Pinnacle Digest

At Pinnacle Digest, we take a generalist yet forward-looking approach. Our aim is to identify and explore stories in early stages, ahead of widespread attention from 'The Street.'

Pinnacle Digest (“PD” or “PinnacleDigest.com”) was established as an online financial newsletter for speculators and micro-cap investors over a decade ago. With the goal of bringing its readers and viewers industry leading coverage on the Canadian venture capital market, PD has built relationships with some of North America’s leaders in the space… from innovative CEOs to award winning geologists, tech entrepreneurs, venture capitalists and money managers, PD has leveraged its relationships with the aim to enhance both its coverage on sponsor companies and overall content creation approach.

Pinnacle Digest

The Panic Premium | M&A Activity About to Surge

The last gold bull market didn’t climax with price alone; it ended in billion-dollar buyouts and 30 to 60 percent premiums. From 2001 to 2011, gold surged from under $300 to over $1,500 before major players truly began scrambling for ounces. Today, with gold pressing historic highs again, investors are asking a familiar question: when does the panic premium return?

The Metal Nobody Talks About | Gallium

Gallium rarely makes headlines, yet it plays a critical role in the systems that power modern life, from AI data centers and satellite communications to advanced radar and high-efficiency power electronics. Supply is heavily concentrated, production is tied to complex industrial processes, and recent export controls have exposed just how fragile the chain can be. Understanding gallium means understanding a quiet pressure point in the global economy.

The Crash That Visits Every Bull Market

Gold and silver have just suffered one of their sharpest corrections in decades, and history suggests this may be far more typical than investors realize. By comparing today’s drawdown to the great precious metals bull markets of the 1970s and the 2000s, this article separates emotional panic from historical patterns. The result is a clearer framework for understanding whether this crash marks an end… or a reset.

Copper’s Breaking Point: Why America’s Next Copper Mines Won’t Arrive in Time

Copper isn’t entering a normal late-stage bull market; it’s entering a mechanical breakdown, where the system that balances supply and demand is failing. When 2026 benchmark treatment and refining charges are set at $0, it signals something darker than “tight inventories”: concentrate scarcity, smelter dysfunction, and a supply chain that can’t respond to price. In this piece, we break down why copper deficits are turning structural, and why America’s list of “real” copper mines coming online is shockingly short.

