Wall Street’s Silent Bet: What a Record Surge in Debt Securities Reveals

Wall Street just made its boldest move since 2008. Broker/dealers have loaded up on debt securities and repos at a historic pace—signaling they’re bracing for a major market correction.

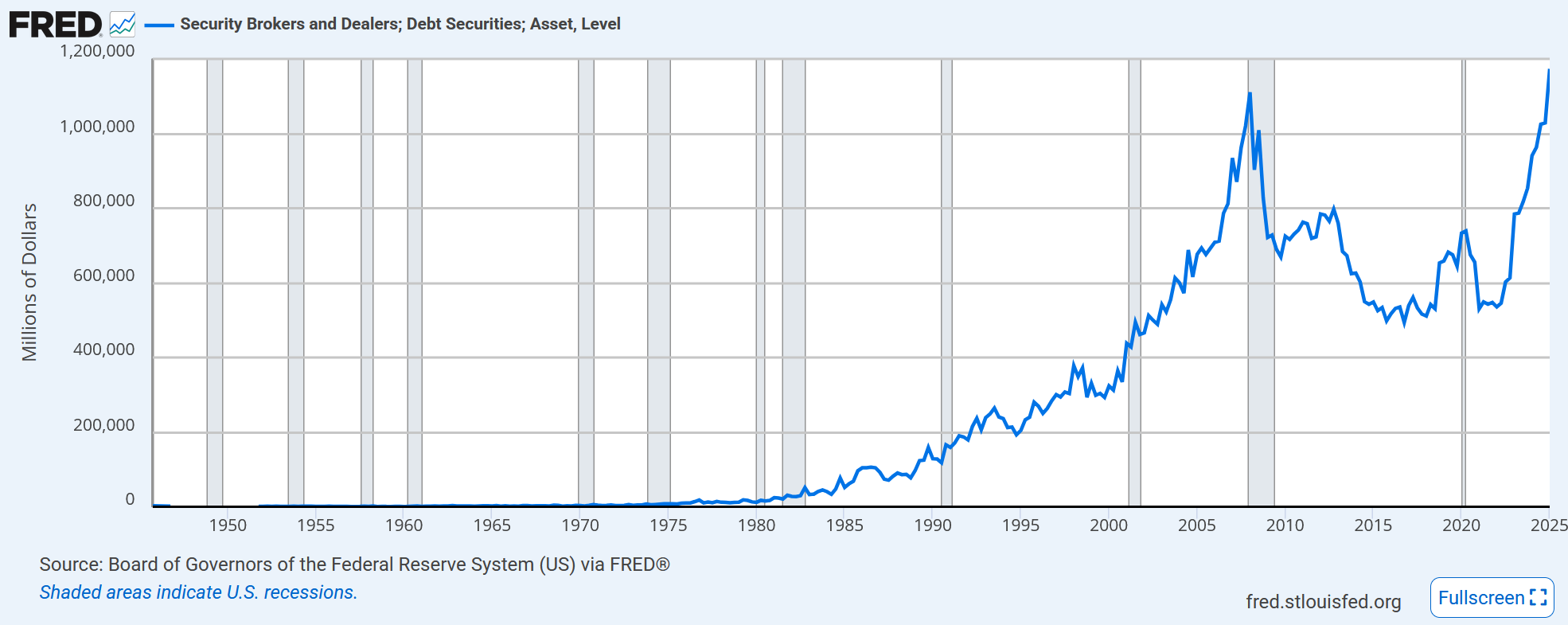

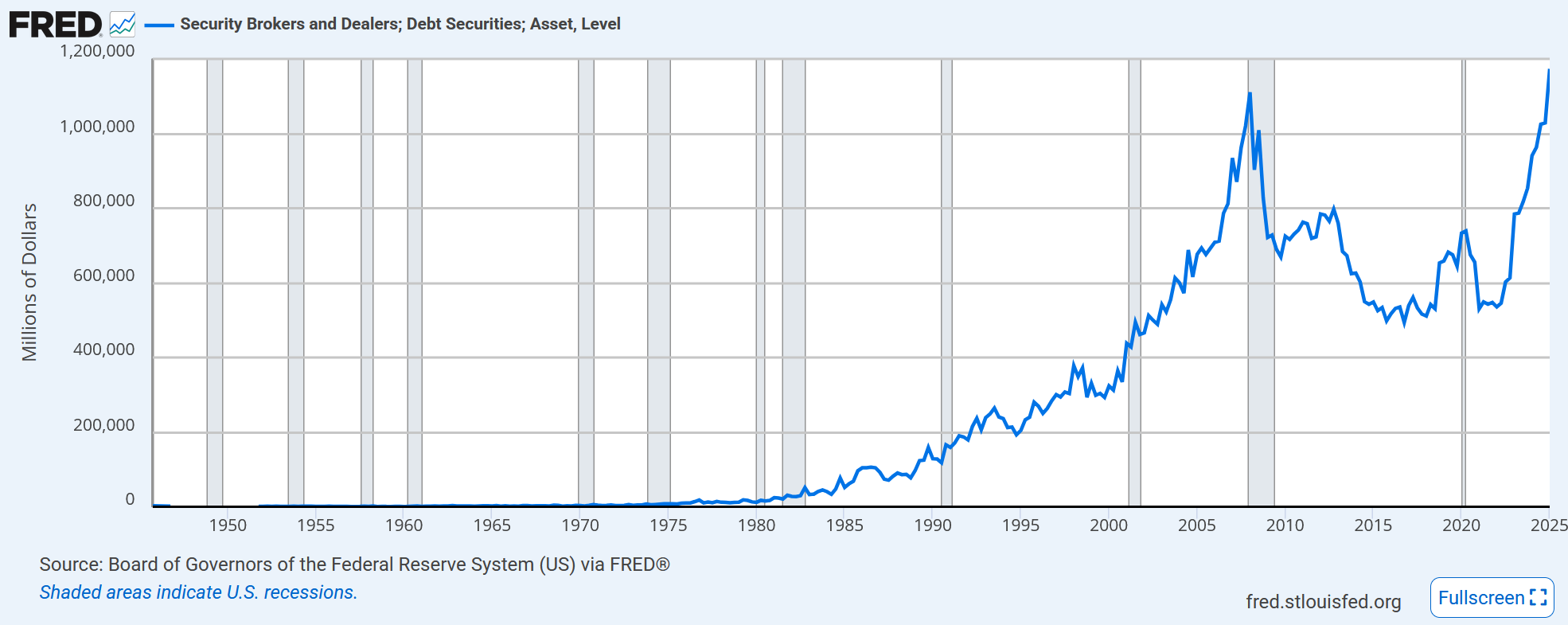

There’s a chart that should terrify even the most optimistic investor.

It’s buried in the depths of the St. Louis Fed’s data archive. Most won’t see it. Fewer will understand it. But those who do might recognize it for what it is: a warning.

The chart tracks broker/dealer holdings of debt securities - essentially the bonds, Treasuries, and agency debt that Wall Street firms are stuffing onto their balance sheets. This isn't a subtle trend. It's a vertical move, and the numbers behind it tell a story that every investor needs to hear.

📈 The Numbers Don’t Lie

Let’s start with the headline:

- Broker/dealer debt securities holdings surged $145 billion in Q1 2025 alone - a 56% annualized increase. That pushes total holdings to a record high, surpassing even the Q1 2008 peak of $1.111 trillion.

Let that sink in.

This is the largest quarterly jump since before the Global Financial Crisis. Over the past year, holdings rose $233 billion, or nearly 25%. But zoom out further and it gets even more dramatic:

- Debt securities are up $523 billion - an 82% increase - over the last 21 quarters.

And it’s not just any debt.

- Agency securities (think mortgage-backed securities and GSE paper) ballooned $105 billion in a single quarter - a 91% annualized increase.

- Over the past year, they exploded by $407 billion—up 255%, to a record $566 billion.

- Treasury holdings also surged: up $33 billion in Q1 and $97 billion year-over-year, reaching a new high of $488 billion. That’s a 114% jump in Treasury holdings over 21 quarters.

This isn’t just balance sheet expansion. It’s a structural shift.

🧨 But How Did Wall Street Finance This Bet?

Answer: The repo market.

- Repo liabilities surged $361 billion in Q1—up 61.8% annualized—to $2.697 trillion, the highest level since Q3 2008.

- Over just 10 quarters, repo liabilities inflated by $1.083 trillion, or 67%.

For context: in the run-up to the 2007–08 crisis, broker/dealer repo liabilities expanded $989 billion over 10 quarters to a cycle peak of $3.132 trillion.

