Startup Risks and Central Bank Gold Purchases Reach Record

From startup stories to record gold purchases by central banks, something big is happening…

Now in his 70s, Daniel fears being forced to move and explains that safety and freedom, not addiction or mental health, have driven ….

From startup stories to record gold purchases by central banks, something big is happening…

If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox.

….

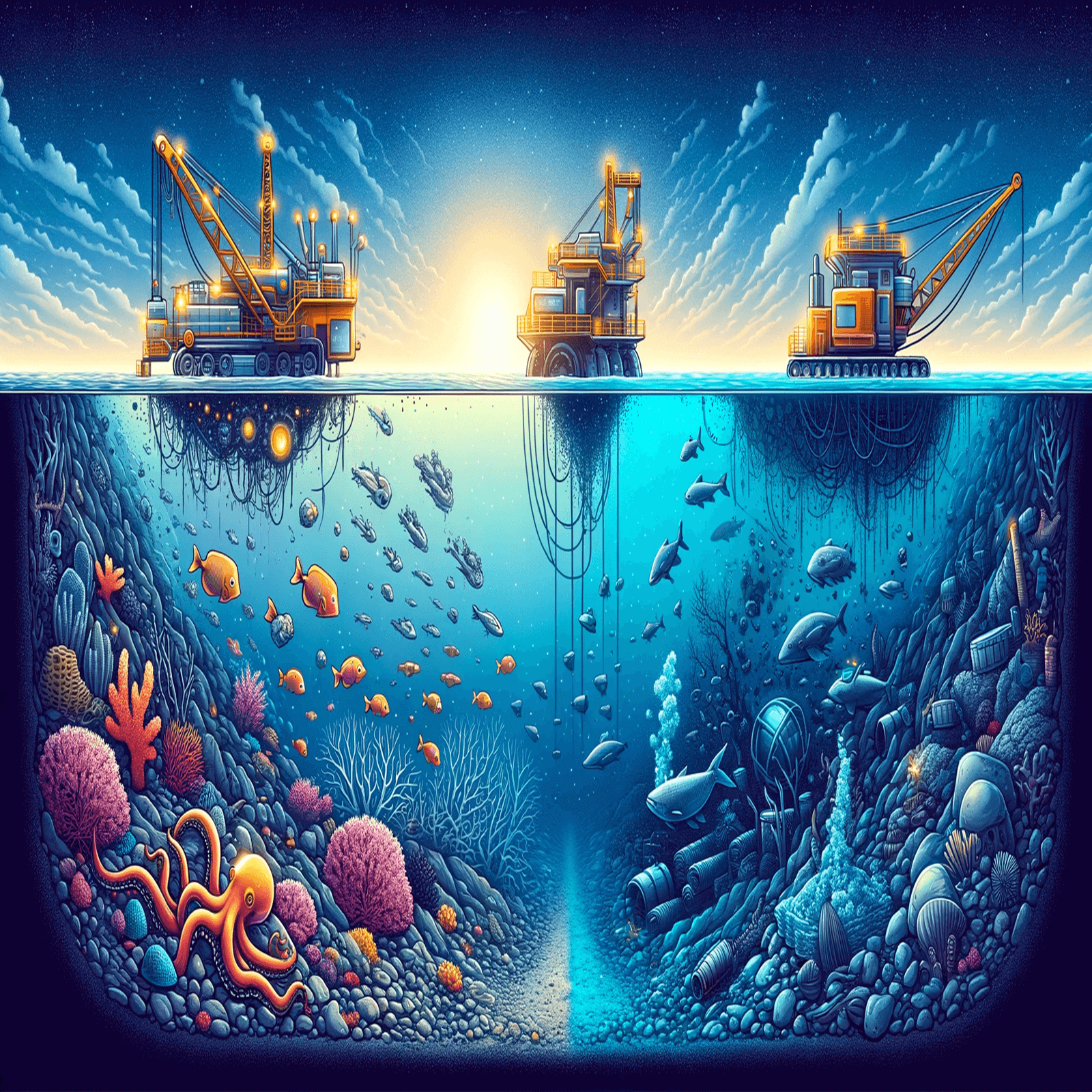

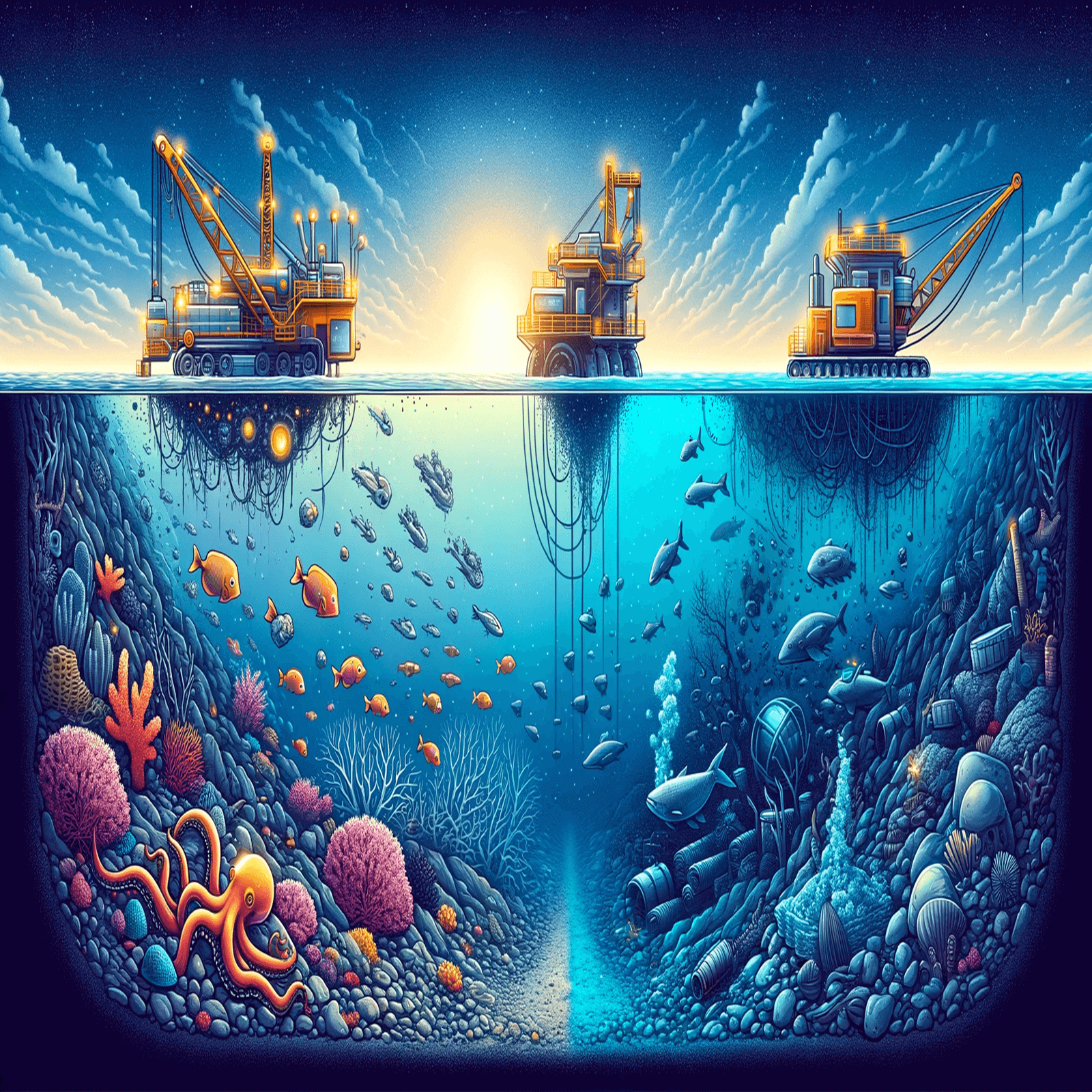

Deep-sea mining projects may become the norm…

Exploring abroad, Canadian ventures face unique risks in the unpredictable venture capital and mining landscapes…

