Mining

From gold and copper to lithium and rare earths, the materials mined from the earth fuel nearly every sector of the global economy. Tracking discoveries, geopolitical shifts, and commodity trends is essential to understanding the future of global industry and resource investment.

The Panic Premium | M&A Activity About to Surge

The last gold bull market didn’t climax with price alone; it ended in billion-dollar buyouts and 30 to 60 percent premiums. From 2001 to 2011, gold surged from under $300 to over $1,500 before major players truly began scrambling for ounces. Today, with gold pressing historic highs again, investors are asking a familiar question: when does the panic premium return?

Mexico’s Silver War: Cartels, Politics, and the Rising Risk to Global Supply

For centuries, silver has shaped Mexico’s fortunes and fueled conflict across its mining regions. As cartel violence intensifies in key production states, investors are being reminded that extracting precious metals in Mexico has never been purely about geology. The country’s long and dangerous history with silver may once again collide with global supply.

I Invited a Priest on My Show to Argue Against Gold. Here’s What Happened.

What happens when a gold-biased investor invites a priest and hedge fund CIO to challenge the metals trade head-on? A conversation about fear, conviction, value investing, and why even the strongest theses deserve pressure testing.

The Metal Nobody Talks About | Gallium

Gallium rarely makes headlines, yet it plays a critical role in the systems that power modern life, from AI data centers and satellite communications to advanced radar and high-efficiency power electronics. Supply is heavily concentrated, production is tied to complex industrial processes, and recent export controls have exposed just how fragile the chain can be. Understanding gallium means understanding a quiet pressure point in the global economy.

Michael Oliver’s Silver Blueprint

Michael Oliver’s core message is that silver isn’t acting like a normal bull market. It’s attempting to create a “new reality”, repricing after decades trapped under a long-term ceiling. The correction he warned about may have been the classic midpoint fakeout seen in past silver surges, and if the rebound holds, the next phase could be where both silver and silver miners surprise investors to the upside.

The Crash That Visits Every Bull Market

Gold and silver have just suffered one of their sharpest corrections in decades, and history suggests this may be far more typical than investors realize. By comparing today’s drawdown to the great precious metals bull markets of the 1970s and the 2000s, this article separates emotional panic from historical patterns. The result is a clearer framework for understanding whether this crash marks an end… or a reset.

Silver Is Getting Too Small to Contain the World’s Demand

Silver isn’t just rising in price; it’s colliding with the limits of its own market structure. With silver trading above $100, a small, fragile market is being asked to absorb massive industrial demand, investor fear, and a breakdown in the hedging systems that normally keep things stable. This article explains why silver’s size, not speculation, is the real reason it’s becoming dangerous, and explosive.

Copper’s Breaking Point: Why America’s Next Copper Mines Won’t Arrive in Time

Copper isn’t entering a normal late-stage bull market; it’s entering a mechanical breakdown, where the system that balances supply and demand is failing. When 2026 benchmark treatment and refining charges are set at $0, it signals something darker than “tight inventories”: concentrate scarcity, smelter dysfunction, and a supply chain that can’t respond to price. In this piece, we break down why copper deficits are turning structural, and why America’s list of “real” copper mines coming online is shockingly short.

Silver’s Third Act: Is This Bull Market Only Halfway Up the Mountain?

Silver is in the middle of its “third act” bull market, echoing the explosive runs of the 1970s and 2000s but with a new twist: structural supply deficits and soaring industrial demand from solar, EVs and the digital power grid. Combined with record sovereign debt, negative real yields, and growing distrust in fiat, the current silver bull market may be far from finished, even if volatility remains brutal.