We’re not just revisiting old highs - we’re nearing them at breakneck speed.

🕵️♂️ What’s the Bet?

Wall Street isn’t loading up on Treasuries and agency paper for fun. Nor are they doing it for yield - these securities are still near historically low returns when adjusted for inflation.

So what’s the motive?

Insurance.

This kind of buildup in high-grade, highly liquid debt—especially financed through repos—suggests one thing: Wall Street is hedging against something big.

They're betting on:

- Market volatility

- Tightening liquidity

- Asset re-pricing

- A potential correction—or worse

This isn’t speculation. It’s defensive positioning. It's as if the largest institutions on the planet are saying, “We see the storm forming. We want to be holding lifeboats, not equities.”

📉 Here is that Chart Again

The FRED chart here shows this visually:

Broker/dealer debt holdings have gone parabolic.

If you overlay it with historical events such as the 2000 tech bubble, 2008 GFC, you’ll notice something chilling: sharp spikes in this data tend to precede or coincide with major market dislocations.

This isn’t a guarantee. But it is a pattern.

🧩 What It All Means for Investors

Most retail investors are watching the S&P 500 hit new highs and assuming all is well. But under the surface, many institutions that move the market could be bracing for something very different.

- This isn’t a rush into risk - it’s a flight to safety.

- This isn’t growth-driven - it’s volatility-hedging.

- This isn’t bullish - it’s a quiet concern.

If you’re not looking at the plumbing of the financial system, you’re flying blind.

🔍 Final Take: Read the Signals, Not the Headlines

Wall Street isn’t tweeting about this. It’s not trending on X. But the data is there.

When broker/dealers flood their balance sheets with Treasuries and agency debt and finance it through the repo market at near-record levels, it’s not because they expect smooth sailing. It’s because they’re preparing for something. The next few weeks, months and quarters could prove very interesting. Furthermore, we could see that the rise in debt securities go even higher. Stay tuned...

Latest Insights

Recent Highlights from Our YouTube Channel

Comprehensive reviews of current market dynamics and the latest trends influencing the future of investments.