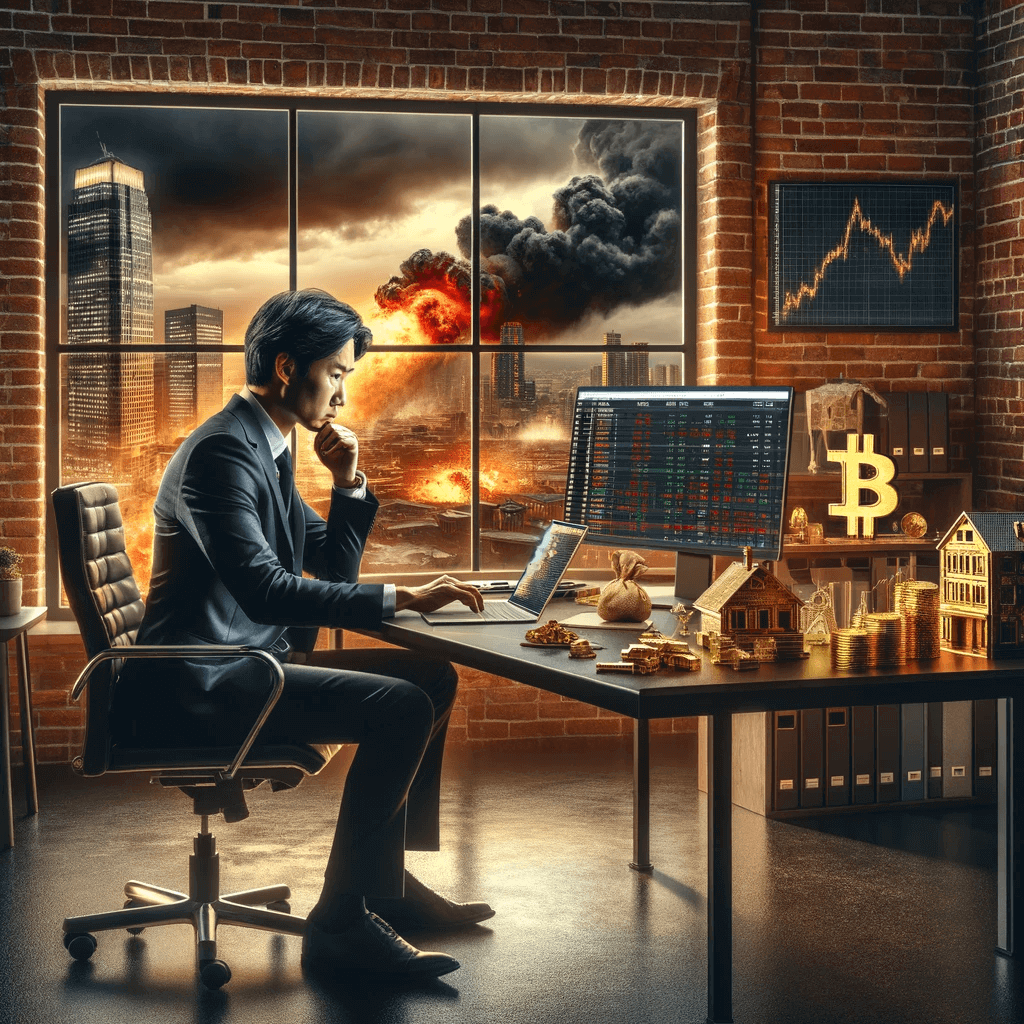

From Bitcoin to real estate and mining, everything will be impacted from this one thing in 2024…

AI’s rapid advancement in the next decade will revolutionize industries, enhance daily life, and pose new ethical challenges.

In the final podcast of 2023, Aaron and Alex share data on the evolving psyche of the North American venture capital investor.