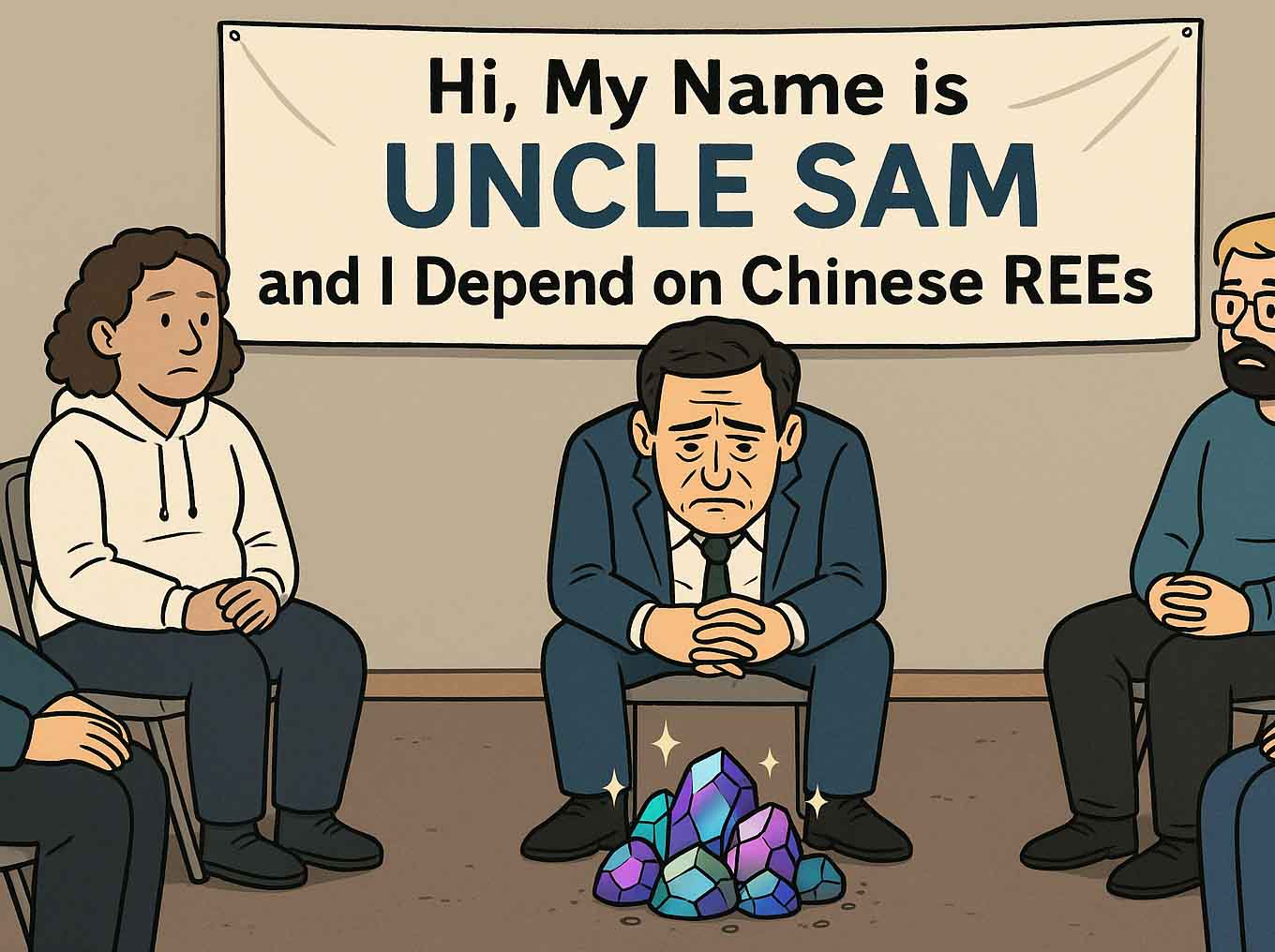

Going Cold Turkey: Why North America Needs Its Own Rare Earth Supply

China still dominates the rare earths that power EVs, wind turbines, smartphones and modern weapons, leaving North America dangerously exposed. This article breaks down how dependent the U.S. and Canada are on Chinese REEs today, what Washington and Ottawa are actually doing about it, and where the biggest opportunities lie for investors as a new mine-to-magnet supply chain is built on our own turf.

The Longest Shutdown Meets All Time Highs: What History Says, What Is Different Now

Global markets have surged to record highs even as Washington endures the longest shutdown in U.S. history. Past standoffs caused little market damage, but this one comes amid record debt and trillion-dollar deficits. Gold is suggesting investors are quietly hedging against the illusion of stability.

The Same Fire, a Different Fuel: Gold 1979–1980 vs. Gold 2024–2025

Gold’s explosive rise in 1979–1980 was fueled by panic and inflation. Today’s surge is different - driven by record central-bank buying, massive debt, and the global shift away from the dollar. As the Fed faces limits that Volcker never did, this bull market may just be getting started.

Chasing the Unprintable: Why Cardboard Beats Currencies

This article explores the rise of sports card collecting - from multimillion-dollar Mantles and Wagners to the steady climb of 1990s Jordan commemoratives - set against the backdrop of a declining U.S. dollar. While fiat currencies are endlessly reproduced, scarce assets from cards to classic cars and gold prove their power to preserve wealth. In a world of infinite printing, only the finite survives.

Lessons from Post-War Financial Repression — And How to Ride Through It

This article explores the lessons of post-WWII financial repression, the winners and losers it created, and how investors today can prepare for a decade of negative real rates, shifting capital flows, and the rise of real assets.

The West Rises: How North America and Australia Sparked the Silver Revival

Fueled by innovative miners, strategic acquisitions, and booming industrial demand, Western silver output soared last year, led by Canada’s 33% jump. Meanwhile, Chile’s 17% drop exposed the vulnerabilities of a sector under pressure from climate challenges and costly project delays.

Lithium Isn’t Dead - it’s More Alive Than Ever

With CATL’s mine closure tightening global supply, lithium’s long-term demand story is back in focus. North America’s rising production could shape the industry’s next boom cycle.

Titanium: The Strategic Metal That Powers Empires

With production concentrated in a handful of countries and demand rising from aerospace to EVs, titanium’s role as a critical mineral has never been more vital. For investors, the story is clear: titanium isn’t just an industrial metal, it’s a pillar of future security and innovation.

Nvidia’s $4 Trillion Moment: A Masterclass in Wealth Creation

By dominating the AI hardware market and evolving into a full-stack platform, Nvidia has created over a million percent returns for long-term investors. Its journey offers key lessons for small-cap speculators and raises important questions about what’s next for the world’s most valuable company.

The GENIUS Act: How a Quiet Law Could Spark a Financial Revolution

By legalizing tokenized securities, integrating stablecoins into the banking system, and introducing tax-deferred crypto accounts, the GENIUS Act lays the foundation for a modernized financial ecosystem, one that could transform how capital flows, how assets are held, and how investors build wealth.

