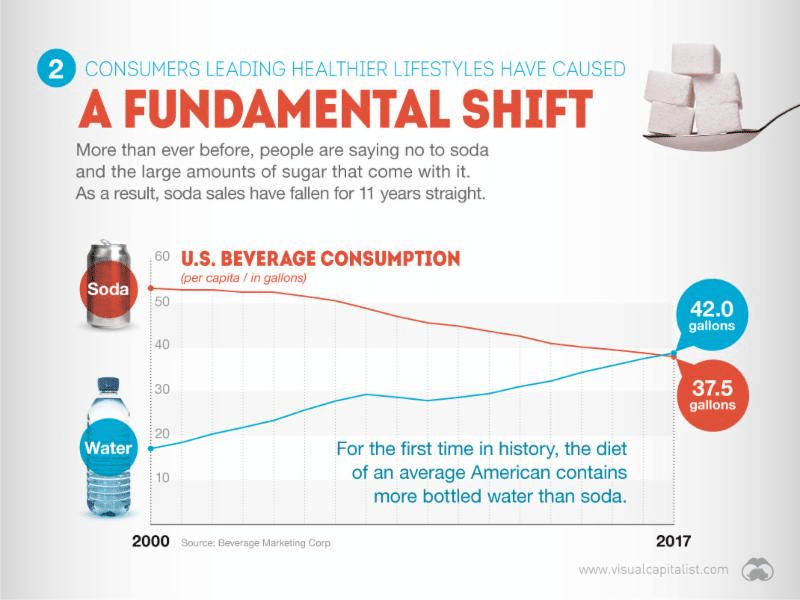

In 2017, Americans drank more bottled water than soda for the first time. With soda in prolonged decline, falling for 11 straight years, bottled water consumption appears to have nowhere to go but up.

In July of this year, Visual Capitalist put out some stunning charts that perfectly illustrate the bottled water trend.

After Decades of Growth the Inflection Point Arrives

Bottled Water Market Growth Forecasts

From an investment standpoint, water is on the verge of going mainstream because data surrounding consumption of bottled water is staggering…

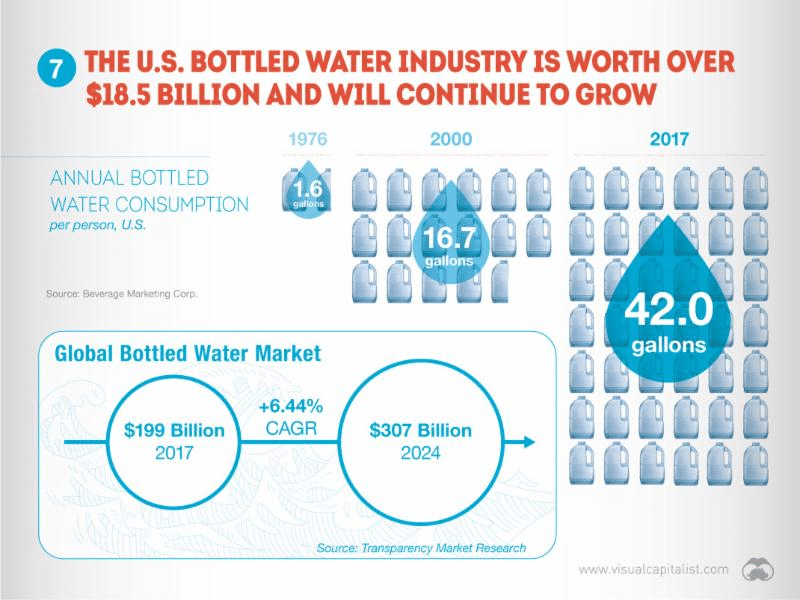

The global bottled water market is expected to grow from US$199 billion in 2017 to US$307 billion in 2024, according to Transparency Market Research. For a quick comparison, the legal cannabis sector is projected to hit $31.4 billion by 2021, according to a new report from Brightfield Group.

What’s more, annual bottled water consumption has gone from 1.6 gallons in 1976 to 16.7 gallons in 2000 to a stunning 42 gallons of consumption per person per year in the United States. People are choosing water above all drinks, and that won’t change anytime soon.

