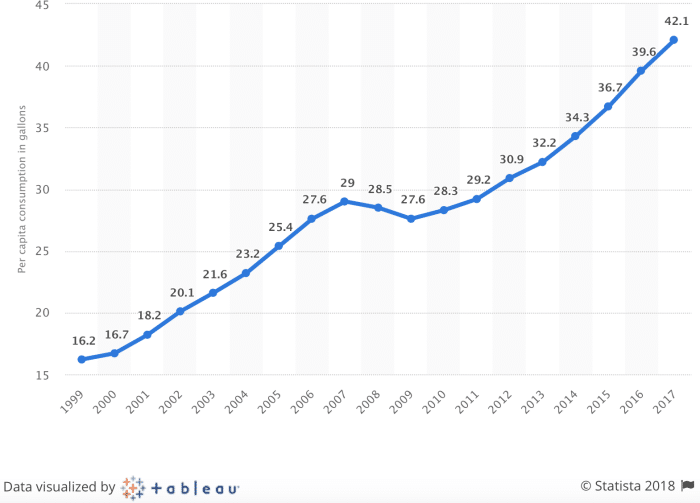

Last week’s letter titled Water is a ‘Right Now’ Investment explains why bottled water is the fastest growing beverage category. According to Charles Fishman of National Geographic, “Americans now drink astonishing amounts of bottled water: In 2015 we bought the equivalent of 1.7 billion half-litre bottles of water every week. That’s more than five bottles of water for every man, woman, and child in the country every single week.”

If you missed our report last week, you’ll want to read why bottled water is now the most consumed drink in America, surpassing soda for the first time in 2017, and how this will draw investors into the space.

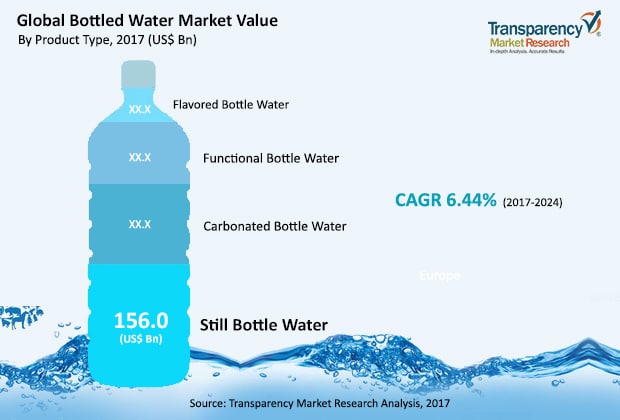

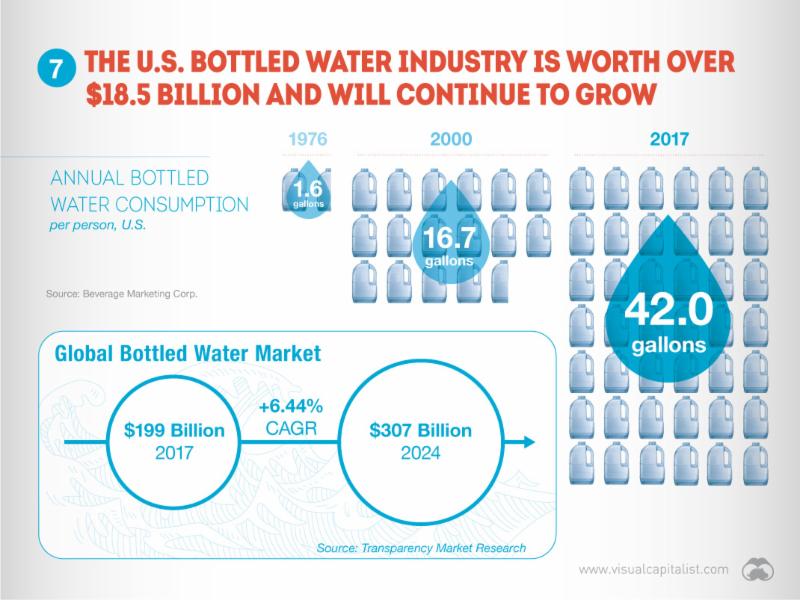

As researchers and speculators, identifying and being positioned in high-growth sectors is critical. While there are numerous reasons, a key one for investors is that it often leads to a period of buyouts. The U.S. bottled water industry is worth over US$18.5 billion and is growing in the 6-7% CAGR range. The global bottled water market is expected to reach more than US$307 billion by 2024 – far larger than the global marijuana market, as but one comparison.

*Stats garnered from Transparency Market Research

From our research over the last several months, majors in the beverage industry are looking to acquire efficiently ran, emerging brands with growing market share, virtually above all other factors. Once acquired, majors often streamline and expand distribution seemingly overnight while making the brand (more) economic. It’s a fascinating and highly competitive space.

The Opportunity

When speculating on TSX Venture stocks, significant risk is inherent. It’s part of the game. But with the risk early-stage companies bring comes the potential for large reward; including, in some rare cases, that coveted buyout potential, a topic we’ve written about at length.