Global Battle Ignites for Cobalt and Sound Money

From cobalt’s chokehold on the EV supply chain to the unstoppable rise of structural inflation, this article unpacks the hidden forces reshaping global markets—and why investors are turning to gold, Bitcoin, and hard assets for protection.

Silver’s Second Shot: Will the Ancient Metal Finally Break Its 1980 $50 High?

Silver is surging toward $38 an ounce, but still hasn’t broken its 1980 high of $50. From ancient currency to clean energy metal, we explore silver’s historic role, industrial comeback, and what may lie ahead.

The Calm Before the Gold Storm: Why the Juniors Haven’t Run—Yet

Junior gold stocks have underperformed despite rising gold prices and strong free cash flows from majors. In this interview, macro strategist Nomi Prins explains why that could change in the second half of 2025.

The Last Domino: Why the Gold Juniors Could Explode as Debt and Rates Collide

As the U.S. fiscal machine creaks under the weight of $37 trillion in debt, the Fed is inching toward its next pivot—and gold is responding. This post explores why macro strategist Nomi Prins believes junior gold miners could be the breakout trade of the next cycle.

The AI Paradox: Why Jim Bianco Says Automation Could Spark Inflation, Not Kill It

Jim Bianco believes AI won’t just eliminate jobs - it will birth entire industries and new inflationary demand. This post unpacks his contrarian take on self-driving cars, decentralized AI, and what investors must understand about the next phase of innovation.

Trapped by Debt: Diego Parrilla on Structural Inflation and the Next Financial Shock

In this gripping conversation, macro strategist Diego Parrilla reveals why structural inflation, yield curve control, and relentless money printing have trapped global markets in a stagflationary spiral. With bonds no longer offering protection and central banks addicted to intervention, investors are being forced into risk - whether they realize it or not.

The AI Jobs Revolution: What Jim Bianco Says Everyone's Getting Wrong

Jim Bianco breaks down why the AI revolution isn’t just about job losses, but about unlocking new productivity and unleashing a wave of decentralized innovation. From the future of self-driving cars to inflation’s role in AI’s economic impact, this episode dives deep into the trends investors and technologists need to watch now.

The Great Repricing: Why the Market Still Doesn’t Get the Fed’s New Playbook

Macro strategist Jim Bianco warns that the era of easy money is over, and most investors haven’t caught on. In this timely episode, he explains why inflation may remain elevated, why bond yields could surge, and why the Fed pivot fantasy is setting portfolios up for a brutal reckoning.

Was Bitcoin a Trap? Mark Yusko’s Chilling Theory on the Digital Dollar Endgame

Was Bitcoin really created by a mysterious genius… or by a shadowy intelligence agency? In this gripping deep-dive, Mark Yusko unpacks a theory that challenges everything we think we know about the world’s most valuable digital asset—and why it may already be too powerful to stop.

Canadian Clean Tech Startups Leading the Global Energy Transition

This article highlights leading Canadian clean tech startups and their groundbreaking innovations in areas like carbon solutions, energy storage, and sustainable materials. It examines the supportive ecosystem and challenges, showcasing Canada's vital role and future potential in the global energy transition.

Loud Budgeting Canada: Financial Transparency Trend 2025

Canada is on the cusp of a significant financial transparency evolution in 2025, driven by both the personal 'Loud Budgeting' trend and major regulatory reforms. This article explores these converging forces, their implications for individuals and businesses, and the future of financial openness in the nation.

Strategic Guide: Leading Copper Exploration Companies

This guide offers a strategic analysis of leading copper exploration companies, examining their diverse approaches, technological innovations, and market positioning. Discover key players, project developments, and the financial drivers shaping the future of copper supply.

Smart Mortgage Strategies: Canadian Homeowners & 2025 Rate Cuts

This article provides Canadian homeowners with actionable strategies to navigate the 2025 interest rate cuts. Understand how these changes impact your mortgage, whether fixed or variable, and make informed decisions for renewals, new purchases, or refinancing in an evolving economic climate.

Institutional Bitcoin Investment: 2025 Sentiment, Trends, and Market Impact

Delve into the 2025 institutional Bitcoin landscape, examining dominant buying behaviors, the transformative role of Spot ETFs, and growing sovereign interest. This analysis uncovers the deep-seated conviction driving institutional adoption and its profound market implications.