Stating the obvious, we’re attracted to water opportunities because water can be consumed by 100% of the population, unlike alcohol, cannabis or other pharmaceutical drugs. Water is life. And as modern lifestyles continue get busier, on-the-go consumers are paying for the health benefits bottled water provides.

Bottled water consumption is essentially guaranteed to increase. Consumption is increasing by billions of gallons each year.

Bottled water consumption worldwide from 2007 to 2017 (in billion litres):

In 2012, the global consumption of bottled water amounted to 288 billion liters and was forecasted to reach 391 billion liters by 2017, according to Statista. Bottled water consumption is marching towards 1 trillion liters per year…

Holy Grail | U.S. Bottled Water Market

There will be a continued breakout in the U.S. bottled water market. Affluent consumers and a booming economy have brought about an explosion in consumer spending. Target’s CEO Brian Cornell stated a couple weeks ago, “There’s no doubt that, like others, we’re currently benefiting from a very strong consumer environment – perhaps the strongest I’ve seen in my career,” according to CNBC.

As the U.S. continues to suffer from droughts and declining access to fresh water sources, premium waters will be all the more sought after. Combine those two factors with aging infrastructure and diminishing quality control in some places (think Flynt, Michigan), and it’s easy to see why demand for quality bottled water will grow. Finally, and most importantly, the cultural shift and growth of health-conscious consumers will lead demand higher.

After flatlining in the mid-to-late 2000s, bottled water consumption has exploded in the U.S., increasing by some 1 billion litres per year of late.

Sales volume of bottled water in the United States from 2010 to 2017* (in billion gallons):

From our perspective, the data points garnered in this report suggest the bottled water sector is poised for consolidation, similar to the way emerging craft breweries have been swallowed up by large mainstream beer companies. Large beverage companies and water bottlers have the facilities and national reach to make leading niche brands more profitable. The US$3.4 billion PepsiCo buyout in August of Soda Stream was a major acquisition in the space, but it most certainly wasn’t the first and will not be the last. Two other major players who’ve been on the acquisition hunt recently are Nestle and Coca-Cola.

Recent Acquisitions & Investment in the Bottled Water Market:

Coca-Cola buys Texas cult favorite sparkling water brand Topo Chico for $220 million

Nestle Waters acquires majority share in Princes Gate Spring Water Ltd

Pepsi invests in bottled water – Business Insider

Niagara Bottling acquires First Quality’s bottled water business

Primo Water completes acquisition of Glacier

Danone invests in firm selling bottled water from ocean floor

Buyouts and Investment will Continue

Cott, a diversified beverage company with a leading volume-based national presence in the North America and European markets, acquired Eden on August 2, 2016. Eden is a leading provider of water and coffee solutions in Europe.

The initial purchase value was EU517.9 million (U.S. $578.5 million at the exchange rate in effect on the acquisition date). Further details here.

Just last week, Reuters reported, “Danone, the maker of Evian and Volvic, is investing in a German company developing a purifier that will enable households to turn tap water into mineral water, as the French group seeks ways to adapt to growing demand for healthier food and drink.”

The issue with many of the brands in the graphic above is that they produce drinks high in sugar. We believe the next wave of acquisitions will be in still, premium, and alkaline water brands.

Walk into a grocery store anywhere in the U.S. and a growing number of bottled water products will be for sale. Think back merely ten years ago, when there may have been just half a dozen bottled waters to choose from at the grocery store. Offerings have increased because the market has grown exponentially and consumers are demanding more options.

Bottled Water Market Expands in Major Retailers Across U.S.

Millennials are leading a refocus on health and wellness and are a key driver behind the ever increasing bottled water market.

According to SocialMediaToday,

“In the U.S. alone there are about 80 million millennials, making them larger than any other demographic in the country. There are also more Millennials in the workforce than other generations, with an expected $1.4 trillion in disposable income by the year 2020.”

Through our connections in Canada and the U.S. we have identified a bottled water company with exceptional year over year revenue growth and market penetration. With sales across the United States, the brand is making a name for itself with some of the world’s largest retailers. As is often the case, the team behind the company’s unique market offering has been building this brand for several years, somewhat under the radar. Now, with record revenue and the company expanding nationwide, we’re a week away from revealing this bottled water market investment opportunity.

All the best with your investments,

PINNACLEDIGEST.COM

P.S. If you’re not already a member of our newsletter and you invest in TSX Venture stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.