Investor Distrust Could Fuel Bitcoin

According to SkyBridge Capital’s Anthony Scaramucci, there’s a link between the GameStop frenzy and Bitcoin: growing support for decentralization. Via Coindesk, “Scaramucci said in an

Insights

According to SkyBridge Capital’s Anthony Scaramucci, there’s a link between the GameStop frenzy and Bitcoin: growing support for decentralization. Via Coindesk, “Scaramucci said in an

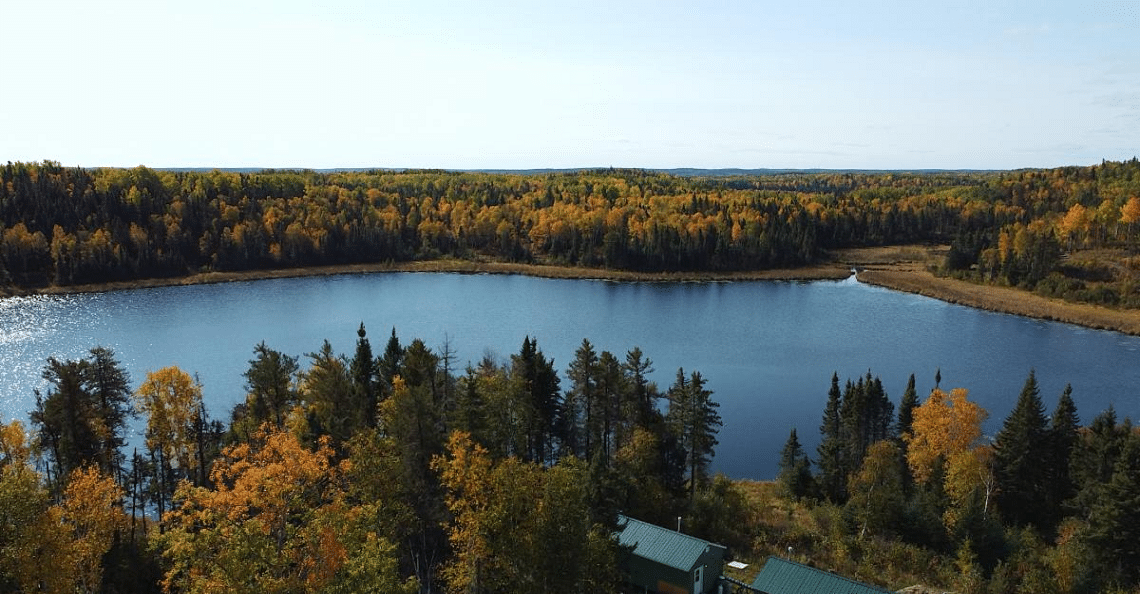

New Placer Dome Gold Corp. (“New Placer Dome” or the “Company“) (TSXV: NGLD) (OTCQB: NPDCF) (FSE: BM5) is pleased to report additional analytical results from

Ladies and gentlemen, there’s a new Stock Challenge Champion in town: member ‘wooloomooloo’! Wooloomooloo (who is also ironically the winner of the January 2020 Stock

As hordes of Reddit investors send stocks like GameStop and Nokia to the moon, retail investors are having a watershed moment. Chamath Palihapitiya summed up

After four years of strong economic growth under Trump, investors everywhere are wondering how the Biden Administration will impact their portfolios. While it’s far too

Stock Challengers are having one heck of a month! Member ‘Phillip Yao’ has taken over first place with an eye-popping return of 249.33%, followed behind

Over 5,000 meters of drilling planned on Rivard to test trenching and five main mineralized veins This is part of an ongoing 40,000 to 50,000

Trillium Gold Mines Inc. (TSXV: TGM) (OTCQX: TGLDF) (FRA: 0702) (“Trillium” or the “Company”) is very pleased to announce the appointment of Donna Yoshimatsu as Vice President, Corporate Development and

2021 may turn out to be the “Year of the Small-Cap” if this month is any indication. We’re a little over two weeks into the

The behavioural and psychological changes spurred by Covid-19 are behind the increased liquidity and once unimaginable valuations on North American stock exchanges. Market sentiment is

From rumours that Biden will cancel Keystone XL on his first day in office to making power-plant emissions extinct by 2035, dramatic policy reversal is

The Company achieves almost entirely pure fluorspar (CaF2) during recent refinement work. Ares greatly improves recoveries for all its upgrading processes through processing advances. The

Exclusive Content

Peter Schiff believes gold will continue to thrive in today’s economic climate…

Discover Kevin O’Leary’s latest predictions for Bitcoin and institutional crypto investments…

Explore Celente’s 2025 predictions on AI, real estate, gold, and economic shifts…

For well over a century, gold stocks have been one of the most popular investment assets

among speculators. An essential fact sometimes ignored is that gold equities often drastically…

Authors for PinnacleDigest.com are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read on PinnacleDigest.com. As with all investments, an investor should carefully consider his investment objectives and risk tolerance before investing. Use of this Site constitutes acceptance of our Terms of Use, Privacy Policy and Disclosure & Compensation. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Pinnacle Digest.

Securities covered in articles on this website are highly speculative. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly. These are not suitable investments for most investors.

All statements in articles on this website are to be checked and verified by the reader. Articles on this website may contain technical or other inaccuracies, omissions, or typographical errors for which PinnacleDigest.com assumes no responsibility.

Please be aware and note the date in which articles are published on this website. As a result of the passing of time, the relevancy of the opinions and facts in articles are likely to diminish over time and may change without an update to the articles. As such, you cannot rely on the accuracy and timeliness of the information provided and should consider many of the articles irrelevant after an extended period of time from the date which it was published. Since there is no specific guideline as to how long an article may remain relevant, you should consider that all articles may be irrelevant shortly after they are published. This is especially true for articles that include information on publicly traded companies.

2025 © Pinnacle Digest. All rights reserved | Privacy Policy | Disclosure & Compensation | Terms of Use

Subscribe to our free newsletter for a weekly dose of the stories that move markets, and much more.

* By submitting your email you will receive our best content in your inbox weekly, which sometimes includes information about our sponsors. And you also agree to our Terms of Use and Privacy Policy.