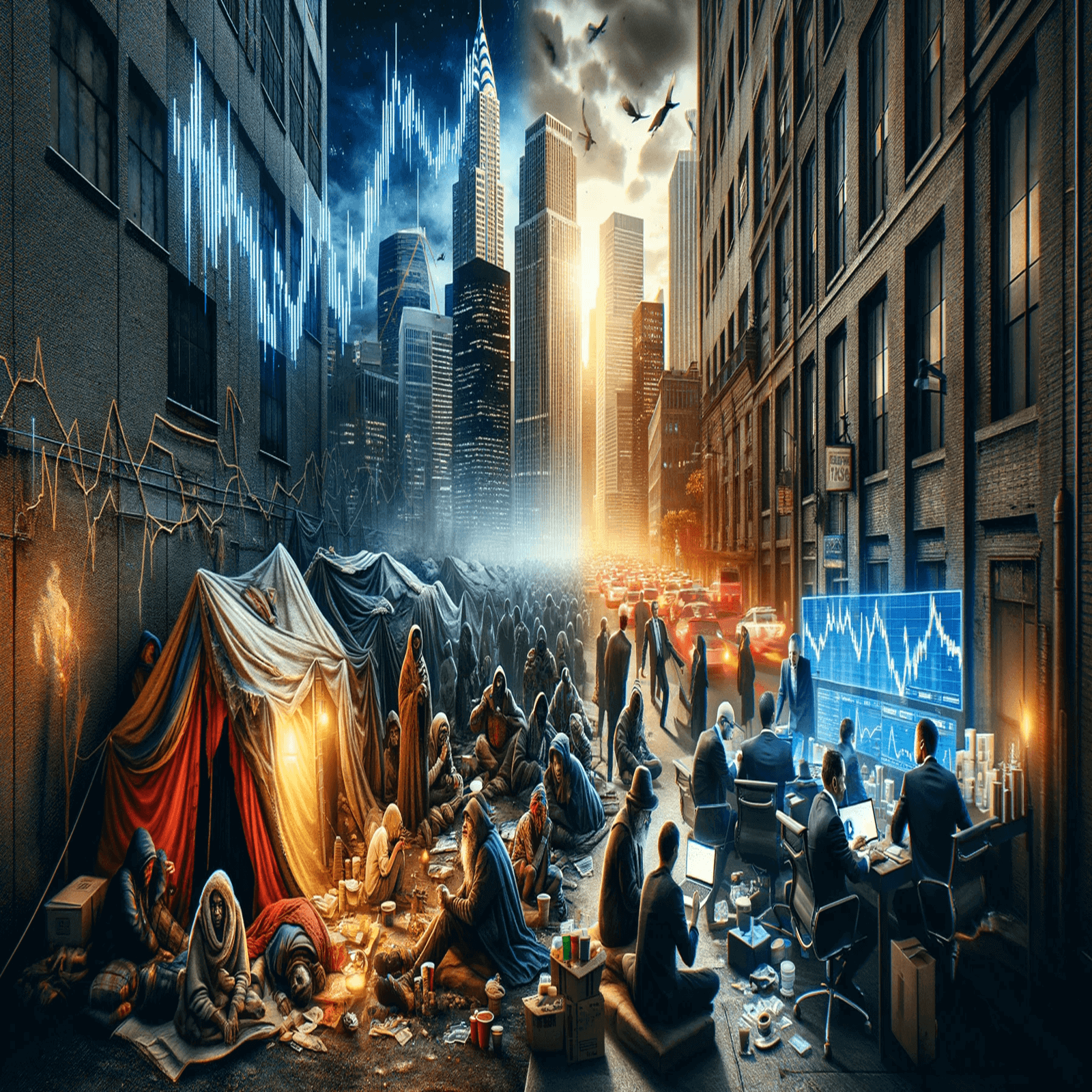

For the most part, it was a challenging year for Canadian investors as mining stocks lagged, and overall investment activity was well below the boom years of 2021 and early 2022. Soaring interest rates and record interest payment spending led many Canadians to tighten their belts and reduce speculative bets. But, with numerous rate cuts anticipated in 2024, the investment landscape will look very different this time next year.

Aaron and Alex discuss what startup CEOs should focus on and the positivity creeping back into venture markets, including the TSXV… A surge in private equity activity points to renewed optimism and potentially higher volumes across the small and micro-cap markets in 2024.

Instead of speculating and funding growth like in 2021 and early 2022, investors are looking for profitability ….

From coups in Africa to historic changes to housing policy in British Columbia, and tens of thousands of layoffs in the U.S. trucking industry, the world is rife with economic turmoil…

Commodities are central to politics and economic policy, which makes every story we covered last week important to catch up on.

What’s been called the most transformative housing legislation in Canada’s history could be a game-changer for British Columbia, but it’s not without concerns…

BC’s new housing legislation ends single-family zoning in towns with over 5,000 people, potentially paving the way for Canada’s first 15-minute cities…

Aaron questions whether or not this sweeping policy will actually bring down the cost per square foot in places like Vancouver.

Many workers in Canada can’t catch a break…

Some Canadians are actually paying their employer to work!

The crime of dining and dashing is rising across parts of Canada, and Ontario is ….

The crime of dining and dashing is rising across parts of Canada, and Ontario is ….

A.I. and energy policy are the driving forces behind big changes in our world right now…

Nuclear energy and uranium miners may be poised for a golden era if COP28’s ambitions come to pass.

Additionally, many investors fail to realize that A.I. may be behind a coming surge in demand for silver and precious metals.

According to Metals Focus, an independent precious metals research consultancy, increased demand for chips powering A.I. technology will drive “widespread support for a range of precious metals bearing components.”

In other words, demand for gold and silver could soar in 2024 and beyond due to the global rollout of all things A.I.