Searching for that ‘buyout potential’ is what has taken us to four continents and many countries in recent years. And that’s what brought us to bottled water… more specifically, an emerging growth company which has chalked up record monthly revenues recently and is now one of the largest (by sales volume) alkaline water companies in the United States.

Needless to say, the company’s unique product is at the expansion phase – right when we look to get involved. And it only began trading on the TSX Venture a few months back.

This bottled water company is a revenue growth story unlike any we’ve featured on the TSX Venture. Today, we’re going to share its story with you…

New Featured Company | Key Metrics

- Provides a unique offering in the bottled water market, an industry with unequivocal upside and several recent buyouts, and has showcased tremendous growth.

- Reported record YoY revenue, with its product in approximately 40,000 retail outlets in America.

- A publicly traded company with a complete product line and market penetration in some of America’s largest national retailers, including Walmart, Albertson’s/Safeway and Krogers. Product is now sold in all 50 states.

- It is challenging for investors to get exposure to the bottled water industry outside of the majors – and they’re involved in various market segments outside of water. This company is a ‘pure play’ in bottled water – our market of focus.

We found all of the above metrics and then some in The Alkaline Water Company (WTER: TSXV) (WTER: OTCQB) – now one of America’s largest alkaline water companies. The company’s product, Alkaline88® water, is now selling across the U.S. in convenience stores, natural food product stores, large ethnic markets and national retailers, including giants Kroger and Walmart. Its product line includes a 500-milliliter, 700-milliliter, 1-liter, 1.5-liter, 3-liter and its bread and butter 1-gallon size bottle, all sold under the company’s trade name Alkaline88®.

Highlighting the explosive growth in this sector, over the last four years The Alkaline Water Company’s revenue growth has exceeded 435%. We will delve into its recent record revenue shortly. Beforehand, such growth begs the question: What makes the product unique?

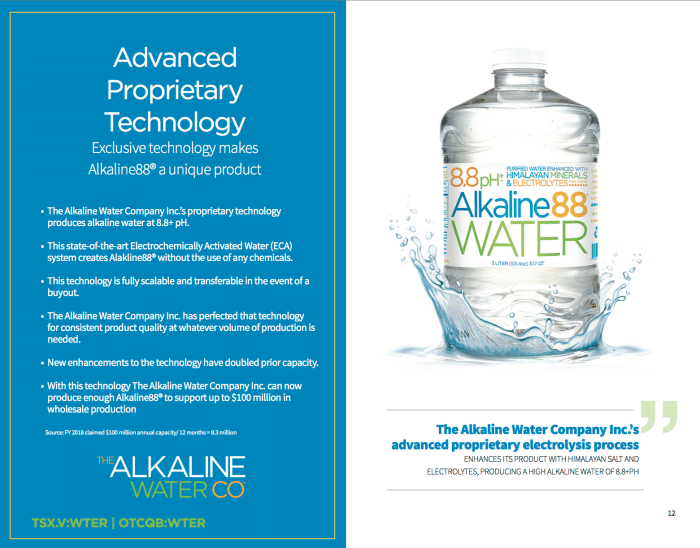

Branding and packaging aside (which is very important in the bottled water space), The Alkaline Water Company (“AWC”) employs a state-of-the-art Electrochemically Activated Water (ECA) system to create 8.8 pH drinking water without the use of any extraneous chemicals. The company further incorporates trace Himalayan minerals considered to be the finest in the world suited to a premier beverage.

This makeup of The Alkaline Water Company’s product is important to understand in the age of a health-conscious driven consumer. It has been critical to the company’s impressive revenue growth to date and instrumental in Alkaline88® bottled water becoming the fastest growing alkaline brand in America. In addition, the market demand for Alkaline88® has the company projecting nearly $40 million in revenue for fiscal year 2019. AWC also anticipates turning cash flow positive in FY 2019 (the company’s fiscal year 2019 has already commenced).

“A quick look at the fastest-growing consumer packaged goods (CPG) companies in the United States underscores three trends driving growth in the beverage category: health, authenticity and innovation.”

The Alkaline Water Company most certainly captures all three of these distinct features with its Alkaline88®.

What’s more, CSP’s Editor in Chief Steve Holtz named Alkaline88® in their “14 New Bottled Waters We’re Watching.” For 20 years, CSP magazine has consistently been at the forefront of the day’s critical issues and trends, keeping business leaders one step ahead of the competition.

Understanding the Bottled Water Market

We detailed in Water is a ‘Right Now’ Investment that the bottled water market is among the largest, fastest growing sectors in the world – expanding by billions of dollars annually.

Per capita consumption of bottled water in the United States from 1999 to 2017 (in gallons):

We wrote last weekend,

“While the above growth is impressive, the global bottled water market is expected to expand by more than $15 billion per year until at least 2024, according to Transparency Market Research

“In terms of revenue, methodology-based market evaluations have confirmed that the global bottled water market will attain a valuation of US$307.2 billion by 2024, swelling up from its evaluated worth of US$198.5 billion as of 2017.”

