A.I. Social Media Influencer and Gold’s Record High Price

Social media and A.I. were always destined to collide. Two of the most powerful investing…

Insights

Social media and A.I. were always destined to collide. Two of the most powerful investing…

Despite inflation slowing, the cost of everything continues to rise. Asa. result, inflation has rattled…

Imagine a high-stakes financial game where the U.S. and Canada, post-pandemic, are still splurging…

In our latest podcast, Aaron and Alex delve into the pressing issue of Europe’s looming…

The affordability crisis is hitting Canada harder than most countries. The annual inflation rate in…

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today.

The days of free money and easy credit are over. And, for many in North America, this means soaring loan servicing costs. But, for Americans

Albemarle is the largest producer of lithium, a critical metal necessary for electric vehicles and other rechargeable batteries. Understanding the company’s approach to hard rock

Higher interest payments is growing U.S. debt like never before…

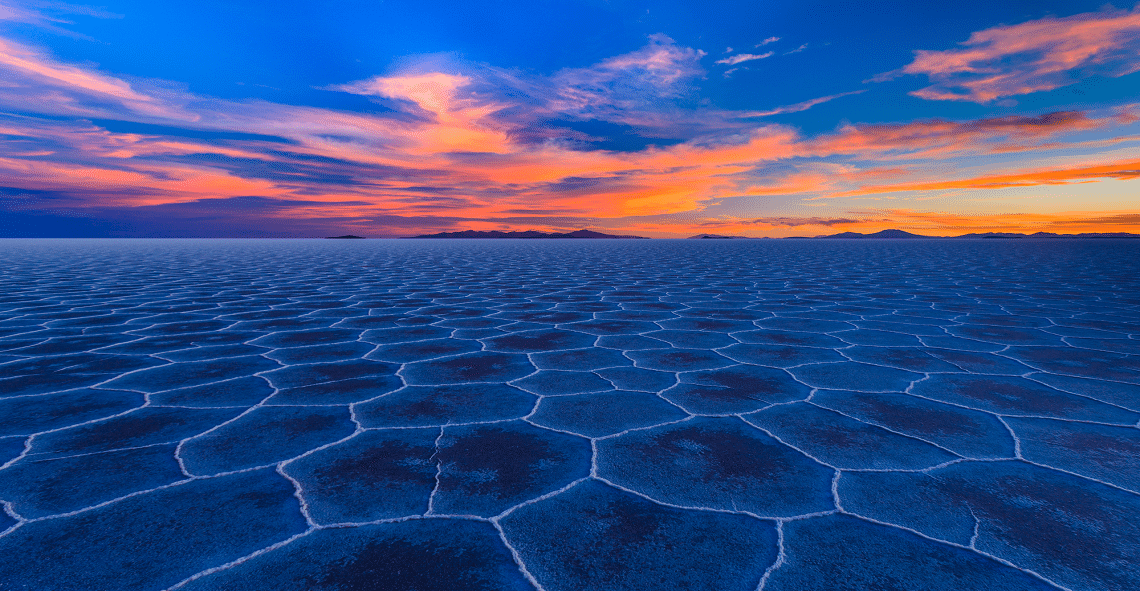

The lithium triangle in South America has long been a global leader in lithium production; however, with groundwater levels dropping, miners are facing pressure. The

As the dog days of summer roll on, we should remember the significance of the current downturn. While venture markets are speculative, risk assets by

Exclusive Content

In a recent deep dive with Aaron Hoddinott, legendary investor and economist Peter Schiff shares his views on the global economy, particularly focusing on inflation and the rising prominence of gold.

As global economic uncertainties persist, Schiff underscores the impending rise of inflation, which he believes is far from being under control. This inflationary trend, coupled with declining confidence in fiat currencies like the U.S. dollar, sets the stage for a significant shift toward gold investment.

The price of gold increased substantially over the last year, and according to Schiff, this trend is only the beginning. He believes that once the decline of the U.S. dollar begins in earnest, gold’s move will become more pronounced.

This scenario positions gold not only as a hedge, but as a potential mainstream investment medium as central banks and investors alike look for stability outside of traditional ….

This scenario positions gold not only as a hedge, but as a potential mainstream investment medium as central banks and investors alike look for stability outside of traditional ….

Discover Kevin O’Leary’s latest predictions for Bitcoin and institutional crypto investments…

Gerald Celente, a distinguished trend forecaster and the founder of the Trends Research Institute, recently joined Aaron Hoddinott to discuss what he believes are imminent shifts in the global economy. In their comprehensive discussion, Celente delves into the critical trends that could reshape the economic and financial landscapes in 2025 and beyond. From the potential of a commercial real estate crisis to a bubble in A.I., and the upside in precious metals, this is a wide-reaching conversation.

Celente, who has dedicated his career to trend forecasting, underscores the importance of understanding emerging patterns to navigate future uncertainties effectively.

He foresees a looming crisis in the multi-trillion dollar commercial real estate sector, suggesting that a downturn here could have catastrophic effects on the broader financial system.

He even goes as far as to say that a commercial real estate crisis (triggered by looming mortgage renewals) has the ….

For well over a century, gold stocks have been one of the most popular investment assets

among speculators. An essential fact sometimes ignored is that gold equities often drastically…

Authors for PinnacleDigest.com are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read on PinnacleDigest.com. As with all investments, an investor should carefully consider his investment objectives and risk tolerance before investing. Use of this Site constitutes acceptance of our Terms of Use, Privacy Policy and Disclosure & Compensation. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Pinnacle Digest.

Securities covered in articles on this website are highly speculative. When investing in speculative stocks of this nature, it is possible to lose your entire investment over time or even quickly. These are not suitable investments for most investors.

All statements in articles on this website are to be checked and verified by the reader. Articles on this website may contain technical or other inaccuracies, omissions, or typographical errors for which PinnacleDigest.com assumes no responsibility.

Please be aware and note the date in which articles are published on this website. As a result of the passing of time, the relevancy of the opinions and facts in articles are likely to diminish over time and may change without an update to the articles. As such, you cannot rely on the accuracy and timeliness of the information provided and should consider many of the articles irrelevant after an extended period of time from the date which it was published. Since there is no specific guideline as to how long an article may remain relevant, you should consider that all articles may be irrelevant shortly after they are published. This is especially true for articles that include information on publicly traded companies.

2025 © Pinnacle Digest. All rights reserved | Privacy Policy | Disclosure & Compensation | Terms of Use

Subscribe to our free newsletter for a weekly dose of the stories that move markets, and much more.

* By submitting your email you will receive our best content in your inbox weekly, which sometimes includes information about our sponsors. And you also agree to our Terms of Use and Privacy Policy.