Silver demand hit a record 1.24 billion ounces in 2022 and will likely run hot over the next several years. And if A.I. isn’t the catalyst for a surge in silver demand, the green revolution should be…

Scientists at the University of New South Wales believe solar manufacturers will ….

S&P Global Market Intelligence reported in the middle of 2023 that the average time from discovery to production is now 15.7 years. ….

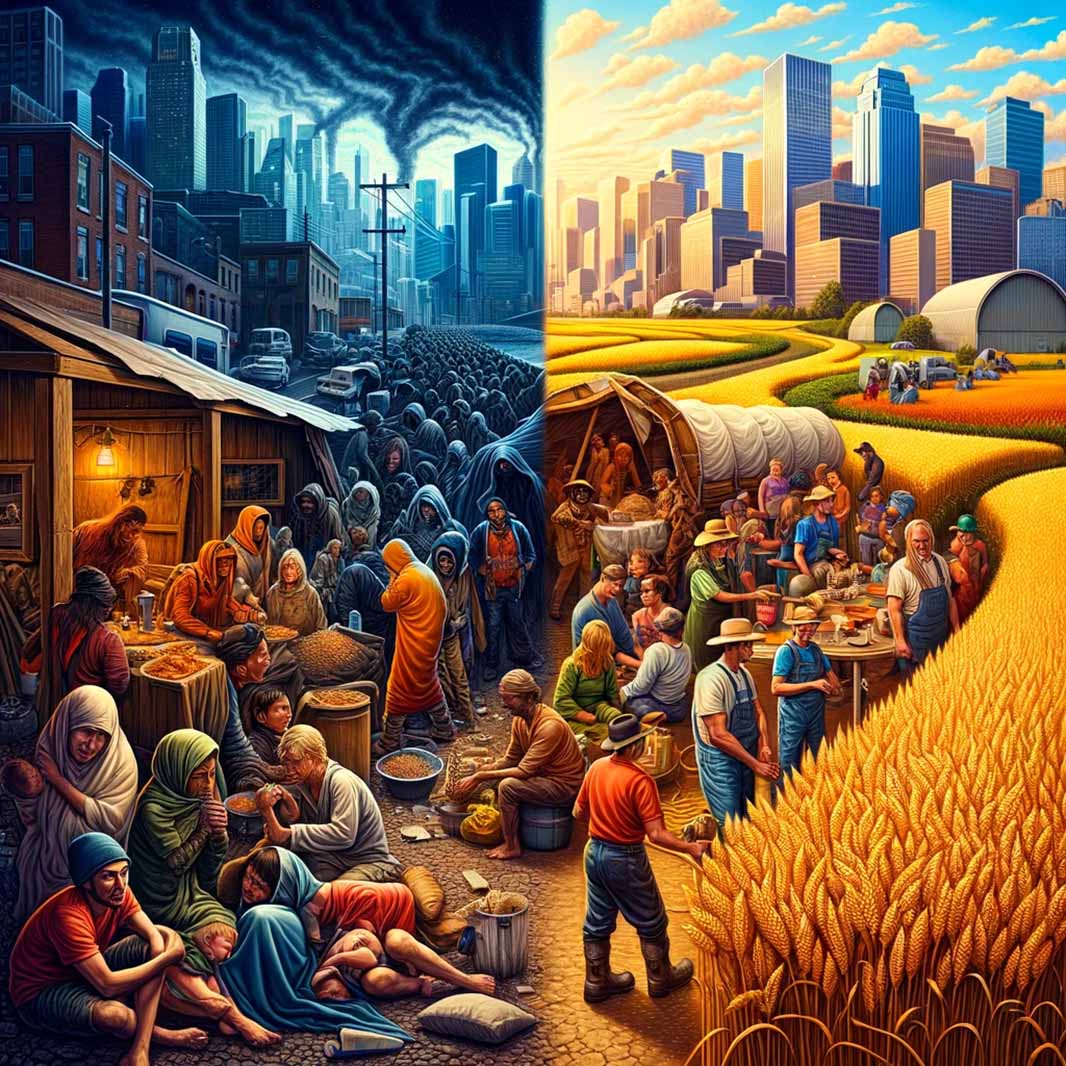

One of the greatest threats to Western civilization is the addiction and mental health epidemic. The World Health Organization noted that the COVID-19 pandemic triggered a 25% increase in the prevalence of anxiety and depression worldwide. And with homelessness soaring across the world, taxpayers are about to fork over more money as governments and municipalities try and tackle the crisis. Canada homelessness levels are causing grave concern for citizens and policymakers alike. Homeless encampments are popping up in cities and towns from coast to coast; in Canada, the rising cost of living, combined with the fallout from the pandemic, has left tens of thousands vulnerable. In early 2024, predictive AI software HelpSeeker forecasted Canada’s homeless population will nearly double in the next six years. Look no further than California as an example of the fallout that can transpire amidst rampant drug use on major city streets and rising homelessness. California is …. As homeless encampments spring up across communities nationwide, few are actually asking those without a permanent address what potential solutions could be… In this interview, Alex meets Daniel, originally from Quebec and came to B.C. in the late 1970s. Now in his 70s, Daniel fears being forced to move and explains that safety and freedom, not addiction or mental health, have driven ….

Now in his 70s, Daniel fears being forced to move and explains that safety and freedom, not addiction or mental health, have driven …. From startup stories to record gold purchases by central banks, something big is happening… If you’re not already a member of our newsletter and you invest in TSX Venture and CSE stocks, what are you waiting for? Subscribe today. Only our best content will land in your inbox. Deep-sea mining projects may become the norm… Exploring abroad, Canadian ventures face unique risks in the unpredictable venture capital and mining landscapes… From Bitcoin to real estate and mining, everything will be impacted from this one thing in 2024… AI’s rapid advancement in the next decade will revolutionize industries, enhance daily life, and pose new ethical challenges. In the final podcast of 2023, Aaron and Alex share data on the evolving psyche of the North American venture capital investor. For the most part, it was a challenging year for Canadian investors as mining stocks lagged, and overall investment activity was well below the boom years of 2021 and early 2022. Soaring interest rates and record interest payment spending led many Canadians to tighten their belts and reduce speculative bets. But, with numerous rate cuts anticipated in 2024, the