We simply had to have exposure to this sector. And much of our research suggests the booming US economy will be home to a large chunk of the growth in the bottled water market over the near term – exactly where The Alkaline Water Company (with the appropriate stock symbol of ‘WTER’) has been growing market share and revenue in recent years. As mentioned, The Alkaline Water Company is now one of America’s largest alkaline water companies (by sales volume), its Alkaline88® product was ranked #18 in the Top 20 Still Water Brands in the U.S, and it is the fastest growing alkaline brand nationwide.

Watch our exclusive video on The Alkaline Water Company above.

The Alkaline Water Company (AWC) has been capitalizing on the ‘health wave’ with a unique and desired product offering, and is targeting record revenue of near US$40 million in fiscal year 2019. In addition to its continued U.S. expansion, AWC received its FDA export approval and believes it will be selling Alkaline88® in international markets by Q3 of FY 2019. President and CEO of The Alkaline Water Company Mr. Richard Wright stated in July, “We expect to see record sales throughout FY 2019 as we continue to expand our domestic and international product offering.”

In that same release Mr. Wright commented, “This is truly a very exciting time for the Company. With the two new national-retailers already online, a full pipeline of additional new grocery chains coming on later this summer, and the 50% organic growth continuing, we expect to see our fiscal 2019 sales double to nearly $40,000,000. This increase in capital will also allow us to bring on a number of new co-packers, suppliers, and personnel to ensure we can support our rapid growth throughout FY19.”

Through Experience, Alkaline Water Company is Appropriately Positioned to Capitalize on US Bottled Water Market

AWC is by no means an overnight success. Businesses such as this typically aren’t. The company kicked off in 2012, and it hasn’t been easy getting to this expansion stage. There have been many learnings and hard lessons along the way. Like many young companies (and young people for that matter), mistakes were made in the early days, timing was likely an issue (alkaline water was nowhere near as popular as it is today when the company started), significant capital was expended (and continues to be due largely to expansion related efforts), and it can take some trial and error to put together the ‘right’ team.

To that point, it’s important we highlight a few details on the subject of operations. When we met with Mr. Richard Wright in Texas, a CEO who is as hard working and determined as they come, he explained something that has really stuck with us…

“…We have 14 employees so we average about $2 million plus [revenue/sales] per employee net currently, which is one of the highest in the industry. The industry averages about $260,000.” That’s slightly less than ten times the explained industry average…

Wright went on to explain, “We use a variable cost model. So, you’re standing in a co-packing facility. All we brought in here was our equipment. And we don’t have any of the overhead… we pay them for every case they produce…”

Lastly,

“I think we have a competitive advantage because our price point on a per ounce basis is about half our competitors when you’re buying in the bulk bottles…”

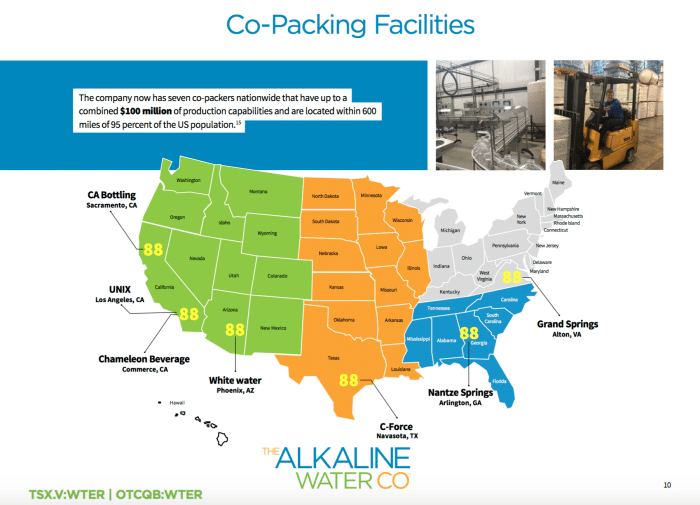

AWC does not own or operate any of their co-packing facilities. This, in our view, is very important. The company has co-packing agreements with seven different bottling companies. They’re located in Virginia, Georgia, California, Arizona and one in Texas which is owned by Gena and Chuck Norris who we had the pleasure of meeting with for our exclusive video on AWC (click here to watch).

The spread-out locations of these facilities are important for two reasons: scalability and transportation costs. AWC’s current capacity at all plants exceeds $8 million per month wholesale, giving them the potential to significantly scale up from current output. Should demand exceed projections, The Alkaline Water Company is ready to meet that demand with little or no shortfall in product supply. What’s more, these facilities were strategically selected because they are located within 600 miles of 95% of the US population, helping with transportation costs.

Another key highlight for The Alkaline Water Company is it is the ONLY U.S. company legally allowed to use “Alkaline88” in its brand name – a key competitive advantage within the category. In case you’re wondering, the 88 symbolizes 8.8 pH alkaline water… a branding coup.