Quantum Computing 2025: Milestones, Hype & Investment Realities

This article dissects the 2025 quantum computing landscape, analyzing key technological milestones, investment trends, and the crucial gap between ambitious roadmaps and commercial reality. It offers insights for businesses and investors navigating this transformative technology's evolution.

WFH Hangover: Commercial Real Estate's Silent Collapse

The shift to remote work has triggered a 'silent collapse' in commercial real estate, particularly office spaces, with high vacancies and looming debt maturities. This article analyzes the downturn, contrasts it with resilient sectors, and explores adaptive strategies for investors navigating this new reality.

2025 Food Security Shocks: Investment Opportunities and Risks

This article analyzes the severe food security challenges expected in 2025, driven by climate change, geopolitical tensions, and reduced aid. It identifies key investment opportunities in AgroTech and sustainable food systems, offering actionable insights for navigating risks and fostering resilience.

Institutional Crypto Adoption & Regulation: Q2 2025 Trends Analysis

This article examines the key institutional crypto adoption and regulatory trends anticipated in Q2 2025. It covers Bitcoin ETF performance, evolving allocation strategies, M&A activity, US and global regulatory shifts, and the rise of altcoin ETFs and institutional DeFi, providing a forward-looking analysis.

Navigating G-Zero Investment Minefields in 2025

This analysis dissects the G-Zero world's impact on 2025 investments, offering strategies for managing volatility and capitalizing on opportunities like nuclear energy and specific M&A plays. It's an essential playbook for sophisticated investors aiming to protect capital and achieve growth amidst geopolitical shifts.

Uranium Price Analysis: $70 Milestone and $100 Potential

Unpack the dynamics of uranium's journey past $70/lb and its trajectory towards a potential $100/lb. Delve into how supply constraints, resurgent nuclear demand, geopolitical factors, and new technological needs are converging to reshape the uranium market and its investment outlook.

SEC Approves Spot Ether ETF Options: A New Era for Crypto Investing

Explore the SEC's groundbreaking decision to permit spot Ether ETF options trading from April 2025. This article dissects the implications for institutional investors, market dynamics, and the evolving regulatory environment surrounding digital assets.

METC Extension: Navigating Opportunities and Hurdles for Canada's Junior Miners

Canada's proposed two-year Mineral Exploration Tax Credit extension offers immediate support to junior miners, yet faces calls for longer-term certainty amidst legislative uncertainties. This article analyzes the extension's implications, industry advocacy, and the strategic path forward for Canadian mineral exploration.

The AI Energy Imperative: Navigating the 2030 Grid Crisis and Forging Sustainable Solutions

AI's exponential growth is projected to double data center energy demand by 2030, straining global grids and necessitating urgent, innovative solutions. This article explores the scale of this challenge and pathways towards a sustainable, AI-powered future.

Global Debt Hits $324 Trillion: Is the 'Everything Bubble' About to Burst in 2025?

Global debt reached a staggering $324 trillion in Q1 2025, fueling concerns about an 'Everything Bubble' collapse. This article dissects the drivers, from emerging market debt to expert warnings, and explores potential impacts on markets and stability.

Critical Minerals Cold War: Lithium & Rare Earths Competition

This article dissects the escalating 'Critical Minerals Cold War,' detailing China's dominance in supply chains for lithium and rare earths, and Western efforts to counter this through diversification and strategic initiatives. It explores key geopolitical battlegrounds and the implications of resource weaponization for global security and the energy transition.

Coinbase S&P 500 Listing: Crypto's Impact on Wall Street

Coinbase's entry into the S&P 500 in May 2025 marks a pivotal moment, legitimizing cryptocurrency within mainstream finance and potentially reshaping investment landscapes. This article dissects the implications for Coinbase, the broader crypto market, and Wall Street's evolving stance on digital assets.

Oil Shock 2025: Underinvestment, Conflict, and Price Spike Analysis

This article provides a comprehensive analysis of the multifaceted risks pointing towards a potential oil shock in 2025. It examines how persistent underinvestment, escalating geopolitical conflicts, and shifting market fundamentals could converge, leading to significant price volatility. Readers will gain a nuanced understanding of the probability, triggers, and potential magnitude of such an event.

Consumer Confidence Collapse: Main Street Gloom and Decade Lows

US consumer confidence has nosedived to multi-year lows, driven by soaring inflation, tariff anxieties, and bleak income prospects. This analysis dissects the data behind this 'Main Street Gloom,' its primary causes, and the heightened risk of an economic downturn.

The $35 Trillion Debt Time Bomb: Analyzing Imminent Explosion Risks

This analysis dissects the escalating U.S. national debt crisis, exploring its core drivers, the crushing weight of servicing costs, and the potential for a debt spiral. Understand the imminent risks to economic stability and the urgent need for fiscal course correction.