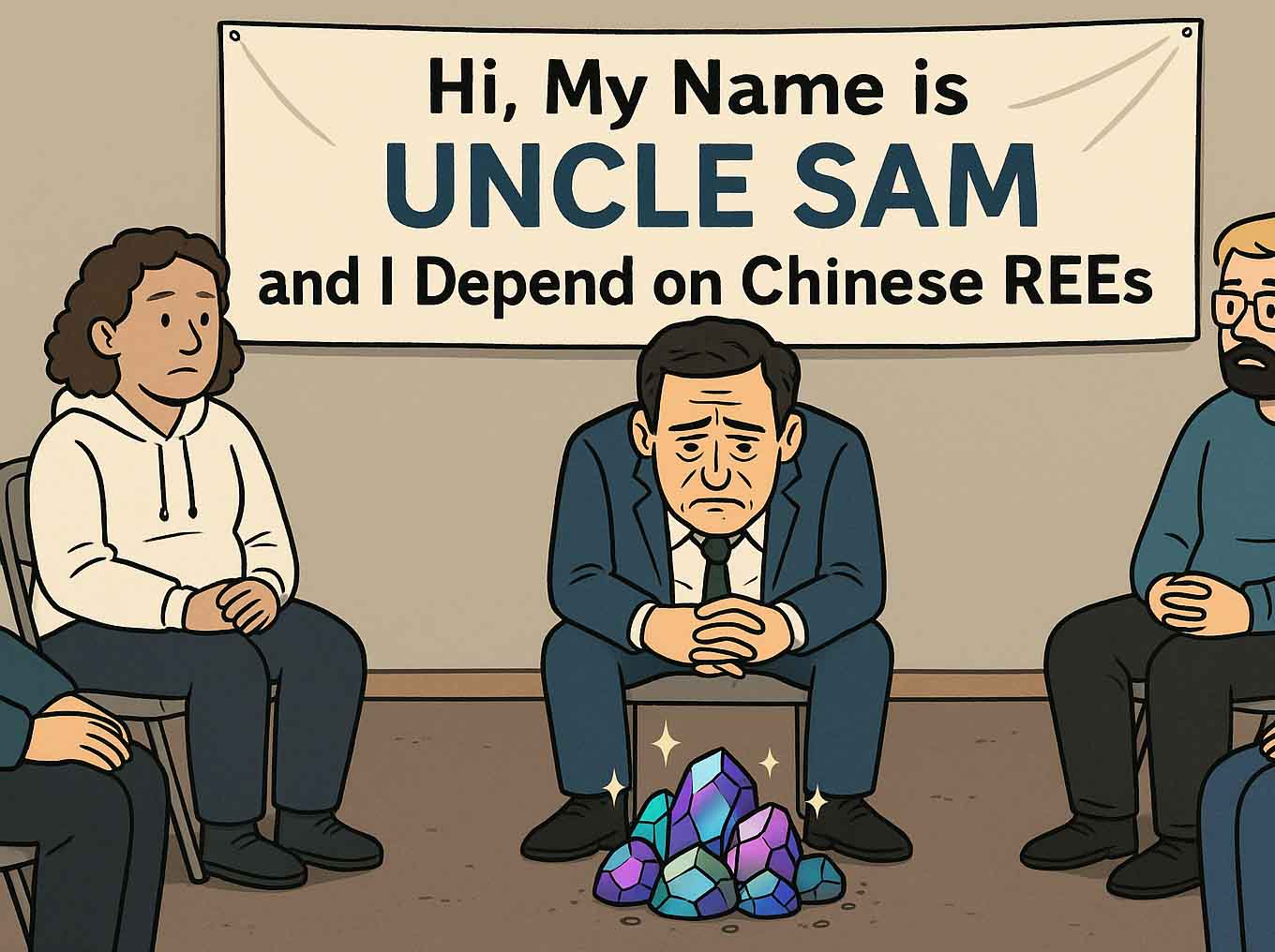

Going Cold Turkey: Why North America Needs Its Own Rare Earth Supply

China still dominates the rare earths that power EVs, wind turbines, smartphones and modern weapons, leaving North America dangerously exposed. This article breaks down how dependent the U.S. and Canada are on Chinese REEs today, what Washington and Ottawa are actually doing about it, and where the biggest opportunities lie for investors as a new mine-to-magnet supply chain is built on our own turf.