Growth in Recent Years

As noted, a key metric for us selecting AWC as a client and investing in it was due to its established and rising revenue over the years. The company reported US$12.7 million revenue in fiscal year 2017, US$19.8 million in fiscal year 2018 and expects to see its fiscal 2019 sales almost double to nearly US$40 million. The risk versus reward made sense to us.

The Alkaline Water Company (WTER:OTCQB) – 3 Year Stock Chart

Major restructuring: Effective December 30, 2015, AWC effected a fifty for one reverse stock split of its authorized and issued and outstanding shares of common stock, hence its relatively tight capital structure today of approximately 30,989,727 shares outstanding and roughly 27.18 million shares in the float.

Record Revenue

On July 6th, the company reported ‘Fiscal 2018 Sales Top $19.8 Million, Up 55 Percent versus Prior Year’.

Fiscal Year 2018 Operational Highlights

- Secured product placement for Alkaline88® in the two largest grocery retailers in the world: Walmart and Kroger.

- Made capital improvements of over $400,000 and tripled East Coast production capacity to $2.8 million per month in wholesale production (based on the average of the monthly East Coast production during FY 2018).

- Alkaline88® was ranked #18 in the Top 20 Still Water Brands in the U.S.

- Alkaline88® was ranked one of the fastest growing enhanced water brands in the U.S. with over 55% year over year growth from FY 2017 to FY 2018.

- Increased Alkaline88® availability to over 40,000 retail locations nationwide.

- Alkaline88® is now available in 47 of the ‘Top 75’ US Retailers and Wholesalers.

- East Coast sales accounted for over 20% of the Company’s gross sales for FY 2018

- Entered into an agreement with an East Coast based bottle supplier for the Company’s 1-Gallon and 3-liter sizes, which will allow a significant increase in annual wholesale production capacity.

- Alkaline88® continues to perform well in current retailers, with sales volume increases between 20 to 70% from FY 2017 to FY 2018

- Revenue for the year ended March 31, 2018 was $19,812,199, as compared to $12,763,630 for the same period ended March 31, 2017, an increase of 55 percent. This increase in revenue is due to the continued acceptance of the Company’s products by consumers and the successful expansion into additional national retailers, including Walmart, Kroger, and Shopko.

- Net loss for the year ended March 31, 2018 was ($6,727,280), as compared to a net loss of ($3,454,600) for the same period ended March 31, 2017.

Click here to read the full release.

Days later, on July 11th, The Alkaline Water Company Inc. reported ‘…Record Quarterly Sales of over US$7.85 million’. That is nearly a US$32 million run rate. From our perspective, that is an impressive feat for a company with an approximate US$57 million *market cap.

*Market cap according to Bloomberg

Expansion Plans

In a June 26th press release, Ricky Wright, CEO and President, stated,

“In the last 60 days, we’ve begun to sell in Walmart, Kroger and Shopko stores nationwide. We are delighted so far with Alkaline88’s® sell-through in these national retailers.”

Update on The Alkaline Water Company Inc.’s National Expansion Plans

AWC has increased its market penetration into some of the world’s largest retailers. Revenue from these stores is beginning to show up in the financials. But plans for expansion are far from over…

Additional details of the Company’s business, finances, appointments and agreements can be found as part of the Company’s continuous public disclosure filed with the Securities and Exchange Commission (“SEC”), available at www.sec.gov, and on the SEDAR website, available at www.sedar.com.

A Track Record of Exceptional Growth

AWC’s growth trajectory is established. The company has been putting up record quarterly sales for years and *may soon be noticed by a major beverage outfit. With its market penetration increasing (recently added Walmart and Kroger to the retailers who carry its brand) we, like the company, expect its revenue numbers to rise in fiscal year 2019.

*We outlined many recent buyouts and the potential for consolidation in the water market last week.

While down in Texas at one of AWC’s co-packing bottling facilities, President and CEO Richard Wright explained the company’s emergence as a national brand candidate. To find out why reaching revenue of near US$40 million could be an important milestone for an emerging beverage company, watch our exclusive interview below. During our visit, Wright further explains AWC’s keys to growth.

Join us on a multi-city trip to numerous retail locations where Alkaline88 is sold. Also, visit Texas bottling facility C-Force, owned by Gena and Chuck Norris – co-packer of The Alkaline Water Company.

The Alkaline Water Company – Striving for ‘National Brand’ Status

When asked: Where do you see the Alkaline Water Company going?

Wright responded,

“We’re at kind of a critical juncture within the company. We’re in all 50 states now, we’re in over 40,000 stores. We think we’ll do about US$40 million dollars this year in sales. At that point in time, we are now known as a national brand. At that point in time, we can expect some sort of interest from outsiders, potentially an acquisition…”

He immediately continued that,

“However, I am critically focused, and our staff is critically focused, on staying to plan. So, we will continue to grow the grocery channel, we’re now in about 80% of it; so, we plan to finish that up this year. In addition, we plan to expand into other classes of trade which includes drug stores, C-stores and big box stores…”

This is another reason AWC and its team are anticipating its revenue numbers will increase. The company has steadily increased the number of stores carrying its product.