Unicorn Mega-Deals: Economic Impact and Future Trends

Manitoba's Secret Weapon: How Sio Silica Could Fuel Tech and Defense

Sio Silica is unlocking one of the purest silica quartz deposits in North America—critical for advanced semiconductors, defense systems, and AI infrastructure. With a low-impact extraction model and strategic ties to national security, this Manitoba-based project could anchor North America’s next wave of technological and military innovation.

Coinbase Joins the S&P 500: From Crypto Startup to Wall Street Powerhouse

Coinbase just became the first pure-play crypto company to join the S&P 500—marking a historic shift in the relationship between digital assets and Wall Street. This is no longer a fringe movement. It's institutional. Here's how Coinbase got here—and what it means for the future of finance.

Why Central Banks Are Buying Gold Like Never Before

Central banks are stockpiling gold at a pace not seen in over 50 years. In this gripping conversation with legendary speculator Lobo Tiggre, we explore why gold is no longer just a hedge—it’s the cornerstone of a new global financial order.

How a War Between India and Pakistan Could Shock Global Markets

Tensions between nuclear-armed India and Pakistan have reached a boiling point following cross-border airstrikes and the closure of Pakistani airspace. While the conflict may seem localized, the market risks are global—impacting oil prices, gold, equities, and investor sentiment. Here's what North American investors need to know.

The Fatal Addiction: How America’s Debt Binge Could Kill the Dollar—and Resurrect Gold

Michael Pento, President of Pento Portfolio Strategies, breaks down why America’s debt-fueled economy is nearing a tipping point. In this post, we unpack his most urgent predictions—from soaring interest payments to gold’s resurgence and the crumbling 60/40 portfolio. If you care about protecting your capital in an era of systemic risk, this is your wake-up call.

David Hunter’s Dire Warning: A Final Melt-Up Before the Global Deflationary Superstorm

David Hunter believes we are entering the final melt-up in global markets—a euphoric rally that will blindside most investors before a catastrophic deflationary bust unfolds. In this blog, we break down Hunter’s bold forecast and explain why liquidity, central banks, and human nature could trigger the greatest collapse of our lifetime.

The Fertility Crisis: Too Few People Will Break the System

While the world frets over inflation, war, and resource scarcity, a quieter crisis is already rewriting the rules of global economics. It’s not too many people — it’s too few. Welcome to the fertility crisis.

Bitcoin Adoption: A New Monetary Order in the Making

From obscure beginnings to a serious financial movement, Bitcoin adoption is reshaping how the world thinks about money, trust, and the future of finance.

Canada’s Economic Future in the Balance: Spencer Fernando on the 2025 Election

Political commentator Spencer Fernando joins Pinnacle Digest to discuss how Canada’s 2025 federal election could reshape its economic future. From stalled pipelines to tax competitiveness and brain drain, this conversation highlights the critical decisions facing the nation at a moment of profound transition.

Crypto vs Banks: Can Bitcoin’s New Titans Challenge Fiat's Old Guard?

Binance and Coinbase may lead in crypto, but they’re still dwarfed by the size and scope of traditional banks. Yet Bitcoin’s growing integration into corporate and sovereign finance is changing the narrative fast. This blog explores the shifting balance of power between crypto-native firms and Wall Street’s legacy titans.

The AI Bubble Deflates: NASDAQ Down to 29 P/E Ratio

As NASDAQ valuations remain elevated on AI promises, global central banks quietly amass record holdings in American tech, while echoes of past bubbles linger ominously.

Grant Williams on Gold, War & What Comes Next

When U.S. Treasury sanctions froze Russia’s reserves, something snapped in global finance. Grant Williams explains why gold is rising, trust is collapsing, and the buy-the-dip era may be over.

Franco-Nevada: The Greatest Royalty Company in History?

Franco-Nevada rewrote the rules of mining by never swinging a pickaxe. This is the story of how a quiet royalty company became one of the greatest wealth-building machines in resource history.

When The Lights Go Out For Canada

Canada’s energy sector is under fire at home—just as global demand surges. Discover why overregulation is jeopardizing our energy future and security.

The Quiet Shift: Why Markets Feel Different This Time

Facing a structural market shift towards scarcity and uncertainty, investors must abandon old habits and focus on long-term discipline and understanding fundamental changes.

The Shopify Illusion: 6 Investing Lessons from Canada’s Fallen Giant

Shopify's rise was legendary—its fall, a masterclass in risk. Discover 6 vital lessons every Canadian small-cap investor needs to survive and thrive in the volatile market ahead.