PinnacleDigest

How to Think Like a Venture Capitalist in Small-Cap Markets

Small-cap markets reward investors who understand the difference between progress and proof. Aaron Hoddinott examines how venture capital thinking applies to sub-billion dollar companies across sectors like AI and mining, where announcements are often mistaken for outcomes.

Mexico’s Silver War: Cartels, Politics, and the Rising Risk to Global Supply

For centuries, silver has shaped Mexico’s fortunes and fueled conflict across its mining regions. As cartel violence intensifies in key production states, investors are being reminded that extracting precious metals in Mexico has never been purely about geology. The country’s long and dangerous history with silver may once again collide with global supply.

I Invited a Priest on My Show to Argue Against Gold. Here’s What Happened.

What happens when a gold-biased investor invites a priest and hedge fund CIO to challenge the metals trade head-on? A conversation about fear, conviction, value investing, and why even the strongest theses deserve pressure testing.

The Metal Nobody Talks About | Gallium

Gallium rarely makes headlines, yet it plays a critical role in the systems that power modern life, from AI data centers and satellite communications to advanced radar and high-efficiency power electronics. Supply is heavily concentrated, production is tied to complex industrial processes, and recent export controls have exposed just how fragile the chain can be. Understanding gallium means understanding a quiet pressure point in the global economy.

The Great Repricing: Control, Debt, Productivity & Why Asset Owners Win the Next Era

We are not entering a normal market cycle. We are entering a repricing driven by debt saturation, slowing demographics, and a surge in AI-led productivity. In this macro shift, currency dilution, policy pressure, and supply constraints are changing how capital behaves.

85,000+ INVESTORS FOLLOW OR SUBSCRIBE TO US

Michael Oliver’s Silver Blueprint

Michael Oliver’s core message is that silver isn’t acting like a normal bull market. It’s attempting to create a “new reality”, repricing after decades trapped under a long-term ceiling. The correction he warned about may have been the classic midpoint fakeout seen in past silver surges, and if the rebound holds, the next phase could be where both silver and silver miners surprise investors to the upside.

The Crash That Visits Every Bull Market

Gold and silver have just suffered one of their sharpest corrections in decades, and history suggests this may be far more typical than investors realize. By comparing today’s drawdown to the great precious metals bull markets of the 1970s and the 2000s, this article separates emotional panic from historical patterns. The result is a clearer framework for understanding whether this crash marks an end… or a reset.

Silver Is Getting Too Small to Contain the World’s Demand

Silver isn’t just rising in price; it’s colliding with the limits of its own market structure. With silver trading above $100, a small, fragile market is being asked to absorb massive industrial demand, investor fear, and a breakdown in the hedging systems that normally keep things stable. This article explains why silver’s size, not speculation, is the real reason it’s becoming dangerous, and explosive.

Copper’s Breaking Point: Why America’s Next Copper Mines Won’t Arrive in Time

Copper isn’t entering a normal late-stage bull market; it’s entering a mechanical breakdown, where the system that balances supply and demand is failing. When 2026 benchmark treatment and refining charges are set at $0, it signals something darker than “tight inventories”: concentrate scarcity, smelter dysfunction, and a supply chain that can’t respond to price. In this piece, we break down why copper deficits are turning structural, and why America’s list of “real” copper mines coming online is shockingly short.

The Oil Mirage: Why Venezuela Won’t Flood the Market

Venezuela’s oil revival is widely misunderstood. This article explains why political change won’t quickly unleash cheap crude, and why Canada’s heavy oil assets remain strategically vital in a fragmented global energy market.

A Year-End Market Outlook: From Abundance to Scarcity

A sober look at the structural forces reshaping markets, from scarcity and geopolitics to capital discipline, and why patience and judgment will define the next chapter.

Silver’s Third Act: Is This Bull Market Only Halfway Up the Mountain?

Silver is in the middle of its “third act” bull market, echoing the explosive runs of the 1970s and 2000s but with a new twist: structural supply deficits and soaring industrial demand from solar, EVs and the digital power grid. Combined with record sovereign debt, negative real yields, and growing distrust in fiat, the current silver bull market may be far from finished, even if volatility remains brutal.

The Next Decade in Markets Will Be Decided by a Barrel of Oil

Markets may be entering a decade defined by energy, not technology. This article breaks down how oil, geopolitics, and a shifting monetary order are creating a new landscape for investors, with insight from strategist Simon Hunt.