Back to the interview…

When asked, “Is there something significant about that $40 million in terms of majors identifying you as a major brand?”

Wright responded,

“…because they can take your national footprint, where the consumer is already aware of the brand, and expand it instantly with their current networks in place.”

As is the case with virtually all new featured company’s and investment opportunities we present, we went to see the Alkaline Water Company and its operations first hand. The Alkaline Water Company’s National Sales Manager, Frank Chessman, stated that Alkaline88® is “…the fastest growing water in the enhanced water category.”

Key Addition

On August 28th, AWC announced the nomination of Brian Sudano, Managing Partner of Beverage Marketing Corporation, as a director of the Company to be presented to stockholders of AWC for election at the annual meeting of stockholders of the Company to be held on September 14, 2018.

According to Alkaline Water Company’s CEO, Richard Wright, Sudano is “one of the most respected names in the beverage world.” He continued, “His insight will be invaluable to the future growth and direction of the Company. His acumen and industry expertise gained as the Managing Partner of Beverage Marketing Corporation, the leading beverage research, consulting, and financial service firm serving the beverage industry, will allow us to further grow with his extraordinary guidance.”

Sudano stated,

“Alkaline88 is a tremendous growth story. The Company has averaged a 75% three-year compounded growth rate and recently reported over $19.8 million in sales for FY 2018. The beverage industry, and specifically the bottled water space, is one of the most competitive markets in the U.S. For a company to achieve what Alkaline88® has done in only 5 short years is to say the least, exceptional…”

Alkaline is Key to The Alkaline Water Company’s Outperformance

As mentioned, the bottled water industry is forecast to increase from US$199 billion in 2017 to US$307 billion in 2024.

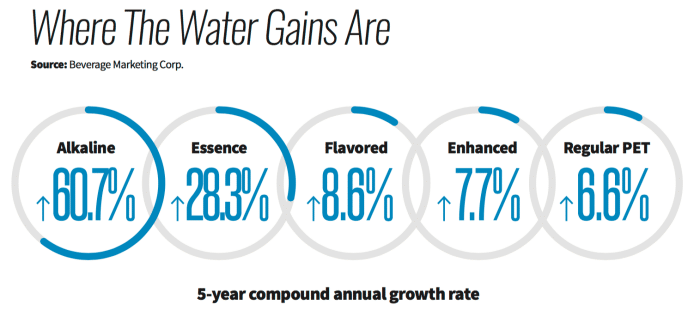

The fastest growing niche within this expanding market is premium waters. And, within premium waters, the fastest growing segment is, by far, alkaline water.

So, in the fast-growing premium water sector, ALKALINE water is truly the tip of the spear – growing by a whopping 5-year compound annual growth rate of approximately 60.7%. Thus, we believe more investors will soon become aware consumers are hungry for alkaline water. Hence the timing of our introduction today.

So, as the alkaline water segment grows feverishly, the first question to ask is – what about the competition? There is plenty of competition in the alkaline water segment. Too many to name here. However, a key advantage is AWC has trademarked its distinctive “Alkaline88” brand…

Trademark possession of a name means no competitor can use it to brand its products. Mr. Richard Wright explains this advantage in our exclusive interview. The Alkaline88® trademark and the products status as a functional, premium alkaline water brand may prove to have further value than what’s been realized to date.

Consider this: Coke’s $4.1 billion buyout of VitaminWater included trademark possession of the word “vitamin” to maximize positioning of the brand within the vitamin water sector.

We strongly believe added value is attributed within the sector by incorporating the word “alkaline” in the company’s Alkaline88® trademark.

“With “alkaline” water dominating the premium water sector, The Alkaline Water Company Inc. and its product, Alkaline88®, is well positioned for a brand-driven acquisition.”

Cultural Shift Benefits The Alkaline Water Company

Our newest featured company is directly benefiting from the cultural shift to eat and drink healthy as consumer demand surges for its product. As with almost all our featured clients, we don’t just review the data or take their word for it. We go see it first-hand. In June and then again in July we ventured on a multi-city trip to see the product on the shelves and better understand the company’s goals.

For us, the chance to invest in one of the fastest growing brands (achieved 75% compounded growth over the last 3 years) in an industry with 6-7% CAGR was enticing. Furthermore, knowing they are positioned and operating in the alkaline water niche, which is the fastest growing segment in the broader bottled water sector, was the cherry on top. For The Alkaline Water Company, the compounding impact of this growth has resulted in its revenue increasing over 435% since FYE 2015.

Recognize that we are biased when it comes to The Alkaline Water Company. AWC is a client and we participated in the company’s private placement completed in May 2018, making us shareholders and cheerleaders. Conduct your own thorough and independent due diligence to properly understand the risks associated with investing in a company of this nature. The company is most certainly at an expansion stage, which often results in further dilution to shareholders. Pick your spots…

*Additional details of the Company’s business, finances, appointments and agreements can be found as part of the Company’s continuous public disclosure filed with the Securities and Exchange Commission (“SEC”), available at www.sec.gov, and on the SEDAR website, available at www.sedar.com.

