FIND THE SIGNAL. DITCH THE NOISE.

We cover what institutions are missing: macro shifts, commodity cycles, and emerging ventures—before they go mainstream.

Watch. Learn. Explore.

Insightful interviews. Bold ideas. Big-picture investing.

Trending Insights

In-depth analyses of the latest market movements and emerging trends that are shaping the future of investments.

Silver’s Third Act: Is This Bull Market Only Halfway Up the Mountain?

Silver is in the middle of its “third act” bull market, echoing the explosive runs of the 1970s and 2000s but with a new twist: structural supply deficits and soaring industrial demand from solar, EVs and the digital power grid. Combined with record sovereign debt, negative real yields, and growing distrust in fiat, the current silver bull market may be far from finished, even if volatility remains brutal.

The Next Decade in Markets Will Be Decided by a Barrel of Oil

Markets may be entering a decade defined by energy, not technology. This article breaks down how oil, geopolitics, and a shifting monetary order are creating a new landscape for investors, with insight from strategist Simon Hunt.

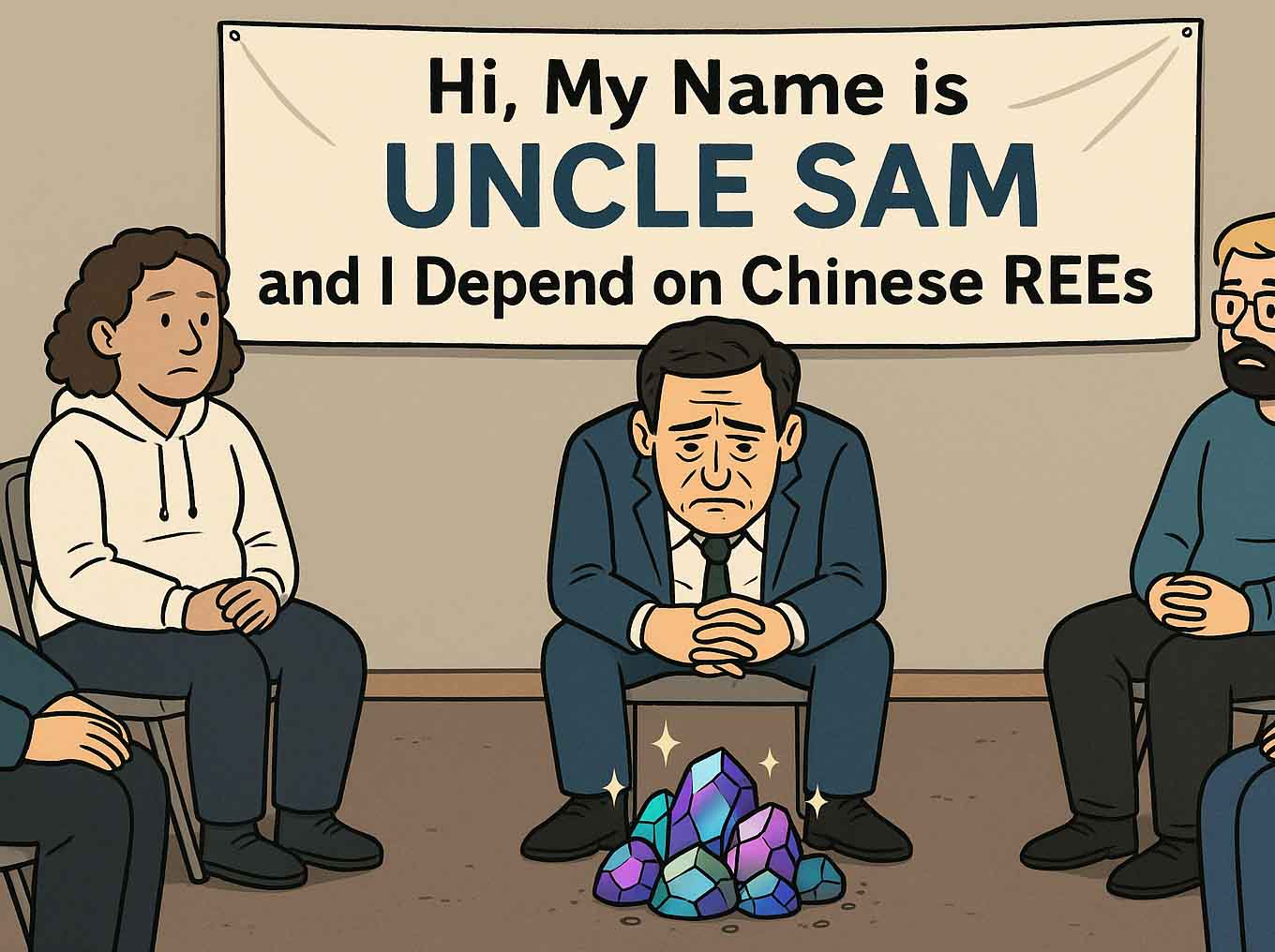

Going Cold Turkey: Why North America Needs Its Own Rare Earth Supply

China still dominates the rare earths that power EVs, wind turbines, smartphones and modern weapons, leaving North America dangerously exposed. This article breaks down how dependent the U.S. and Canada are on Chinese REEs today, what Washington and Ottawa are actually doing about it, and where the biggest opportunities lie for investors as a new mine-to-magnet supply chain is built on our own turf.

The Japanese Bond Time Bomb: How a JGB Shock Could Hit North American Stocks

Japan, the original architect of zero rates and QE, is suddenly being forced to live in a world of real interest costs, and its ¥1,300+ trillion debt pile is creaking as the 10-year JGB approaches 2%. This post explores how a spike in Japanese bond yields could morph from a “local” issue into a global shock, triggering carry-trade unwinds, repatriation flows, and a painful repricing of North American equities.

Budget 2025: Canada Bets Big on Mining, Productivity, and National Strength

Budget 2025 marks Canada’s boldest resource strategy in decades. With billions in new funding for critical minerals, infrastructure, and productivity, Ottawa is betting on mining and industrial investment to drive long-term growth. Expanded tax credits, a sovereign fund for critical minerals, and the removal of key regulatory barriers signal a decisive pivot toward real assets, national competitiveness, and economic resilience.

85,000+ INVESTORS FOLLOW OR SUBSCRIBE TO US

Be part of our investor community spanning YouTube, our weekly newsletter, and social media. Get sharp insight on capital flows, commodity cycles, and macro trends shaping tomorrow’s markets.