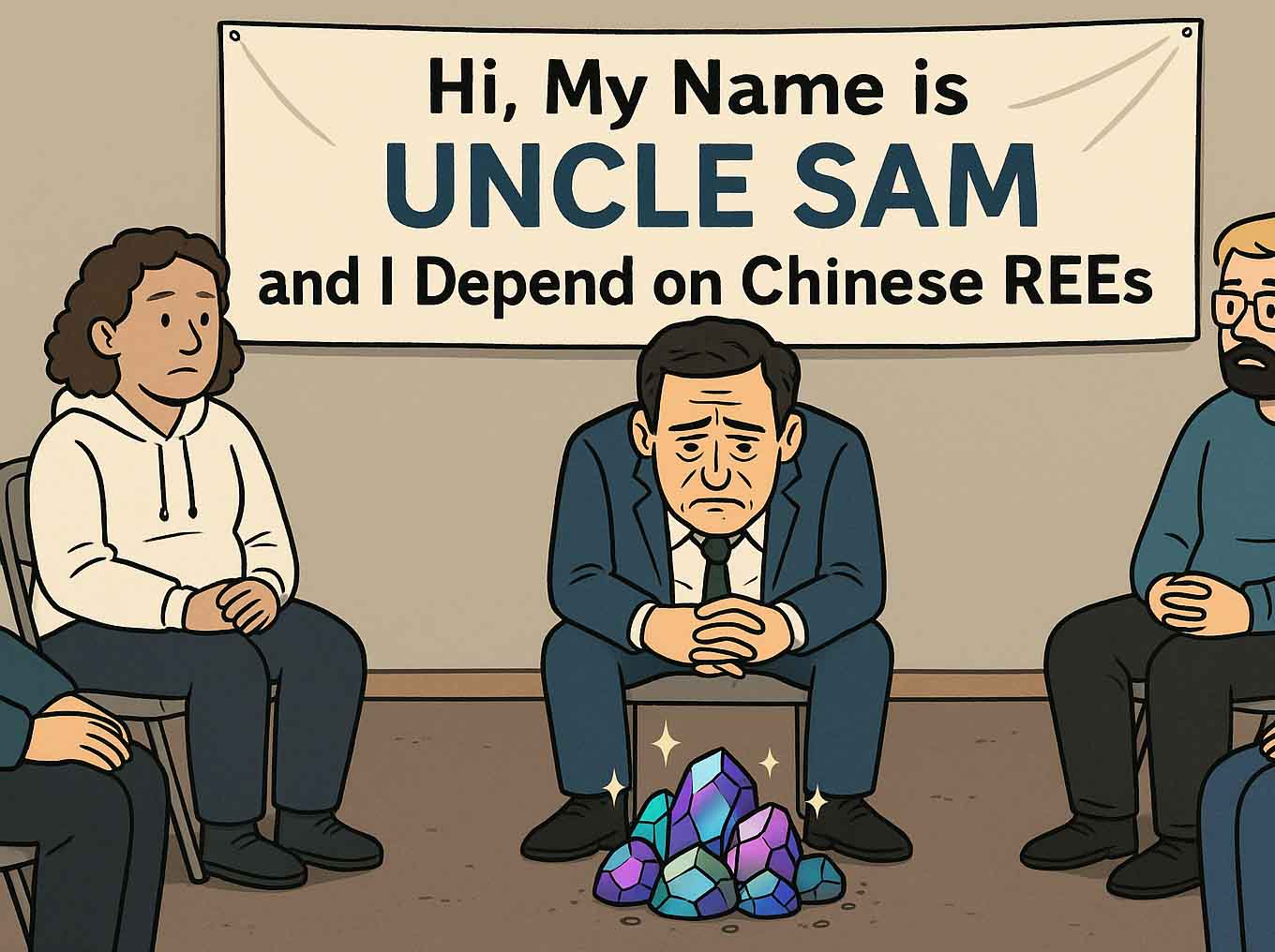

Going Cold Turkey: Why North America Needs Its Own Rare Earth Supply

China still dominates the rare earths that power EVs, wind turbines, smartphones and modern weapons, leaving North America dangerously exposed. This article breaks down how dependent the U.S. and Canada are on Chinese REEs today, what Washington and Ottawa are actually doing about it, and where the biggest opportunities lie for investors as a new mine-to-magnet supply chain is built on our own turf.

The Japanese Bond Time Bomb: How a JGB Shock Could Hit North American Stocks

Japan, the original architect of zero rates and QE, is suddenly being forced to live in a world of real interest costs, and its ¥1,300+ trillion debt pile is creaking as the 10-year JGB approaches 2%. This post explores how a spike in Japanese bond yields could morph from a “local” issue into a global shock, triggering carry-trade unwinds, repatriation flows, and a painful repricing of North American equities.

Budget 2025: Canada Bets Big on Mining, Productivity, and National Strength

Budget 2025 marks Canada’s boldest resource strategy in decades. With billions in new funding for critical minerals, infrastructure, and productivity, Ottawa is betting on mining and industrial investment to drive long-term growth. Expanded tax credits, a sovereign fund for critical minerals, and the removal of key regulatory barriers signal a decisive pivot toward real assets, national competitiveness, and economic resilience.

The Longest Shutdown Meets All Time Highs: What History Says, What Is Different Now

Global markets have surged to record highs even as Washington endures the longest shutdown in U.S. history. Past standoffs caused little market damage, but this one comes amid record debt and trillion-dollar deficits. Gold is suggesting investors are quietly hedging against the illusion of stability.

85,000+ INVESTORS FOLLOW OR SUBSCRIBE TO US

Be part of our investor community spanning YouTube, our weekly newsletter, and social media. Get sharp insight on capital flows, commodity cycles, and macro trends shaping tomorrow’s markets.