From southern California to the heartland of Texas, enjoy watching our backstage visit with The Alkaline Water Company…

Click to watch our exclusive coverage.

From a revenue standpoint, The Alkaline Water Company is the fastest growing company we’ve ever had the pleasure of introducing in our more than 10-year history of working with small-caps. The company is poised for further growth, and could be nearing the pivotal US$40 million in revenue in fiscal year 2019. As an emerging national brand, we believe The Alkaline Water Company (WTER: TSXV) (WTER: OTCQB) has the potential to become a buyout candidate in the future.

All the best with your investments,

PINNACLEDIGEST.COM

MEET THE MANAGEMENT TEAM FOR THE ALKALINE WATER COMPANY

The Alkaline Water Company Stock information

Exchanges: TSX Venture and OTCQB

Symbol on Both Exchanges: WTER

Stock Price: CAD$2.54 – US$1.83

10-Day Avg. Volume on OTCQB: 49,500 (approximate)

Recent News from the Company

The Alkaline Water Company Inc. (WTER) added to the LD Micro Index (LDMi)

The Alkaline Water Company Increases its Production Capacity at Phoenix, Arizona Based Co-Packer

Corporate Presentation

Click to view The Alkaline Water Company’s Corporate Presentation – September, 2018

Online Resources

Visit The Alkaline Water Company Online

Disclosure, Risks Involved and Information on Forward Looking Statements:

Please read the following carefully before proceeding.

THIS IS NOT INVESTMENT ADVICE. All statements in this report are to be checked and verified by the reader.

This report may contain technical or other inaccuracies, omissions, or typographical errors, for which Maximus Strategic Consulting Inc., owner of PinnacleDigest.com (“Pinnacle Digest” or “we”), assumes no responsibility. We cannot warrant the information contained in this report to be exhaustive, complete or sufficient. The Alkaline Water Company Inc. is a client and sponsor of PinnacleDigest.com. PinnacleDigest.com authored and published this report. Because we are paid by The Alkaline Water Company Inc., and therefore we are not independent reporters, our coverage of The Alkaline Water Company Inc. features many of its positive aspects, and not the potential risks to its business or to investing in its stock.

Important: Our disclosure for this report on The Alkaline Water Company Inc. applies to the date this report was released to our subscribers (September 8, 2018) and posted on our website. This disclaimer will never be updated, even after we sell our shares of The Alkaline Water Company Inc.

In all cases, interested parties should conduct their own investigation and analysis of The Alkaline Water Company Inc. (“The Alkaline Water Company” or “AWC” or “the Company”), its assets and the information provided in this report.

You should refer to The Alkaline Water Company’s public disclosure documents found on the SEDAR website (www.sedar.com) and the U.S. Securities and Exchange Commission’s website (www.sec.gov) before considering investing in the Company. The public disclosure documents will help investors fully understand The Alkaline Water Company’s business and the risks associated with the Company.

The statements and opinions within this report expressed by Pinnacle Digest are solely those of Pinnacle Digest and not the opinions of The Alkaline Water Company. The statements and opinions within this report expressed by representatives of The Alkaline Water Company are solely those of The Alkaline Water Company and not the opinions of Pinnacle Digest.

While the information contained in this report has been prepared in good faith, neither Maximus Strategic Consulting Inc. nor Pinnacle Digest, give, have given or have authority to give, any representations or warranties (express or implied) as to, or in relation to, the accuracy, reliability or completeness of the information in this report (all such information being referred to as “Information”) and liability therefore is expressly disclaimed to the fullest extent permitted by law. Accordingly, neither Maximus Strategic Consulting Inc., nor any of its shareholders, directors, officers, agents, employees or advisers take any responsibility for, or will accept any liability whether direct or indirect, express or implied, contractual, tortious, statutory or otherwise, in respect of, the accuracy or completeness of the Information or for any of the opinions contained in this report or for any errors, omissions or misstatements or for any loss, howsoever arising, from the use of this report.