investment landscape will look very different this time next year. Aaron and Alex discuss what startup CEOs should focus on and the positivity creeping back into venture markets, including the TSXV… A surge in private equity activity points to renewed optimism and potentially higher volumes across the small and micro-cap markets in 2024. Instead of speculating and funding growth like in 2021 and early 2022, investors are looking for profitability …. From coups in Africa to historic changes to housing policy in British Columbia, and tens of thousands of layoffs in the U.S. trucking industry, the world is rife with economic turmoil… Commodities are central to politics and economic policy, which makes every story we covered last week important to catch up on. What’s been called the most transformative housing legislation in Canada’s history could be a game-changer for British Columbia, but it’s not without concerns… BC’s new housing legislation ends single-family zoning in towns with over 5,000 people, potentially paving the way for Canada’s first 15-minute cities… Aaron questions whether or not this sweeping policy will actually bring down the cost per square foot in places like Vancouver. Many workers in Canada can’t catch a break… Some Canadians are actually paying their employer to work! The crime of dining and dashing is rising across parts of Canada, and Ontario is ….

The crime of dining and dashing is rising across parts of Canada, and Ontario is …. A.I. and energy policy are the driving forces behind big changes in our world right now… Nuclear energy and uranium miners may be poised for a golden era if COP28’s ambitions come to pass. Additionally, many investors fail to realize that A.I. may be behind a coming surge in demand for silver and precious metals. According to Metals Focus, an independent precious metals research consultancy, increased demand for chips powering A.I. technology will drive “widespread support for a range of precious metals bearing components.” In other words, demand for gold and silver could soar in 2024 and beyond due to the global rollout of all things A.I. Silver demand hit a record 1.24 billion ounces in 2022 and will likely run hot over the next several years. And if A.I. isn’t the catalyst for a surge in silver demand, the green revolution should be… Scientists at the University of New South Wales believe solar manufacturers will ….

Canada Homelessness to Double by 2030?

Homelessness, Recessions, and Soaring Stock Valuations

Do the Homeless Have the Solution?

Startup Risks and Central Bank Gold Purchases Reach Record

An Explorer’s Quest for Lithium in Quebec’s James Bay Region

Deep-Sea Mining, Grid Failure Warnings and the Humanization of AI

2024 Investing: Lessons from History and Current Global Threats

2024: The Year of Opportunity & Navigating Geopolitical Risk

AI Uncovered: How Machine Minds are Transforming Our World

Big Trends Shaping Venture Capital in 2024

Investors Target Tech

Canadian Real Estate and African Coups

Why Isn’t the Rule of Law Being Upheld?

A.I. and Nuclear Energy to Garner Capital in 2024