Cautionary Note Regarding Forward-Looking Information: Much of this report is comprised of statements of projection. This report contains “forward-looking information” within the meaning of Canadian securities legislation and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements”). All statements, other than statements of historical fact, that address activities, events or developments that The Alkaline Water Company or Pinnacle Digest believes, expects or anticipates will or may occur in the future are forward looking statements. Such statements include but are not limited to, statements with respect to future growth predictions for the bottle water industry; statements regarding the expected declining growth for carbonated soft drinks; statements relating to no other company being as uniquely positioned in the bottled water market as The Alkaline Water Company; the statement that the Company can now produce enough Alkaline88 to support up to $8 million a month in sales revenue; any statement that the Company’s current production capacity well exceeds its mid-term volume projections and should demand exceed projections, the Company is ready to meet that demand with little or no shortfall in product supply; the Company expecting growth in sales to increase in the months ahead; the anticipation that more retailers will carry the Company’s product on their shelves; the Company expects to see its fiscal 2019 sales increase to nearly US$40 million; the Company expects to reach positive cash flow in fiscal year 2019; that the Company will be able to scale its operations efficiently if sales continue to grow; statements that if the Company reaches near US$40 million in revenue it can expect interest from outside companies, potentially interest from an acquisition perspective; that the Company has the potential to become a buyout candidate and that Alklaine88 is well positioned for a brand-driven acquisition and other statements, estimates or expectations. Often, but not always, these forward-looking statements can be identified by the use of forward-looking terminology such as “expects”, “expected”, “budgeted”, “targets”, “forecasts”, “intends”, “anticipates”, “scheduled”, “estimates”, “aims”, “will”, “believes”, “projects” “could” “would” and similar expressions (including negative variations) which by their nature refer to future events.

By their very nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond The Alkaline Water Company’s control. These statements should not be read as guarantees of future performance or results. Forward looking statements in this report are based on the opinions and estimates of the Company’s management or Pinnacle Digest at the date the statements are made, as well as a number of assumptions made by, and information currently available to, the Company or Pinnacle Digest concerning, among other things, that the demand for the Company’s products will continue to significantly grow; that there will be continued expansion of direct store distributor sales; that there will be increased production capacity through implementation of new technology; that there will be an increase in number of products available for sale to retailers and consumers; that there will be an expansion in geographical areas by national retailers carrying the Company’s products; that there will be an expansion into new national and regional grocery retailers; that there will be an entry by the Company into international markets; that third parties will honor their contractual obligations; and that the Company will be able to obtain additional capital to meet the Company’s growing demand and satisfy the capital expenditure requirements needed to increase production and support sales activity.

Factors that could cause actual results to vary materially from results anticipated by such forward looking statements include, but are not limited to, governmental regulations being implemented regarding the production and sale of alkaline water; additional competitors selling alkaline water bulk containers reducing the Company’s sales; a competitor infringing on the Company’s trademark; the fact that the Company does not own or operate any of its production facilities and that co-packers may not renew current agreements and/or not satisfy increased production quotas; the fact that the Company has a limited number of suppliers of its unique bulk bottles; the potential for supply chain interruption due to factors beyond the Company’s control; the fact that there may be a recall of products due to unintended contamination; the inherent uncertainties associated with operating as an early stage company; changes in customer demand; the extent to which the Company is successful in gaining new long-term relationships with new retailers and retaining existing relationships with retailers; the Company’s ability to raise the additional funding that it will need to continue to pursue its business, planned capital expansion and sales activity; competition in the industry in which the Company operates; volatility in the Company’s stock price and market conditions. It’s also important to understand that The Alkaline Water Company has not reached profitability. And even if its revenue increases, there is no certainty that will translate into the Company being profitable.

These forward-looking statements are made as of the date of this report being publicly released, and neither Pinnacle Digest nor the Company assume any obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by applicable law, including the securities laws of the United States and Canada. Although Pinnacle Digest and The Alkaline Water Company believe that the assumptions inherent in their respective forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to their inherent uncertainty.

Readers of this report should consult all of the information set forth herein and should also refer to the risk factors disclosure outlined in the reports and other documents The Alkaline Water Company files with the SEC, available at www.sec.gov, and on the SEDAR website, available at www.sedar.com.

We Are Not Financial Advisors: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned anywhere in this report (particularly in respect to The Alkaline Water Company Inc.). PinnacleDigest.com is an online financial newsletter owned by Maximus Strategic Consulting Inc. We are focused on researching and marketing for small public companies. This report is intended for informational and entertainment purposes only. The author of this report and its publishers bear no liability for losses and/or damages arising from the use of this report.

Be advised, Maximus Strategic Consulting Inc., PinnacleDigest.com and its employees are not a registered broker-dealer or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer.

Never, ever, make an investment based solely on what you read in an online newsletter, including Pinnacle Digest’s online newsletter, or Internet bulletin board, especially if the investment involves a small, thinly-traded company that isn’t well known.

PinnacleDigest.com’s past performance is not indicative of future results and should not be used as a reason to purchase any security mentioned in this report or on our website.

The past performance of The Alkaline Water Company’s management, directors, advisors and leadership personnel is not indicative of future results for the Company and should not be used as a reason to purchase any security mentioned in this report.

We Are Biased: The Alkaline Water Company Inc. is a client of ours (details in this disclaimer on our compensation). We also own shares and warrants of The Alkaline Water Company Inc. For those reasons, we want to remind you that we are biased when it comes to the Company.

Because The Alkaline Water Company has paid us CAD$75,000 plus gst for our online advertising and marketing services, and we (Maximus Strategic Consulting Inc. and its president Aaron Hoddinott) own shares and warrants of the Company, you must recognize the inherent conflict of interest involved that may influence our perspective on The Alkaline Water Company; this is one reason why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor and a registered broker-dealer before considering investing in the Company.

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its officers, directors, employees, and consultants shall not be liable for any damages, losses, or costs of any kind or type arising out of or in any way connected with the use of its reports, products or services, including this report. Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, its employees, consultants and affiliates are not responsible for any information provided by any of the companies mentioned in our reports or third party writers. You should independently investigate and fully understand all risks before investing.

We want to remind you again that PinnacleDigest.com is often paid editorial fees for its writing and the dissemination of material. The clients (including The Alkaline Water Company) represented by PinnacleDigest.com are typically early-stage companies that pose a much higher risk to investors than established companies. When investing in speculative stocks such as The Alkaline Water Company it is possible to lose your entire investment over time or even quickly. The Alkaline Water Company is not an appropriate investment for most investors.

Set forth below is our disclosure of compensation received from The Alkaline Water Company Inc. and details of our stock and warrant ownership in the company as of September 8, 2018:

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, has been paid CAD$75,000 plus GST to provide online advertisement coverage for The Alkaline Water Company for a pre-paid six month online marketing agreement. The Alkaline Water Company has paid for this coverage. The coverage includes, but is not limited to, the creation and distribution of reports authored by PinnacleDigest.com about The Alkaline Water Company (reports such as this one), as well as display advertisements and news distribution about the Company on our website and in our newsletter. Both Maximus Strategic Consulting Inc. and its President Aaron Hoddinott own shares and warrants of The Alkaline Water Company which were purchased by subscribing to The Alkaline Water Company’s private placement that closed on May 31, 2018. In that private placement both Maximus Strategic Consulting Inc. and Aaron Hoddinott purchased Units of the Company at a price of US$0.75 per Unit. Each Unit consisted of one share of common stock of the Company (each, a “Share”) and one-half of one share purchase warrant (each whole warrant, a “Warrant”). One Warrant entitles the holder thereof to purchase one additional Share of the Company (each, a “Warrant Share”) at a price of US$0.90 per Warrant Share for a period of two years from closing of the private placement. Both Maximus Strategic Consulting Inc. and Aaron Hoddinott intend to sell every share they own of The Alkaline Water Company for their own profit. All shares Maximus Strategic Consulting Inc. and Aaron Hoddinott currently own or purchase in the future of The Alkaline Water Company will be sold without notice to Pinnacle Digest’s subscribers and the general public. Please recognize that Maximus Strategic Consulting Inc. and its President Aaron Hoddinott benefit from price and trading volume increases in The Alkaline Water Company. Please recognize that we are extremely biased when it comes to The Alkaline Water Company.

Maximus Strategic Consulting Inc. and PinnacleDigest.com (including its employees and consultants) are not chartered business valuators; the methods used by business valuators often cannot justify any trading price for most junior stock exchange listed companies. The Alkaline Water Company is a junior stock exchange listed company.

Any decision to purchase or sell as a result of the opinions expressed in this report OR ON PinnacleDigest.com will be the full responsibility of the person authorizing such transaction, and should only be made after such person has consulted a registered financial advisor and conducted thorough due diligence. Information in this report has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete. Our views and opinions regarding the companies we feature on PinnacleDigest.com and in this report are our own views and are based on information that we have received, which we assumed to be reliable. We do not guarantee that any of the companies mentioned in this report (specifically The Alkaline Water Company) or on PinnacleDigest.com will perform as we expect, and any comparisons we have made to other companies may not be valid or come into effect.

To get an up to date account on any changes to our disclosure for The Alkaline Water Company (which will change over time) view our full disclosure at the url listed here: https://www.pinnacledigest.com/disclosure-compensation/

Maximus Strategic Consulting Inc., owner of PinnacleDigest.com, does not undertake any obligation to publicly update or revise any statements made in this report.

Learn how to protect yourself and become a more informed investor at www.investright.org

No warranty, either express, or implied, is given for the information and opinions published in this report. All information is provided “as is” WITHOUT WARRANTY OR CONDITION OF ANY KIND, EXPRESS OR IMPLIED, AND ALL SUCH WARRANTIES OR CONDITIONS ARE HEREBY DISCLAIMED. MAXIMUS STRATEGIC CONSULTING INC. AND ITS SERVICE PROVIDERS ASSUME NO RESPONSIBILITY TO YOU OR TO ANY THIRD PARTY FOR ANY ERRORS OR OMISSIONS.

Trading in the securities of The Alkaline Water Company should be considered highly speculative.

We are Not Medical Professionals: This report was produced without the consultation or advice of a medical professional. The described benefits and opinions of alkaline water, or specifically Alkaline88 water, must not be viewed as medical advice. You should consult with a licensed medical doctor and nutritionist to learn about the potential benefits of alkaline water and Himalayan rock salt. The Company has not conducted any clinical studies regarding the health benefits of alkaline water and accordingly make no claims as to the benefits of alkaline water.